When questioning the market’s capacity to overcome obstacles, one should begin by reviewing popular bearish themes. Do they strike a familiar chord or an unfamiliar one? How far off is financial ruin?

For example, I almost find myself chuckling at the idea that four more years of Washington gridlock is now being described as a negative for stocks. Check the Stock Trader’s Almanac, folks… the best bull moves in U.S. history have been synonymous with different parties in branches of power.

Another perma-bear mantra is the deepening recessions around the globe. Granted, developed world economies from Europe to Japan continue to contract and the desire for eurozone debt is exceptionally unstable. That said, the “same-old” news that pestered investors throughout 2011 is partially offset by improving economic conditions in the emerging markets, particularly China.

There are other reasons to be pessimistic, to be sure. Republicans and Democrats could fail to achieve a deal on a fiscal cliff remedy. The world’s largest corporation by market capitalization, Apple (AAPL), could see more panicky investors flee. And Santa Claus could decide that he can’t afford the insurance coverage on his sleigh.

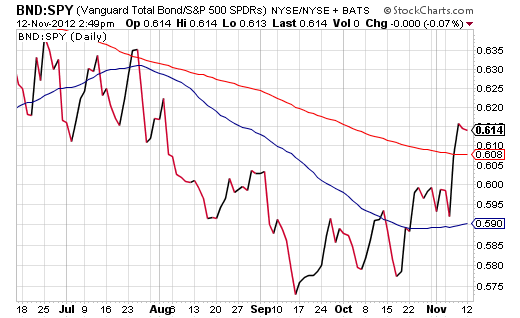

All kidding aside, there are a variety of technical trends that provide a clearer picture of the terrain. Vanguard Total Bond Market (BND) is demonstrating remarkable relative strength over the S&P 500 SPDR Trust (SPY); since mid-September, a pattern of “higher highs” in the BND:SPY price ratio is indicative of “risk-off” behavior.

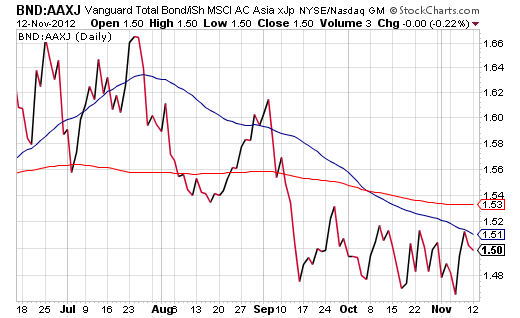

By the same token, Vanguard Total Bond Market (BND) is showing weakness relative to the iShares Asia excl Japan Fund (AAXJ). The BND:AAXJ price ratio has remained below key trendlines, suggesting that investors may not be abandoning risk, but rather, shifting their focus back to faster growing economies.

Regional risk shifts are hardly new. Throughout the 2002-2007 equity bull run, emerging markets handily out-hustled U.S. stocks. In 2009-2012, however, the more exposure you had to domestic holdings, as opposed to the “emergers,” the better your portfolio performed.

Some will certainly disagree with my contention that Asia is in great shape, let alone the notion that Asian Stock ETFs represent an excellent risk-reward opportunity. Yet perhaps they are underestimating the global community’s conventional and unconventional easing measures; that is, fiscal and monetary stimulus will continue to reflate risk assets in the foreseeable future, and Asian equities should be a favored beneficiary.

Looked at another way, investing involves comparing alternatives — risk assets versus “riskless” high-grade sovereign debt. When the powers that be are united in suppressing high-grade sovereign bond yields… when those sovereign yields are near historical lows with negative real returns… money tends to flow toward reasonable opportunities elsewhere.

In the U.S., the winners have been diversified high yield corporate bonds and preferred shares. I’ve continued to see low volatility and high risk-reward benefits in the ownership of ETFs like iShares High Yield Corporate Bond Fund (HYG) and iShares Preferred Bond Fund (PFF). (Note: The eventual bursting of a Treasury bond balloon would be painful to yield producers, but the balloon still has room for plenty of hot air.)

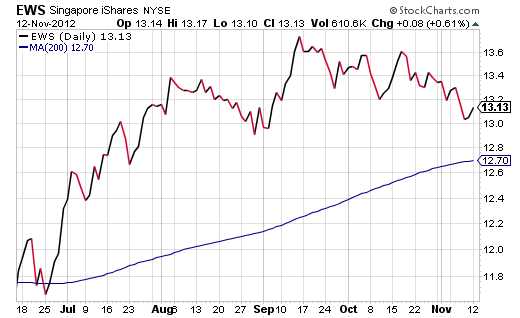

Abroad, you can pick up capital appreciators with annualized yields near 3.6% by thinking Southeast Asia. The stars shine brightest for iShares Singapore ETF (EWS) and iShares Malaysia ETF (EWM). Keep an eye on the 200-day moving average for support, using it for an entry point if it holds or an exit point if it breaks down entirely.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Low Sovereign Debt Yields Pushing Emerging Market Stock ETFs Higher

Published 11/13/2012, 02:35 AM

Updated 07/09/2023, 06:31 AM

Low Sovereign Debt Yields Pushing Emerging Market Stock ETFs Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.