The odds are virtually nil that the Federal Reserve will raise interest rates through early 2020, according to Fed funds futures. Driving the market’s forecast: accumulating signs that the economy is slowing and inflation remains subdued. As long as this one-two punch remains is force, which seems likely based on recent data, the central bank’s recent run of policy tightening has likely ended and may even reverse course later in the year.

Meantime, the crowd is projecting that the Fed’s target interest rate will remain stable at the current 2.25%-to-2.50% range through January 2020, based on Fed fund futures via CME. Using this market as a guide, there’s a zero probability for a rate hike through early next year. In fact, the market’s projecting a small but slowly rising chance of a rate cut, edging up to a 26% probability by next January.

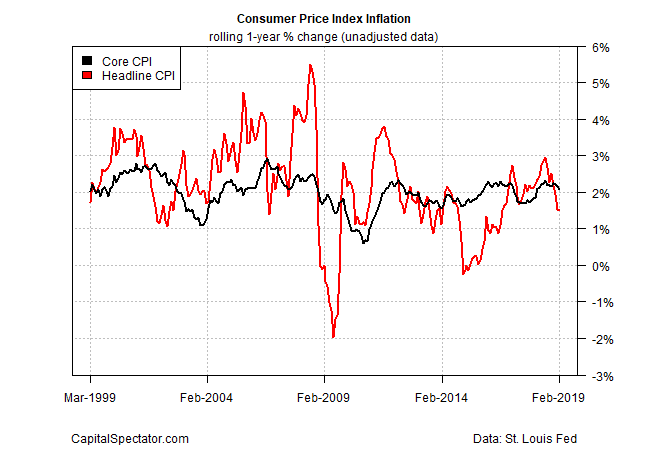

Yesterday’s update on the consumer price index (CPI) supports the no-rate-hike scenario. The core reading of inflation edged down to a 2.1% annual pace (in seasonally adjusted terms) through February, reflecting a rate that’s effectively holding at the Fed’s 2% inflation target.

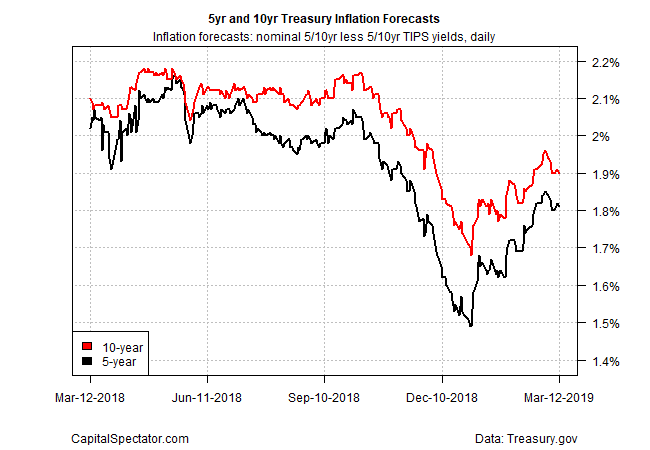

The Treasury market’s implied forecast for inflation points to more of the same for the foreseeable future, based on the spread for nominal less inflation-indexed yields. The widely followed United States 5-Year Treasury spread is currently at roughly 1.8%, suggesting that the market continues to price in expectations that the Fed’s 2% inflation target (or lower) will prevail for the near term.

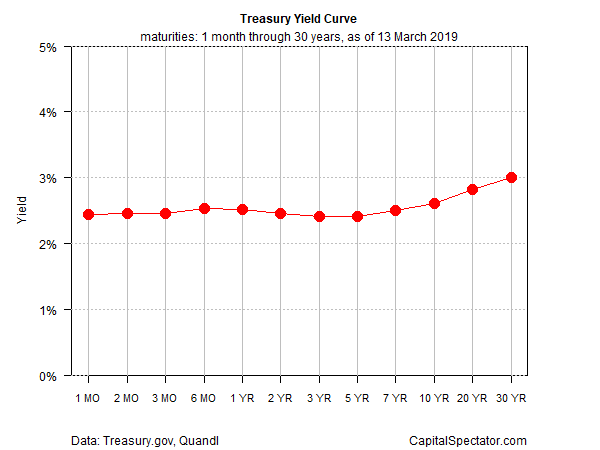

Meantime, the near-flat Treasury yield curve continues to project relatively soft growth and tame inflation. For some maturities, the curve is inverted. For instance, a 1-Year Treasury currently yields slightly more than a 5-year: 2.52% vs. 2.41%, based on daily data via Treasury.gov as of yesterday (March 12).

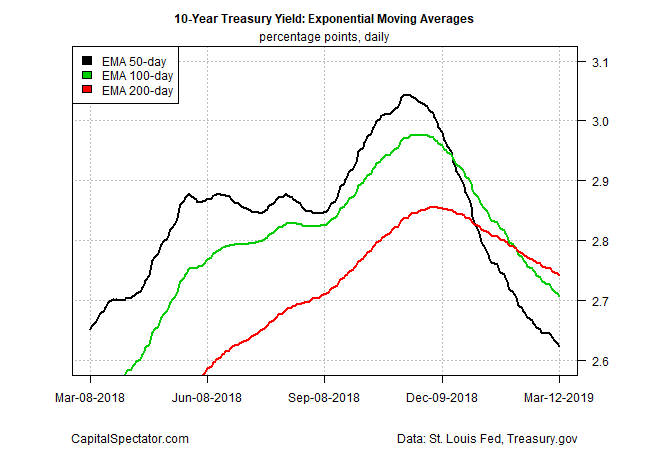

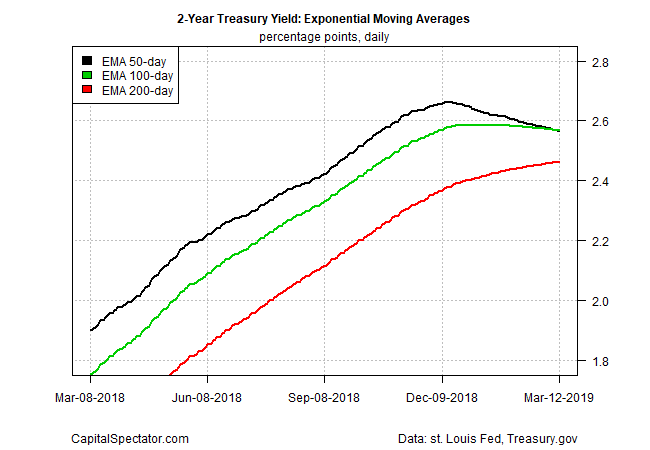

Profiling interest-rate momentum via a set of exponential moving averages suggests that rates will remain flat if not tick lower in the days and weeks ahead. The benchmark 10-year Treasury yield, for instance, continues to reflect a strong downside bias via this analysis.

The 2-Year yield, which is considered a proxy for Fed policy expectations, appears to be at a tipping point in transitioning to a downside bias.

The critical factor, of course, is the economy, but the recent downshift in growth indicates that an upside breakout for inflation or interest rates is unlikely. Gross domestic product (GDP) rose a moderate 2.6% in last year’s fourth quarter, marking the second straight quarter of deceleration.

Several nowcasts anticipate that GDP growth will continue to slide in this year’s first quarter. For example, the Atlanta Fed’s GDPNow model is projecting that output will decelerate to a near-flat rise of just 0.2% in Q1, as of the March 11 estimate.

The economy’s risk outlook, in short, looks firmly skewed to the downside. The probability of recession remains low, at least for now, but the possibility of contraction is edging higher, if only on the margins.

Nonetheless, Fed Chairman Jay Powell on Sunday said that “the outlook for our economy, in my view, is a favorable one.” He did, however, recognize that the macro trend is downshifting. “I think growth this year will be slower than last year. Last year was the highest growth that we’ve experienced since the financial crisis, really in more than 10 years. This year, I expect that growth will continue to be positive and continue to be at a healthy rate.”

Powell’s relatively upbeat assessment provides a baseline for managing expectations by comparing future comments with his latest outlook. Meantime, it’s fair to say that the Fed chair sees limited upside risks for economic growth and inflation. In other words, the case for expecting more rate hikes is on ice until the incoming data tells us otherwise.