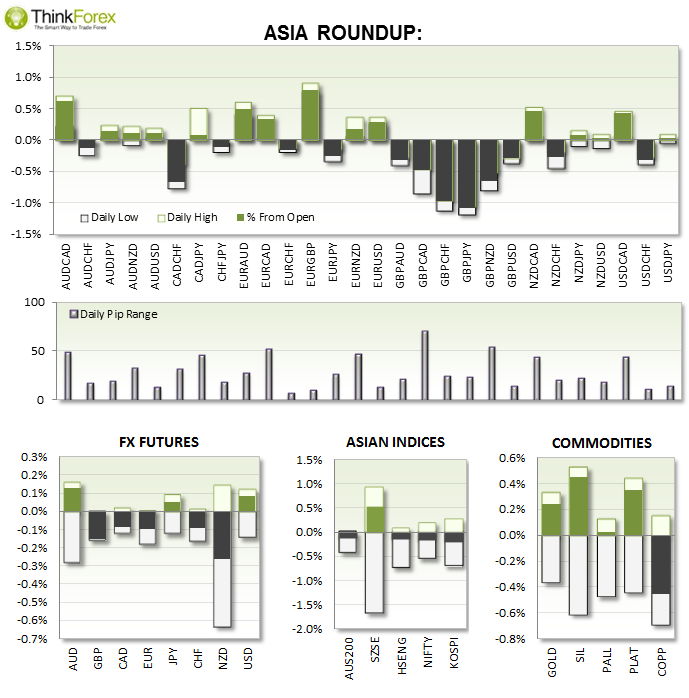

- Quiet start to the FX week as prices remained near last week's closing prices

- JPY consumer confidence up from last month but slightly below expectations, at 41.5 vs 42.3 forecast;

- Tertiary Industry Activity contracts by -0.1% m/m

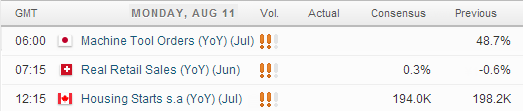

UP NEXT:

Being a relatively quiet start to the week we can expect market moves to be limited (albeit any increase geo-political concerns). Under such events then safe havens such as USD, CHF, JPY and Gold tend to attract the money flow.

TECHNICAL ANALYSIS:

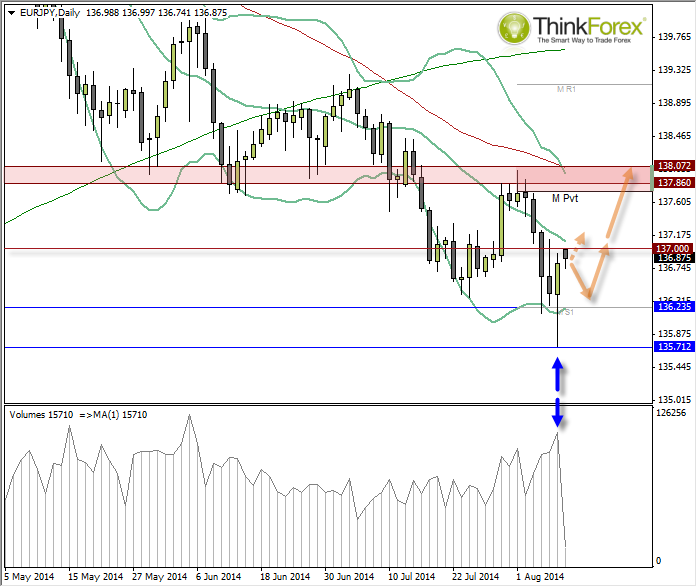

EUR/JPY: Trading the bans

Friday's candle with a Bullish Hammer with an elongated body and on high volume. This suggests a bottom (near-term) and the fact it is now back within the Bollinger Band suggests we may now travel towards the opposite band.

However at current prices is difficult to achieve a decent reward/risk ratio, so I would prefer to buy into any weakness and seeking bullish setups on lower timeframes within the body of Friday’s candle.

Of course the trouble with this strategy is you are trading against the trend, which makes it extra risky. For this reason I would require a decent reward/risk ratio to justify the additional risk.

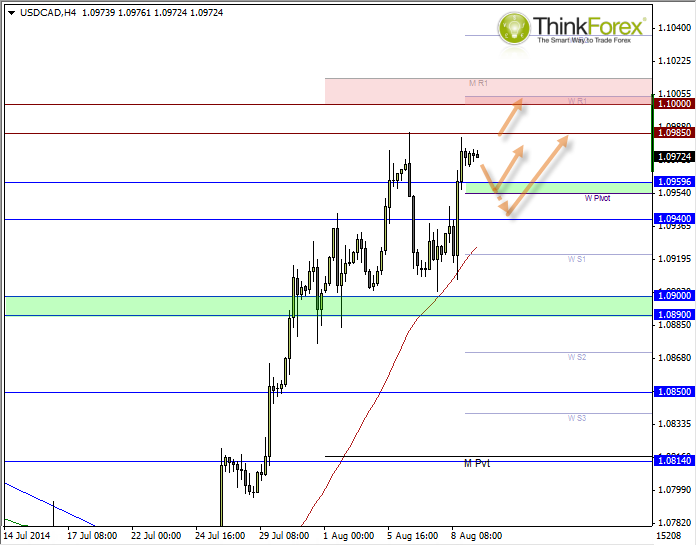

USD/CAD: Eyeing up 1.10

We can within a cat-whisker within this key level and that fact that USDCAD closed near the weekly highs and open back up at these levels (without gapping) suggests we may well test 1.10 this session.

With Canadian Data out tonight then any shortfall should help support USDCAD en route to 1.10.

Any retracement towards 1.0955 may entice bullish swing traders, or for a deeper pullback we can consider buy setups around 1.094 However below here I would prefer to stand aside until a clearer direction begins to take hold.