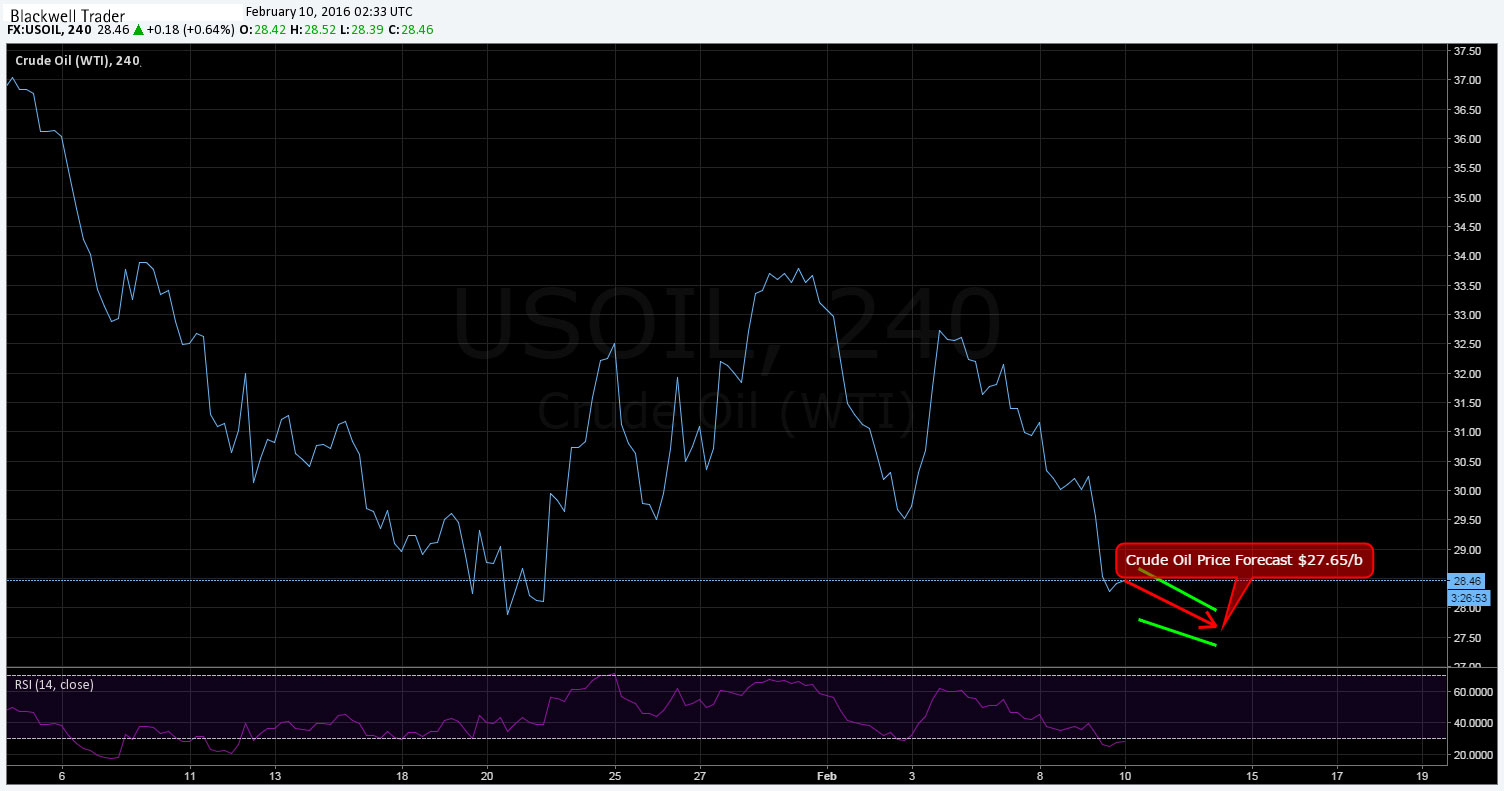

As the world focuses upon the growing uncertainty around equities, the downside risks for crude oil continue to mount. As the commodities price remains severely depressed below the $30 handle, some are now questioning whether Iran’s returns to the market could see oil trading at levels not seen for many decades.

The crude oil markets are largely facing a cross roads as OPEC seemingly weighs the options in either rebalancing supplies or continuing their campaign against the US shale producers. Although OPEC based supply is forecast to contract by 600,000 barrels a day in 2016 there is no guarantee that production in both Iran and Iraq will not increase to fill the void. In fact, January saw a net increase of 280k barrels a day as a battle ensued between Iran, Saudi Arabia, and Iraq over their respective market shares. Subsequently, it seems that given the pressure on OPEC member’s economies, there is little scope for the needed supply cuts to return oil to a reasonable equilibrium price.

Subsequently, analysts are now suggested that a breach of the $20.00/b level is now not unthinkable given the continuing supply glut along with slipping global growth. Despite some of the bearish fundamental data, the EIA remains relatively positive about the near term prospects of the commodity, citing some rather buoyant global GDP growth figures courtesy of the IMF. However, the IMF forecast of 3.4% growth in 2016 is predicated with a whole swathe of conditions which are unlikely to come to fruition.

In addition, the EIA bullish outlook for crude oil also relies heavily upon significant supply cuts from both OPEC and Non-OPEC members which are unlikely moving forward. It has been stated in our research notes before that despite the best intentions of industry bodies and regulators the only way forward is for the market to rebalance and accept the new world oil order. Subsequently, coordinated OPEC cuts alone are unlikely to sustain a rebalancing given the relative speed of increasing rig activity within the US shale industry. Ultimately the market will dictate when, and at what speeda sustainable crude equilibrium will be introduced.

Given the current status of global growth, and the addition of peak oil storage within the US, it is likely that crude oil will face a volatile coming quarter that could see plenty of pain suffered by all producers. In fact, given the current debt crisis amongst US junior producers, the market may indeed witness some defaults and corporate collapses as inefficient operators find difficulty in competing within the $20-$30 range. This is largely what OPEC has been gambling on and it appears to be rapidly coming to fruition. However, whether lower oil prices are a symptom of slowing global growth of the instigator remains unanswered.

Ultimately, OPEC may prevail against US shale producers but at what cost? The market rebalancing is unlikely to leave any participants unscathed and may very well bring some countries to the brink of economic collapse and thereby destabilise the region. Subsequently, as is often said…be careful what you wish for, as you might just get it.

Subsequently, my near term, fundamental forecast, remains unchanged at $27.65/b.