Monday was one of the lowest volume days on the the stock market since the history of mankind. The SPDR S&P 500 (ARCA:SPY) traded at about 1/2 of its normal volume while the iShares Russell 2000 Index (ARCA:IWM) managed about 65% and the PowerShares QQQ (NASDAQ:QQQ) 57%.

Even the metals space was light, with the SPDR Gold Trust (ARCA:GLD) trading at 80% of the normal turnover, the iPath DJ-UBS Copper Subindex TR ETF(JJC) at 22% and the iShares Silver Trust ETF (ARCA:SLV) at 70%. Even crude oil was light with the United States Oil Fund (USO) trading less than 40% and the Brent United States Brent Oil Fund LP (BNO) trading only 1100% of normal volume.

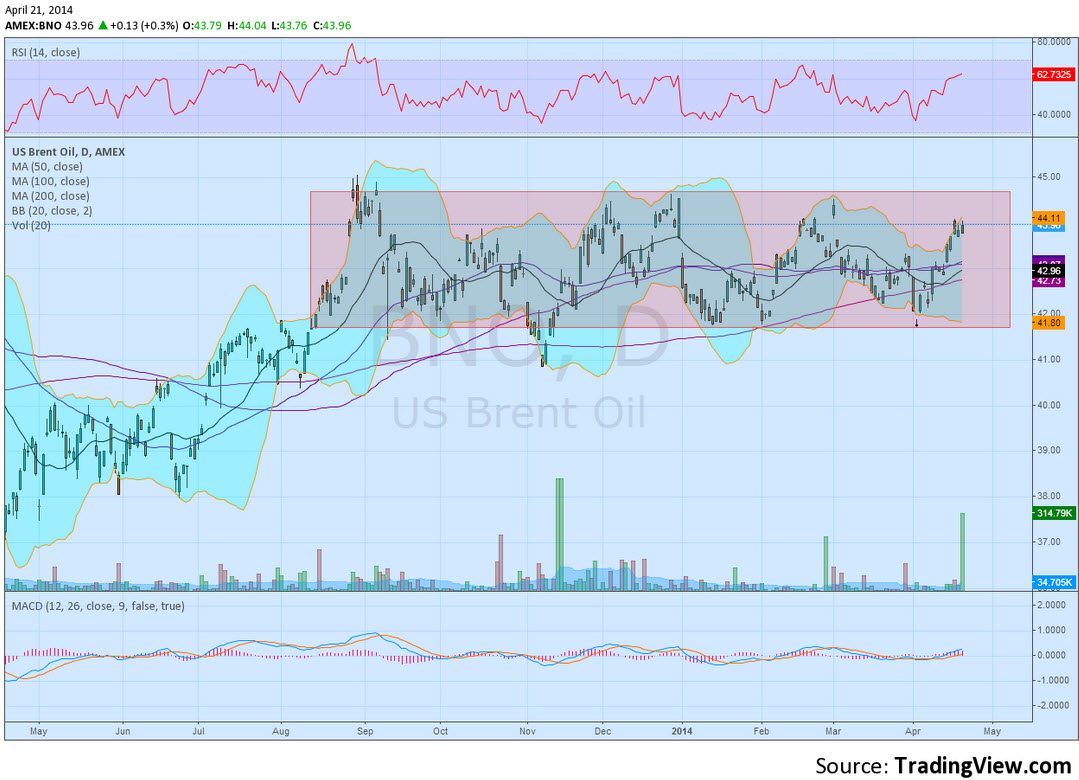

What? Wait a minute. BNO traded 11 times normal volume on one of the lightest days since forever? What's going on there? First, BNO is not a heavily trade ETF, with only about 29,000 shares traded per day on average, so the 269,000 that traded is not a panic or mania. So is there something going on there? Let's look at the price action.

The daily chart is not so interesting, moving sideways since August in a $3 range between 41.70 and 44.70. But isn't that odd in and of itself with the conflict between Russia and Ukraine, and West Texas Intermediate Crude in an uptrend? Maybe, but this is not the place to look for news to explain stuff. We look at price action.

The clue may be in the weekly chart. The longer view shows an ascending triangle that has been holding tightly against the top rail as resistance. With the bottom support tightening up it may be just like a bull in the chute ready for the gate to open to explode out. Which side is the gate on the top or bottom is anybody’s guess, but the momentum indicators RSI and MACD both support a move to the upside. A break over the resistance zone, over 44.70 would target a move to 58 on a conservative measure. That is enough to create some excitement isn’t it?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.