Market Brief

The FX markets made a flat start; a data/event-full week is ahead of us. USD/JPY and JPY crosses traded mixed in Tokyo as industrial production estimate in May printed slower-than-expected expansion, the housing starts in May dropped by 15% in May (vs. -10.5% exp. & -3.3% last). USD/JPY advanced to 101.47, then tumbled to 101.24 before the European opening. Trend and momentum indicators are marginally bearish, offers trail below the 200-dma (101.72). EUR/JPY remains ranged and should continue seeing resistance at 138.79/139.09 (21&200 dma) before Thursday’s ECB meeting. The key support stands at 137.70/75 (June support).

EUR/USD recorded the highest close since June 5th (ECB) on Friday. The pair opened flat in Asia and rallied to 1.3654 as Europe walked in. EUR/USD is stuck between 21/200-dma (1.3598/1.3674). Euro-zone June inflation estimates are due today (09:00 GMT), a breakout above 1.3674/77 (post-ECB resistance) is monitored to confirm sustainable positive trend. EUR/GBP correction continues. Short-term resistance is eyed at 0.80400 (21-dma & June corrective uptrend top).

The Cable consolidates gains below the year-high 1.7063. The macro prudential measures announced by FPC to taper the boom in UK’s housing market were judged soft by traders. However, Carney’s cautious speech on BBC (household debt remains highs, the rate normalization will be limited and gradual) keep the fresh demand limited. Key support zone stand at 1.6923/53 (June 18/25 low resp.)

In Australia, the TD securities inflation flattened in June, the year-on-year inflation advanced to 3.0%. AUD/USD remained well bid above 0.9409; trend and momentum indicators are flat. The RBA verdict (Tue) should help defining fresh direction. On the upside, 0.9445-0.9460 resistance zone remains solid as RBA is expected to renew its dovish tone. First line of support stands at 0.9339/71 (Fib 61.8% on Oct’13 – Jan’14 drop / 21-dma).

USD/CAD extended weakness to 1.0658 at week opening. The oversold conditions (RSI at 25%, lower BB at 1.0684) suggest a short-term upside correction. The bias is clearly on the downside; traders look to sell the corrective rallies. Canada releases April GDP figures today. If the strong market expectations are met, we should see further extension of CAD-gains. EUR/CAD trails down following closely the Apr-Jan downtrend bottom. Technically, 21-dma crossed below 200-dma reinforcing the bearish sentiment from tech players. We place our first target to 1.45000. Support is seen at 1.44102. (Jan 6th & ytd low).

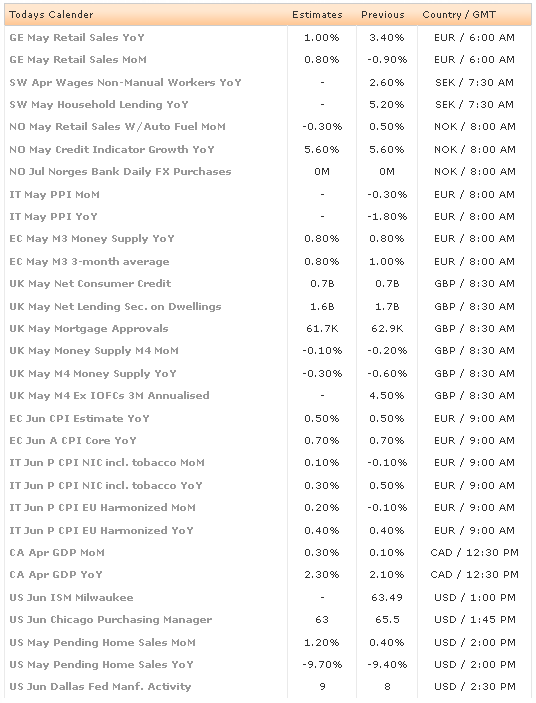

Today, traders watch German May Retail Sales m/m & y/y, Swedish April Household Lending y/y, Norwegian May Retail Sales with Auto Fuel m/m, Credit Indicator Growth, Italian May PPI m/m & y/y, Euro-Zone May M3 Money Supply, UK May Net Consumer Credit, Net Lending Securities on Dwellings, Mortgage Approvals, M4 Money Supply, Euro-Zone Jun CPI Estimate y/y and June (prelim) Core CPI y/y, Italian Jun (prelim) CPI m/m & y/y, Canadian April GDP m/m & y/y, US June ISM Milwaukee, June Chicago Purchasing Manager, US May Pending Home Sales m/m & y/y and Dallas Fed June Manufacturing Activity.

Currency Tech

EURUSD

R 2: 1.3735

R 1: 1.3677

CURRENT: 1.3612

S 1: 1.3598

S 2: 1.3565

GBPUSD

R 2: 1.7332

R 1: 1.7063

CURRENT: 1.7023

S 1: 1.6953

S 2: 1.6923

USDJPY

R 2: 102.20

R 1: 101.72

CURRENT: 101.42

S 1: 101.01

S 2: 100.76

USDCHF

R 2: 0.8975

R 1: 0.8955

CURRENT: 0.8912

S 1: 0.8904

S 2: 0.8882