Next in line in the earnings confessional is Lowe's Companies, Inc. (NYSE:LOW) -- the home improvement name is slated to report its fourth-quarter results before the market opens, Feb. 27. LOW shares are suffering today, however, after competitor Home Depot (NYSE:HD) revealed a disappointing full-year forecast. At last check, the retailer is down 0.7% at $104.31.

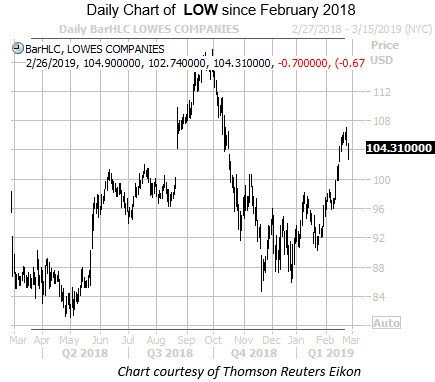

Lowe's stock lagged on the charts between mid-October and late January but rebounded sharply in February -- up 8.6% month-to-date. Today's pullback is finding a foothold near an Oct. 17 bear gap, though the stock is still down 11.4% from its Sept. 28 record high of $117.70.

Switching gears toward its earnings history, LOW's has closed lower the day after five of the company's past eight quarterly reports, including a 5.7% drop in November. On average, the shares have swung 5.7% the day after earnings, regardless of direction. This time around, the options market is pricing in a slightly smaller move, with implied volatility data indicating a 5.4% swing for tomorrow's trading.

Put option traders have been sprinting toward the home improvement name, per data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). Specifically, LOW's 10-day put/call volume ratio comes in at 1.13 and ranks in the 74th annual percentile. In simpler terms, puts have been bought over calls at a faster-than-usual clip.

On the flip side, analysts have been optimistic toward the stock. Currently, 16 of the 22 covering brokerages sport "buy" or "strong buy" ratings.