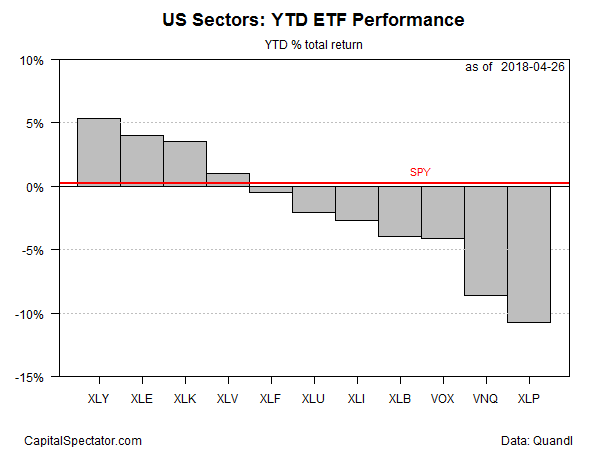

Red ink continues to prevail for most US equity sectors for year-to-date (YTD) performances through Thursday’s close (April 26). Just four of the eleven sectors are currently posting gains this year, based on a set of ETFs.

The strongest YTD performer at the moment: consumer discretionary stocks. The Consumer Discretionary Select Sector SPDR (XLY) is up 5.3% this year. The gain represents the biggest sector premium over the broad market’s fractional 0.2% year-to-date return, based on the SPDR S&P 500 ETF SPY. Meanwhile, the Consumer Staples Select Sector SPDR Fund (XLP) is nursing the biggest YTD sector loss: the ETF is off nearly 11% so far in 2018.

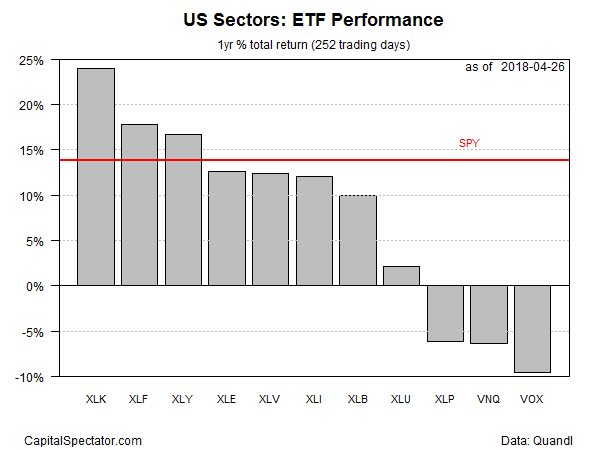

For the one-year trend, tech remains the clear winner. The Technology Select Sector SPDR (XLK) is up a strong 24% over the past 12 months – well ahead of the rest of the field.

Paul Nolte, portfolio manager at Kingsview Asset Management, says:

Tech has been the leading sector of the market for years, and while it took a back seat over the past few weeks, it is now reasserting its leadership and the market is following.

While I’m not comfortable with market valuations overall, tech still looks relatively inexpensive.

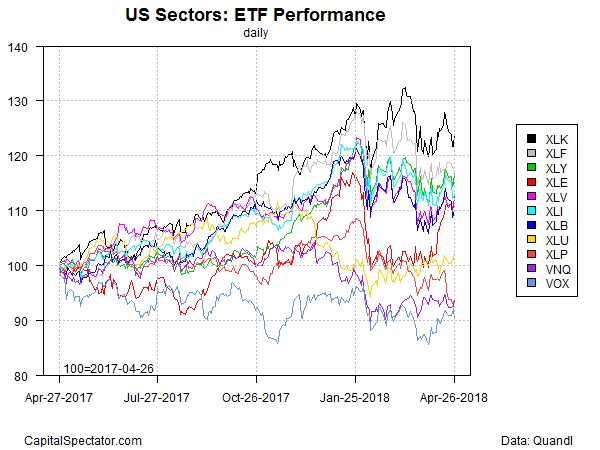

Tech’s dominance for the trailing one-year window remains conspicuous, as the performance chart below reminds. Although XLK has stumbled recently, the ETF is still firmly in the lead relative to year-earlier prices.

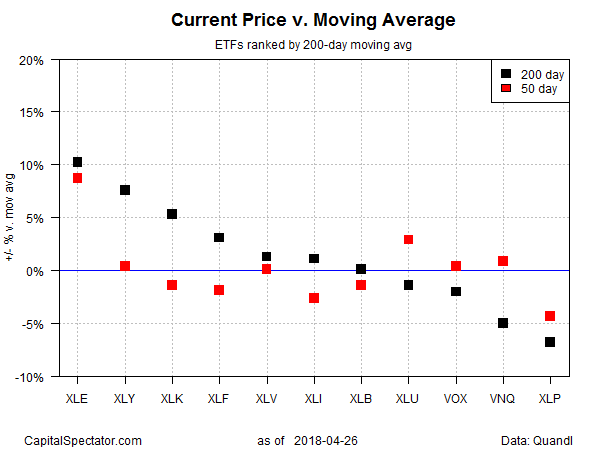

Ranking the sector ETFs by current price relative to 200-day moving average, however, reveals that energy stocks are posting the strongest momentum profile at the moment. The Energy Select Sector SPDR (XLE) closed yesterday at roughly 10% above its 50- and 200-day average – a bullish outlier vs. the other sector ETFs on this score.

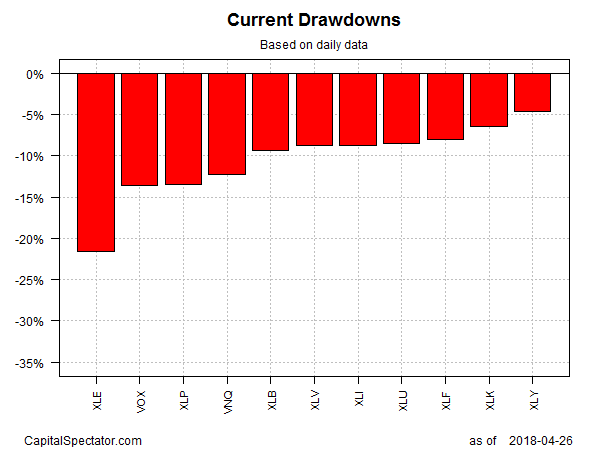

Ranking sector ETFs by current drawdown, on the other hand, reveals that the energy sector is still deep in the hole. XLE’s peak-to-trough decline is 20%-plus at the moment, substantially deeper compared with drawdowns in the other sectors.