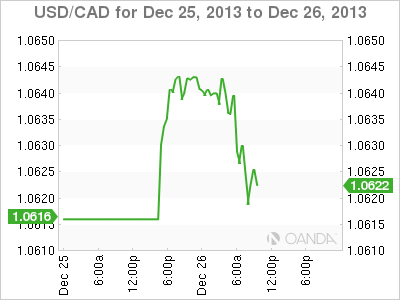

The Canadian dollar has edged higher in Thursday trading, as USD/CAD trades in the low-1.06 range. Trade on Thursday is expected to be thin, as Canadian markets are closed for the Boxing Day holiday. Today's only US release was Unemployment Claims, and the key indicator dropped sharply to 338 thousand.

US Unemployment Claims dropped sharply on Thursday. The indicator fell to 338 thousand, down from 379 thousand in the previous release. The estimate stood at 346 thousand. The sharp reading was a dramatic reversal from numbers over the past two weeks, which were much higher than the forecast. With the Federal Reserve poised to begin its long-awaited QE taper next month, employment releases have taken on added significance. If the labor market continues to improve, we are likely to see further QE reductions, which would give a boost to the US dollar against its major rivals.

There was some holiday cheer from US releases on Tuesday, as manufacturing and housing numbers pointed upwards. Core Durable Goods Orders posted a strong gain of 1.2%, its best showing since April. The key manufacturing indicator had posted four consecutive declines, so the sharp gain was welcome news. Durable Goods Orders bounced back from a sharp decline in October with a gain of 3.5%, well above the estimate of 1.7%. New Homes Sales also impressed with a five-month high, climbing to 464 thousand. The estimate stood at 449 thousand.

Across the border, Canadian GDP posted a modest gain of 0.3%, but this was more than enough to beat the estimate of 0.1%. GDP has posted three straight readings of 0.3%, and each has beaten the estimate, as the Canadian economy continues to grow at a faster pace than expected. The release boosted the Canadian dollar, which has recovered from the sharp losses sustained after the Fed's dramatic taper announcement.

The year ended on a dramatic note as the US Federal Reserve announced last week that it would begin tapering its $85 billion QE program by $10 billion, commencing in January. This will reduce the Fed's asset purchases to $75 billion every month, comprised of $40 billion in Treasuries and $35 billion in mortgage bonds. The announcement came as somewhat of a surprise, as most analysts had expected the Fed to hold off on any QE reductions until early next year. The Canadian dollar responded by losing over a cent against its US counterpart.

In its tapering announcement, the Federal Reserve was careful to separate tapering from rate hike expectations. Fed chairman Bernard Bernanke stated that interest rates are likely to remain low even after the unemployment rate drops below 6.5%. Previously, the Fed had stated that it would start to consider rate increases when unemployment fell below this level. With the US unemployment rate at 7.0%, it appears a safe bet that we won't see any change in US rates for quite some time.

USD/CAD" title="USD/CAD" height="300" width="400">

USD/CAD" title="USD/CAD" height="300" width="400">

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.0442 | 1.0502 | 1.0573 | 1.0652 | 1.0783 | 1.0852 |

USD/CAD has edged lower in Thursday trading, as the proximate support and resistance lines (S1 and R1 above) remain in place.

- On the downside, 1.0573 continues provide support. It could face pressure if the loonie continues to improve. This is followed by support at 1.0502, which is protecting the 1.05 line.

- 1.0652 is providing weak resistance. This is followed by a stronger line at 1.0783.

- Current range: 1.0573 to 1.0652

Further Levels in both directions:

- Below: 1.0573, 1.0502, 1.0442 and 1.0337

- Above 1.0652, 1.0783, 1.0852, 1.10 and 1.1094

OANDA's Open Positions Ratio

USD/CAD ratio is showing little change on Thursday, continuing the trend we have seen all week. This is consistent with what we are seeing from the pair, which is showing very little movement. A slight majority of the open positions in the USD/CAD ratio are short, indicating a slight bias towards the Canadian dollar gaining ground against the US currency.

The Canadian dollar continues to hold firm despite strong US numbers this week, including sharp Unemployment Claims earlier on Thursday. With the Canadian markets closed, we can expect the pair's movement during the North American session to be limited.

USD/CAD Fundamentals

- 13:30 US Unemployment Claims. Estimate 338K. Actual 346K.

*Key releases are highlighted in bold

*All release times are GMT