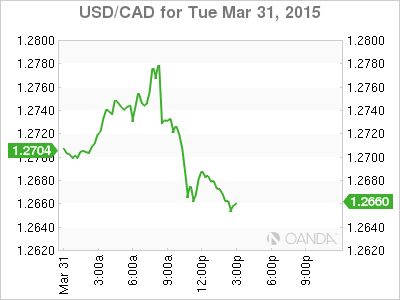

The Canadian economy surprised to the upside after the gross domestic product in January was reported to have shrunk 0.1 percent versus the expected 0.2 percent contraction. Prior to the release the USD/CAD was trading at 1.2776. With oil prices continuing their downward spiral the GDP figure was able to boost the CAD to 1.2720. The Canadian dollar will continue to be under pressure this week as employment data out of the U.S. could reignite the USD rally.

Yesterday’s comments from Bank of Canada Governor Stephen Poloz about the ‘atrocious’ effect of lower oil prices on the economy still linger as the impact is just beginning to be felt. The better than expected GDP could push back a second rate cut this year by the BOC. Governor Poloz has been explicit that the first cut, which came as surprise to the market, was a pre-emptive move. The services sector shrunk the most in the GDP reading, which accounts for 70 percent Canada’s production. Poloz is confident that a weaker loonie can boost exports to avoid a further slowdown.

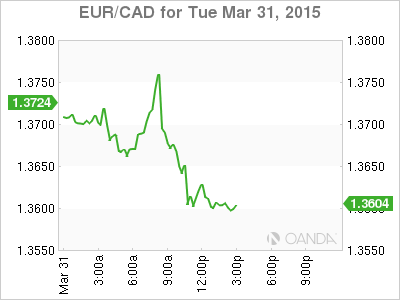

Data out of Europe met expectations. European inflation came in at the forecasted level of -0.1% but failed to aid the EUR. Unemployment in the Eurozone ticked upwards to 11.3%. The higher than forecasted Canadian GDP data helped the CAD recover versus the EUR. After the release of European figures the EUR/CAD depreciated but started an upward move prior to the release of the Canadian growth figures the EUR/CAD was at 1.3770 only to give most of it back. The current level of 1.3660 is close to the post European inflation release reaction levels.

The trade balance will be announced on Thursday and an important figure after Governor Poloz’s statement as the deficit is expected to decrease to -1.8 billion as the fall in the loonie has given exporters an edge.

Canadian employment data usually shares a release date with the American jobs report but they have gotten out of sync in the last two months. The non farm payrolls release will be the biggest economic indicator of the week. Due to the Good Friday holiday there will be less investors watching, but given the importance of the data it is sure to make an impact. Without a Canadian counterpart the move could be one directional against the CAD. A stronger than expected report would strengthen the USD versus the CAD as the U.S. economy continues to reach levels where the Federal Reserve would be in a position to finally raise interest rates. Rate divergence would further depreciate the Canadian dollar, but as Governor Poloz illustrates it can give exporters an opportunity to recover market share with a cheaper currency. The problem lies in the competitiveness of Canadian products even at lower prices as manufacturing was deeply hurt by the rise of the loonie and has not fully recovered.