The September British Pound is under pressure this morning as traders square up positions ahead of the start of the two-day European Summit on Thursday. The uncertainty over the outcome of the meeting has caused a choppy, two-sided market this week.

Although there is a developing bias to the downside due to skepticism about whether the meeting will accomplish anything substantial, traders remain cautious because of the outside chance of a surprise move. This attitude is being reflected by this week’s technical picture.

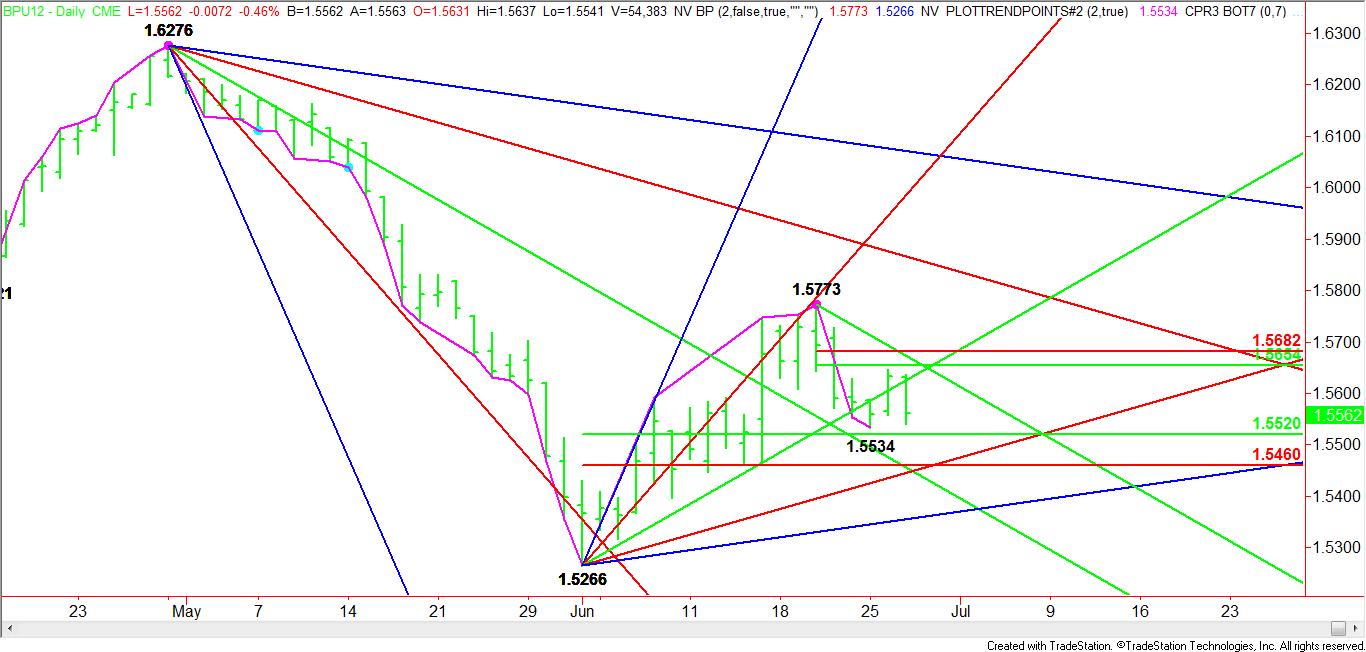

To recap this week’s trading activity, on Monday the British Pound was weak as traders continued to short the market following last week’s closing price reversal top at 1.5773 on June 20. In addition, the Sterling took out a former support angle while challenging a key 50% price level. When the selling pressure subsided, the market rallied on Tuesday, testing another short-term 50% price level. The lack of follow-through to the upside has caused traders to once again explore the short-side of the market this morning.

Based on the main range of 1.5266 to 1.5773, the key downside target is a retracement zone at 1.5520 to 1.5460. The short-term range at 1.5773 to 1.5534 has created an upside retracement zone at 1.5654 to 1.5682.

Since the market is trading on the bearish side of an uptrending Gann angle at 1.5626 today, one has to conclude that there is a bias to the downside. Furthermore, the Sterling is also trading below a downtrending Gann angle at 1.5663. These two angles nearly cross at 1.5646 and 1.5653 on Thursday. Combined with the 50% level at 1.5654, they also create a potential upside target and resistance cluster.

On the downside, the 50% price level at 1.5520 is the first target. On June 28, an uptrending Gann angle and a Fibonacci price level form a support cluster at 1.5456 and 1.5654.

Volume is light ahead of the European Summit so the market may drift into the support zone over the next two days. Without any clarity regarding the outcome of the summit, the British Pound appears to be in the hands of the bearish traders. This may not be because of more shorting pressure, but because of the lack of interest in the long side.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Low Volume Weighing On September British Pound

Published 06/27/2012, 06:27 AM

Updated 05/14/2017, 06:45 AM

Low Volume Weighing On September British Pound

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.