Lords Defeat May Again on Brexit

- The House of Lords opposed Prime Minister Theresa May on an important legislation regarding Brexit. The Lords supported a modification to the government’s alleged European Union (Withdrawal) Bill. The modification would guarantee the majority of EU rules on political, social and economic rights will be included as part of British law after Brexit. Please note that this is the third loss in a row for May accounting only for the past week. Further uncertainty within the UK’s political stage could weaken the pound even further.

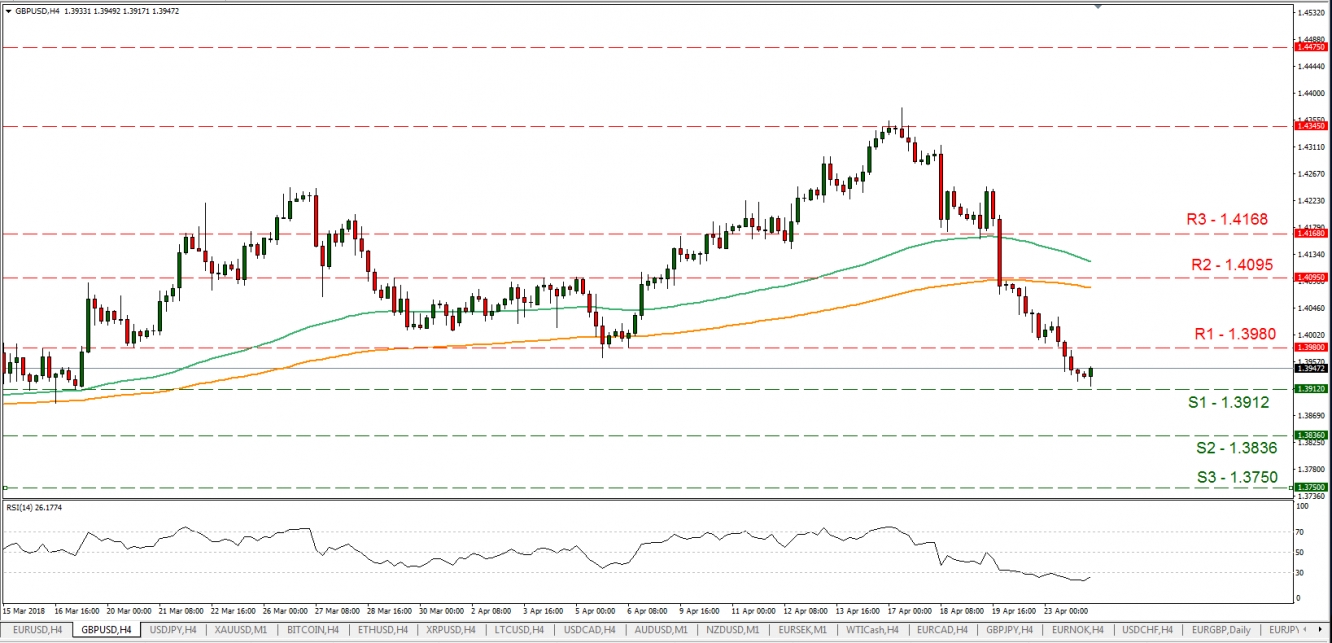

- Cable dropped further yesterday breaking the 1.3980 (R1) support level (now turned to resistance). Should the momentum continue we could see the pair dropping even further. However, the pair seems to be stabilizing somewhat currently as it did yesterday before its drop. If the bears continue to have the upper hand on the pair, we could see it breaking the 1.3912 (S1) support line and aiming for the 1.3836 (S2) support level. Should the bulls take over the reins, we could see it breaking the 1.3980(R1) resistance line and aim for the 1.4095 (R2) resistance hurdle.

G7 foreign ministers discuss as main subjects Russia and Iran matters

- During the G7 meetings on Monday, the leading nations examined ways in order to restrict Russia's activity on geopolitical maters on both conflicts in Syria and Ukraine. Moscow’s ties with the West are somewhat damaged and could worsen even further. US officials emphasized that its priorities also included Iran’s “harmful” regional actions and ending North Korea’s nuclear programs. US Secretary of State John Sullivan stated “Russia should join forces with the US in Syria otherwise will be held responsible.” The unresolved dispute of US with Russia could weaken the Ruble further.

In today’s other economic highlights:

- During today’s European session we get Germany’s Ifo Business Climate for April while in the American session we get the US Consumer Confidence indicator for April as well as the New Home Sales figure for March. All these indicators could move the EUR/USD somewhat.

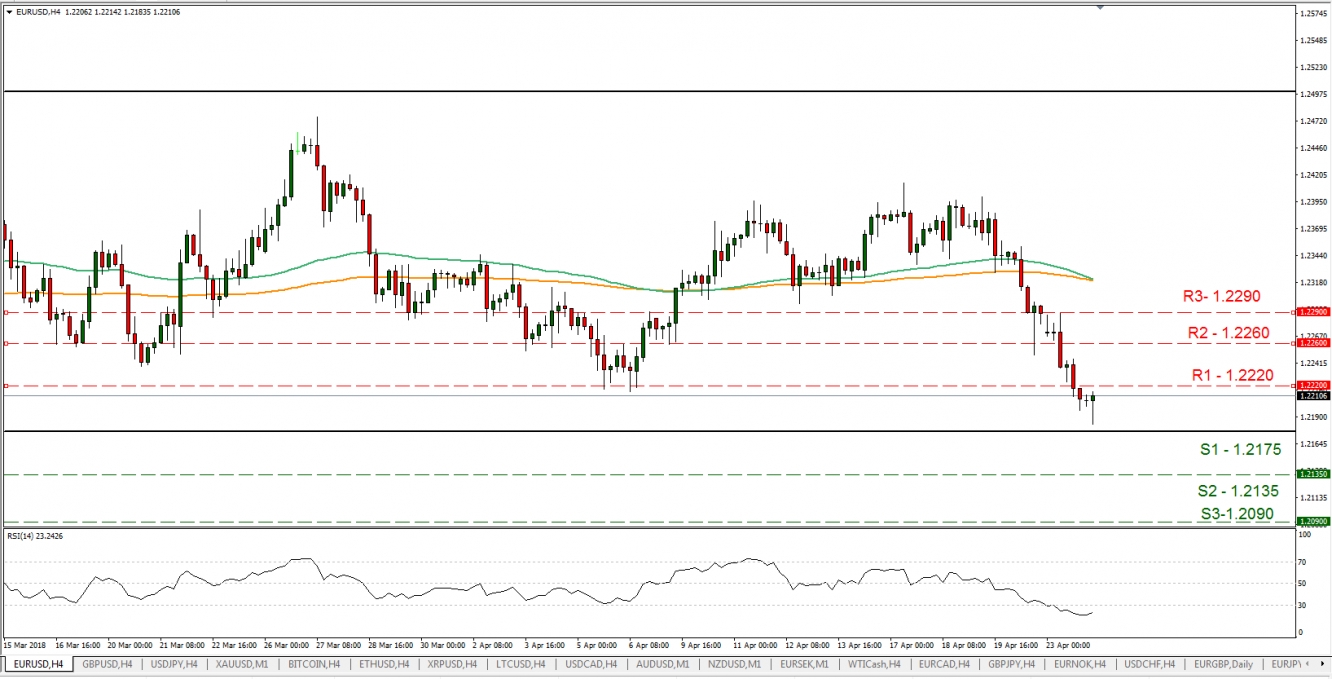

- EUR/USD also traded in a bears market yesterday breaking both the 1.2260 (R2) and the 1.2220 (R1) support levels (now turned to resistance). We could see the pair dropping even further as today’s financial data may prove to be unfavorable for the common currency. On the other hand, the greenback seems to be enjoying a positive momentum due to the rise of the US10-Year treasury yield to almost 3%. Please also note that the pair is aiming towards the 1.2175 (S1) support line which is also the lower boundary of the sideways movement it had since the 17th of January. Should the pair continue to be under selling interest we could see it breaking the 1.2175 (S1) support level and aim for the 1.2135 (S2) support barrier. Should it find buying orders along its path we could see it breaking the 1.2220 (R1) resistance level and aim for the 1.2260 (R2) resistance hurdle.

- Last but not least, today we get the API weekly crude oil stock and as for speakers, Philadelphia Fed President Harker and Bank of England Governor Mark Carney speak.

EUR/USD

·Support: 1.2175 (S1), 1.2135 (S2), 1.2090 (S3)

·Resistance: 1.2220 (R1), 1.2260 (R2), 1.2290 (R3)

·Support: 1.3912(S1), 1.3836(S2), 1.3750(S3)

·Resistance: 1.3980(R1), 1.4095(R2), 1.4168(R3)