Enormous government stimulus and a busy printing press have revived fears of out of control inflation that plagued economists after the global financial crisis when unconventional monetary policies and huge fiscal stimulus were used so widely for the first time.

Advocates of low-inflation predictions cite the experience after 2008 when for many years inflation had to be pushed by extremely loose monetary policy.

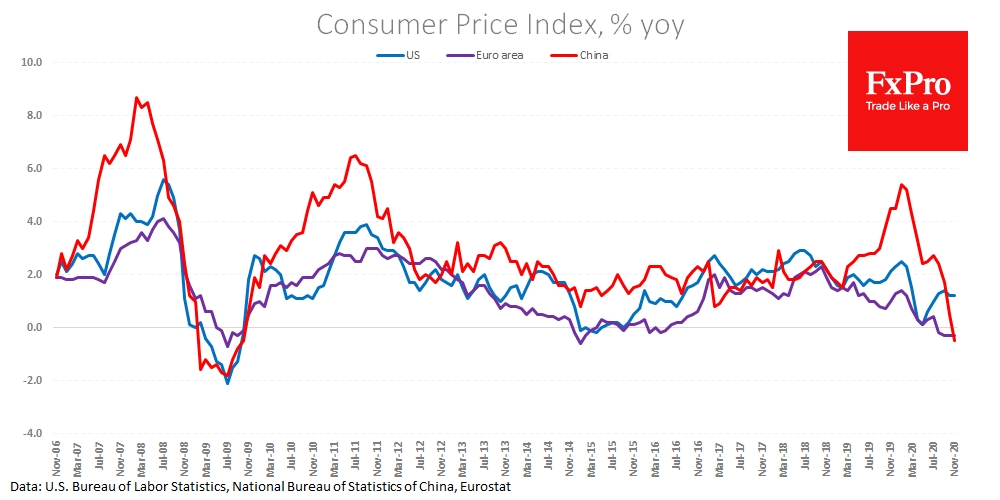

This time, as the world is just recovering from an unprecedentedly sharp downturn in many economies, excessively slow, rather than rapid, consumer price growth again risks being a problem. The available inflation data is also on the dovish side at the central bank. Since February last year, annual inflation in the world’s largest economies has turned downwards, going into negative territory in the eurozone and China.

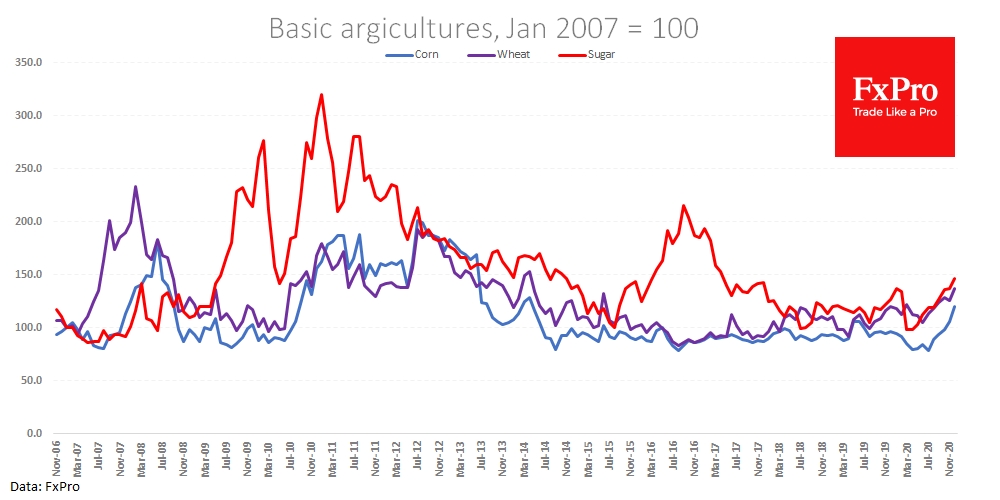

The weakness of consumer inflation in the past decade has not, however, prevented multiple increases in agricultural commodity prices in the first phase of the economic recovery.

The positive outlook for commodity markets is reinforced by a low base effect. In the first half of 2020, sugar and corn prices were at their lowest levels for many years. However, they started to rise steadily in May along with Wheat.

A similar triple reversal was observed in early 2009, together with the start of a rally in most markets. Over the next two years, through 2011, sugar prices tripled, while corn and wheat doubled.

Given that extreme monetary conditions are now supported by a much wider range of countries and that consumers are not skimping on food thanks to government support, the potential for commodity market price increases is even greater than it was a decade ago.

Short-term traders would do better to keep global trends in mind, given that trends in agricultural commodities are longer, often stretching over many months before major pullbacks. Sugar, for example, has shown nine months of back-to-back gains, while corn has seen a six-month rally that added more than 50% to its price.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Low Inflation Drives Up Agricultural Prices

Published 01/06/2021, 06:52 AM

Updated 03/21/2024, 07:45 AM

Low Inflation Drives Up Agricultural Prices

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.