As North Korean President Kim Jung Un and U.S. President Donald Trump shot barbs and threats at each other – threats which included Trump’s promises of fire and fury and perhaps more – Shotspotter Inc (NASDAQ:SSTI), a gunfire detection and location technology company, reported earnings. I think the promising results were lost in the crossfire and the resulting market swoon. SSTI’s first earnings results as a publicly traded company suggest this is a unique opportunity to invest into the early stages of what could be a tremendous growth trajectory.

ShotSpotter (SSTI) experienced a strong post-earnings gap up, but the downtrending 20-day moving average (DMA) provided too much resistance. The stock still trades just above its IPO price of $11.

From a technical standpoint, SSTI’s chart shows that the sellers currently hold the advantage over buyers. SSTI was not able to make much progress after its first day of trading. Once the stock hit a new intra-day all-time low on August 1st, sellers rushed in and pushed the stock as low as $9.33 before the current rebound. A post-earnings gap up was met by fresh sellers who quickly filled the gap. Once SSTI can manage a new post-earnings high, I will assume interest has returned. However, I am not going to wait and will start accumulating shares as soon as the coming week of trading.

SSTI is a very small company. Based in tiny Newark, CA, SSTI has a market cap of $110M and about 70 full-time employees. The company’s IPO on June 7, 2017 raised $32.2M with 3.2 shares issued. The vast majority (95%) of its revenue, $5.8M in the second quarter of 2017, comes from its public safety solution which helps police departments detect, identify, locate, and respond quickly to gunfire. The revenue from its security solutions sold to six university campuses so far is minimal (the University of Alabama just went live). An innovative integration in General Electric’s (GE) smart city CityIQ platform has generated $250K so far and depends on GE’s success with its partnership with AT&T (NYSE:T). The following promotional video below explains how the San Francisco police department is using SSTI technology to reduce gun-related homicides in the city.

SSTi’s $5.8M in revenue in Q2 represented 48% year-over-year growth and 28% quarter-over-quarter growth. The revenue included a one-time uptick from the development project with GE. SSTI added $1.6M in deferred revenue for a total of $17M. Of this total, $13.9M is short-term. “Live miles” starts revenue recognition. SSTI added 45 net square miles of product coverage in Q2 on top of the existing 450 square miles. The company does not disclose backlog or bookings. SSTI gave the following revenue guidance:

“The company expects revenue for the full year 2017 to be within a range of $21.5 million and $22.5 million, revised upward from previous revenue guidance of a 35% increase over 2016 revenue, which equates to revenue of approximately $21.0 million.”

SSTI is not yet profitable. The Q2 net loss of $4.3M included a $3.7M expense from a preferred stock warrant liability. The net loss represents $1.16 per share based on 3.7 million basic and diluted weighted average shares outstanding and is down from last Q2’s $1.44 per share. Gross margins increased to 54% from 38% in 2016’s Q2. Gross margin was 41% in Q1 2017. SSTI is targeting a gross margin of 65%. Research and Development (R&D) declined as the company released R&D consultants.

Going forward, R&D should consume 13 to 15% of revenue. Sales and marketing was 23% of revenue, a large drop from last Q2’s 34% of revenue. SSTI expects sales and marketing to consume 21 to 24% of revenue going forward. The company added two highly experienced sales directors who are expected to help drive sales growth in the U.S. The company is looking to add one sales rep each in EMEA (Europe, Middle East, and Africa) and in its South American/Caribbean market by the end of Q1 2018. G&A expense was 17% of revenue. The increase from last Q2’s 14% share of revenue came from the expense of operating as a public company. G&A should consume 18 to 22% of revenue going forward.

Thanks to the IPO, SSTI’s balance sheet looks pretty good. The company is sitting on $35.1M in cash and cash equivalents. That balance will drop by at least $13.5M after it pays down its outstanding debt. Prepayment penalties prevented SSTI from paying off the debt right after the IPO. The interest rate on this debt must be very high otherwise I am surprised SSTI is in a rush to pay it down. Normally, I would assume this kind of small company needs its free cash to help fund aggressive growth plans. SSTI expects positive operating cash flow by the end of 2017 and profitability by the second half of 2018. These will be key milestones to hit to assure investors that the company’s growth potential is on track.

There were several good questions posed during the Q&A session of the earnings call. Here are the additional items I learned and concluded from the answers to those questions:

- Seasonality: Q1 and Q3 tend to be lower than Q2 and Q4.

- Product cycle: 90 to 120 days from booking to a typical deployment.

- GE integration: no visibility into the rollout.

- Sales cycle: Hard to define. Tends to be long and complicated. Combined with normal seasonality, I interpret this reality to mean that SSTI could experience very lumpy revenues. This business dynamic will increase the odds of trigger finger stock sell-offs (aka buying opportunities) when the company misses guidance from time-to-time. However, the relative size of the deferred revenue suggests that the company may be able to smooth the lumpiness for now. Net new miles may not be recognized for one or two quarters after sales commissions get paid on a successful booking.

So SSTI earnings provided a solid start to the company’s life as a public company. Still, this is a small beginning compared to the reported opportunity. SSTI cited a total addressable market of 1600 cities worldwide and 6800 campuses, train stations, and airports for a total of $1.4B in potential annual subscription revenues. For comparison, at the end of Q1 2017, SSTI had 74 public safety customers in 89 cities and municipalities. Its system sent alerts on 80,000 gun fire incidents. The international story will soon become a focus because the the U.S. has been making significant progress in the last 25 to 30 years in reducing gun violence.

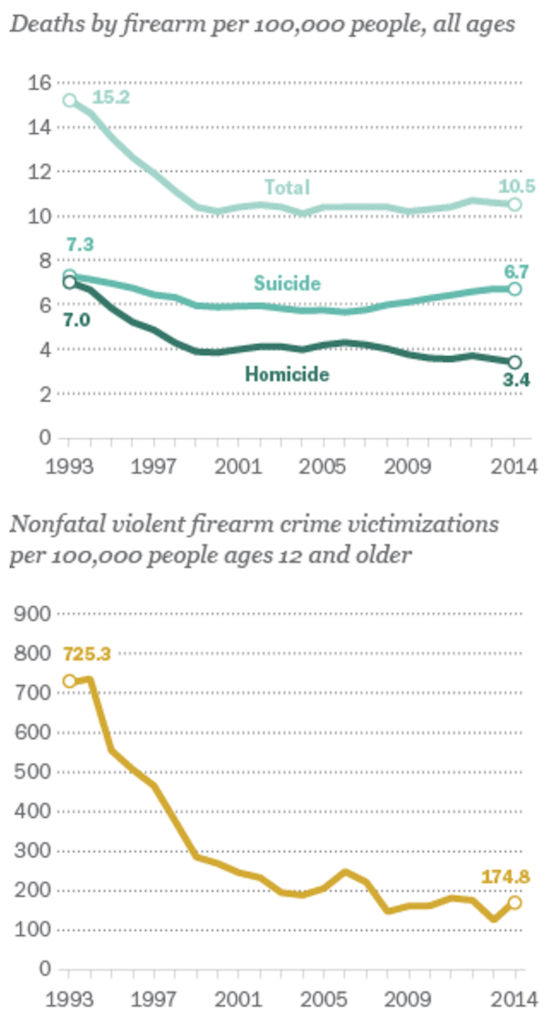

The Pew Research Center provided a report two years ago titled “Gun homicides steady after decline in ’90s; suicide rate edges up” which included the following two telling charts about the reduction of gun violence in America.

Gun violence has dropped dramatically since the 1990s but the rate of improvement has notably slowed in recent years.

For another perspective, available FBI data show that murders by any firearm have dropped from about 8,900 in 2010 and 2012 to 8,454 in 2013 and 8,124 in 2014.

Perhaps ShotSpotter implementation will be a key tool in helping the U.S. close the gap with other rich countries in the Western World. The chart below from the New York Times shows the tremendous gap between the U.S. and other countries where the gun culture is of course not nearly as strong.

The U.S. has a lot of work to do to bring gun-related homicides down to the rates seen in other rich, Western countries.

Ultimately, I think ShotSpotter will be acquired by another security/safety-oriented company that has the global reach to take this technology to the next level. For example, if ShotSpotter is successful with General Electric (NYSE:GE), I could easily see GE making the move to simplify its implementation by buying the company. Time will tell of course but the odds are in favor of SSTI: President and CEO Ralph Clark, a Harvard-trained Business School graduate, led his last company to an acquisition by Symantec (NASDAQ:SYMC).

Be careful out there!

Full disclosure: long T