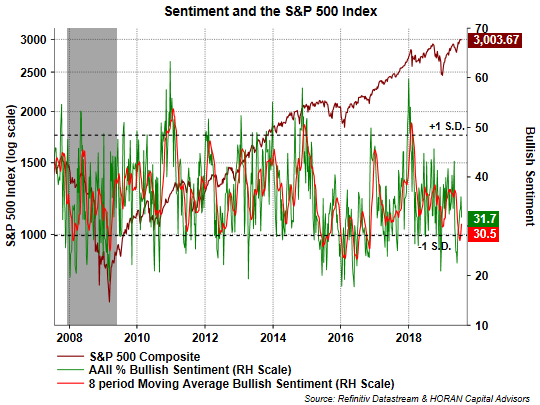

In the most recent report on investor sentiment by the American Association of Individual Investors, individual investors continue to express a low level of bullish sentiment. As the sentiment indicators are contrarian ones, a low bullish sentiment reading is viewed as one positive for higher equity prices. No one indicator works in a vacuum, but it does seem the individual investor remains cautious on the current equity market. The sentiment readings tend to be volatile from week to week, as a result evaluating the 8-period moving average smooths this volatility. For the week, the 8-period moving average did tick slightly higher to 30.5% from the prior week but remains at a lower level.

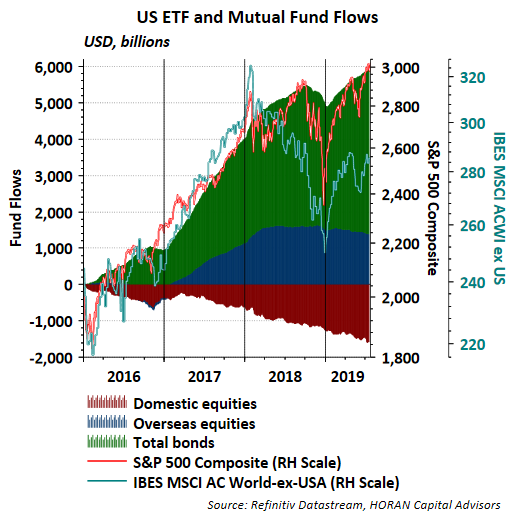

Another area showing investor skepticism is in mutual fund and ETF flows. In spite of the strong performance of U.S. domestic equities versus international equities and bonds, investor flows continue to be outflows for domestic mutual funds and ETFs. Broadly, bonds have garnered a large portion of the inflows over the last three and a half years in spite of their lower return. For equities, it seems they are climbing the proverbial 'wall of worry.'