Home improvement retailer Lowe's Companies, Inc. (NASDAQ:NYSE:LOW) is slated to report first-quarter earnings before the open tomorrow, May 23. Today, however, the firm is making headlines after announcing J C Penney CEO Marvin Ellison is leaving the department store to be president and CEO of Lowe's. After initially soaring on the news, LOW stock is down 1% at $86.52, at last check.

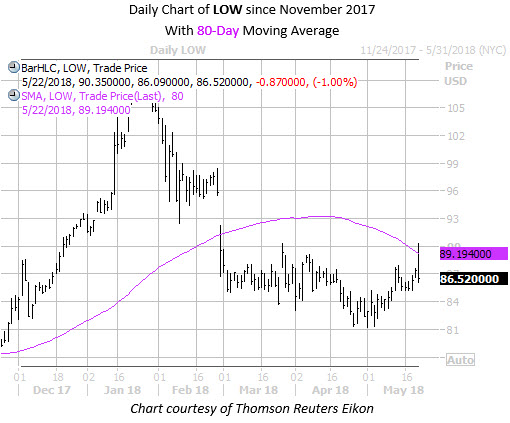

Since gapping lower after earnings in late February, LOW stock has struggled beneath the round-number $90 level. This region is now home to the security's descending 80-day moving average -- a trendline that the shares briefly surpassed at today's intraday peak.

Digging into its earnings history, LOW stock has posted a negative return the day after the last four reports. Overall, the stock has averaged a one-day post-earnings swing of 4.5% over the past two years, regardless of direction. This time around, the options market is pricing in a slightly larger-than-usual 6.8% next-day move, per data from Trade-Alert.

Caution looms around Lowe's earnings, too, as just last week, sector peer Home Depot (NYSE:HD) reported a first-quarter earnings miss. In the options pits, LOW's 10-day put/call volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) comes in at 0.69. While this indicates that bought calls have exceeded bought puts on an absolute basis, the ratio sits in the 76th percentile of its annual range, suggesting LOW puts have been purchased over calls at a faster-than-usual clip during the past two weeks.

Echoing this, Lowe's stock's Schaeffer's put/call open interest ratio (SOIR) of 0.74 ranks in the 80th percentile of its annual range. Though the ratio indicates that short-term calls still outnumber puts on an absolute basis, the elevated percentile tells us that near-term traders have rarely shown a greater preference for puts over calls in the last year.

Today, Lowe's put volume is running at four times the average intraday clip, with roughly 24,000 contracts exchanged. Most active is the June 89 put, while shorter-term traders are picking up the weekly 5/25 82- and 83-strike puts.