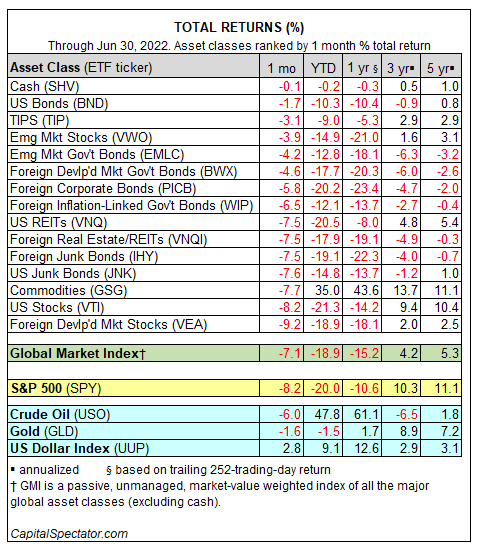

In June, losses weighed on every slice of the major asset classes, based on a set of proxy ETFs. Even cash took a hit, albeit a fractional one.

Selling took a toll far and wide last month, with the foreign stocks in developed markets falling the most. VEA lost 9.2% in June, leaving it in the red by nearly 19% year to date.

US stocks (VTI) suffered nearly as much and for 2022 the loss in American shares exceeds 21%. US bonds (BND) are nursing lesser losses, but by fixed-income standards it’s fair to say that everyone’s favorite safe haven looks decidedly risky this year via a 10.3% year-to-date decline.

The Global Market Index (GMI) continued to lose ground in June. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, tumbled 7.1% last month and lost 18.9% year to date.

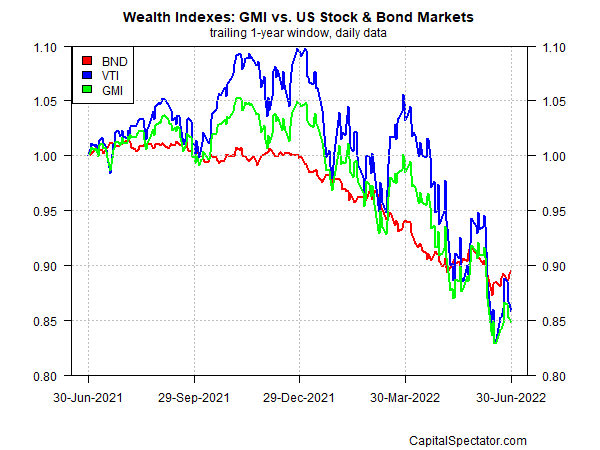

Comparing GMI’s performance to US stocks and bonds over the past year highlights that bonds (BND) are providing some ballast recently, at least in relative terms – an attribute that previously had been in short supply for 2022.