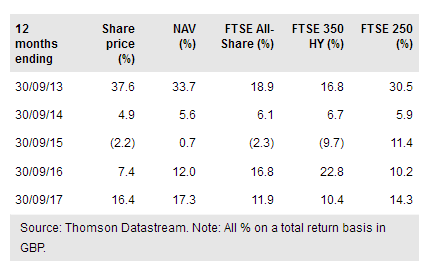

Lowland Investment Co (LON:LWI) invests across the UK stock market with the aim of providing attractive capital and income returns for its investors. Managed by James Henderson and Laura Foll at Janus Henderson Investors, LWI’s portfolio is diversified over more than 100 stocks, allowing the managers to back undervalued and recovery situations over the long term by starting with small positions to limit downside risk. An example of such a stock is insurance company Hiscox, bought in the aftermath of the collapse of the Lloyd’s insurance syndicates, since when its market capitalisation has increased from £40m to c £4bn. Holdings such as this have helped LWI to outperform its FTSE All-Share Index benchmark (in NAV total return terms) over one, three, five and 10 years, and since James Henderson began managing the portfolio in 1990.

Investment strategy: Multi-cap growth and income

LWI’s managers seek to construct a diversified portfolio of typically 100+ predominantly UK stocks, chosen from across the market capitalisation spectrum, with a tilt towards value and recovery situations. While wishing to retain exposure to index gains through holding heavyweight stocks such as Shell (LON:RDSa) and HSBC, they favour small and mid-cap companies for their superior capital and dividend growth characteristics. As these stocks may be under-researched, the managers make use of valuation screens as well as meeting hundreds of companies each year. Positions are built and divested slowly in order to limit volatility.

To read the entire report Please click on the pdf File Below: