Key Points:

- The third leg of the Elliot wave has extended further than expected.

- It looks like leg four is now underway.

- Long-term bias remains bearish.

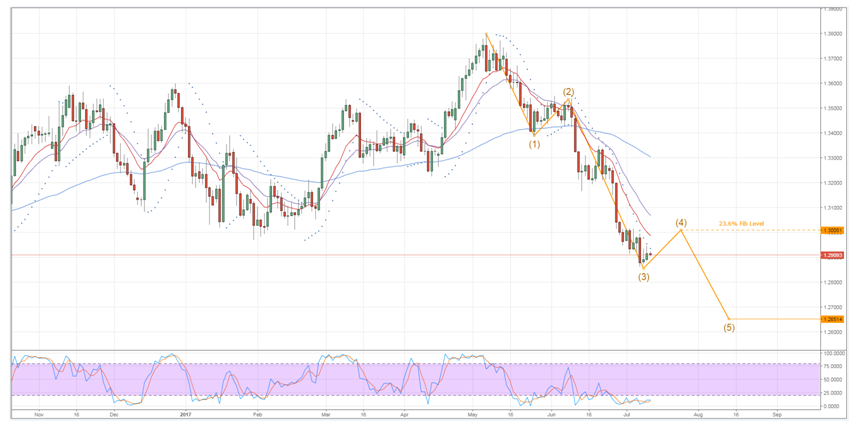

The third leg of the loonie’s Elliot wave extended somewhat below where it was originally forecasted but the decline is now looking just about ready to reverse. As a result, we could have a week or two of gains before selling pressure resumes and sends the pair back to the lows seen early in 2016.

As shown below, a number of technical factors are aligning which signals that leg number three of the Elliot wave should have run its course. Firstly, both stochastics and RSI are oversold and the former is in dire need of being relieved. Indeed, it appears that this need to rally is strong enough to offset even yesterday’s rather notable swing against the greenback following the softer JOLTS Jobs data.

Also worth noting, it would only require an advance of around 30 pips for the USDCAD to invert another key technical reading to bullish. Specifically, the Parabolic SAR is currently on the cusp of moving below price action – a strong indicator that near-term momentum has shifted from bearish to bullish. What’s more, such an inversion would likely be accompanied by a near-term price bump that could actually see the MACD and signal line cross over, yet another indicator of a change in the near to medium-term bias for the pair.

Once we have confirmed the end of leg number three, we expect the fourth leg of the wave to drag price action back to around the 1.30 handle. Here, the 23.6% Fibonacci retracement should help to encourage another reversal and a subsequent downtrend. This fifth and final leg should terminate around the 1.2651 mark which could see the 12-month uptrend entirely undone.

Ultimately, that final push lower is subject to some fundamental risk which is worth keeping in mind. Nevertheless, these are more likely to muddy the overall pattern rather than disrupt it entirely which means our bias is still bearish in the medium to long-term. However, be on guard for any corrective structures that could be seen as the fifth leg ends given that any resulting buying pressure could see the pair move sharply higher rather quickly.