USD/CAD rallied to its highest levels since June of 2019 in early trading on Friday. The Canadian dollar was pressured as crude oil prices fell to their lowest levels in over a year. The Canadian dollar has a positive correlation with crude oil, since it is one of the world’s leading oil producing nations.

The selloff in crude oil was spurred by fears of a cononavirus pandemic that could hinder global economic growth and in turn reduce demand. China and the United States are the world’s largest oil consumers. Earlier in February, the International Energy Agency said that it expects global oil demand will fall in the first quarter of 2020 - which would mark its first quarterly contraction in over 10 years.

On Wednesday the number of new coronavirus infections in China was exceeded by new cases abroad, underscoring the danger of the outbreak becoming a pandemic. Over 83,000 people in at least 53 countries have been infected, and more than 2,800 have lost their lives. The vast majority of cases so far have been in China.

On Thursday, Tedros Adhanom Ghebreyesus, the director general of the World Health Organization (WHO) said: “This virus has pandemic potential.”

He also warned; “we are actually in a very delicate situation in which the outbreak can go in any direction based on how we handle it.”

European markets sank in early trading on Friday, following Thursday’s bloodbath in US stocks, with the Dow closing 1,190 points lower. US stock index futures currently point to a lower open. Meanwhile the safe haven Japanese yen and Swiss franc are trading sharply higher.

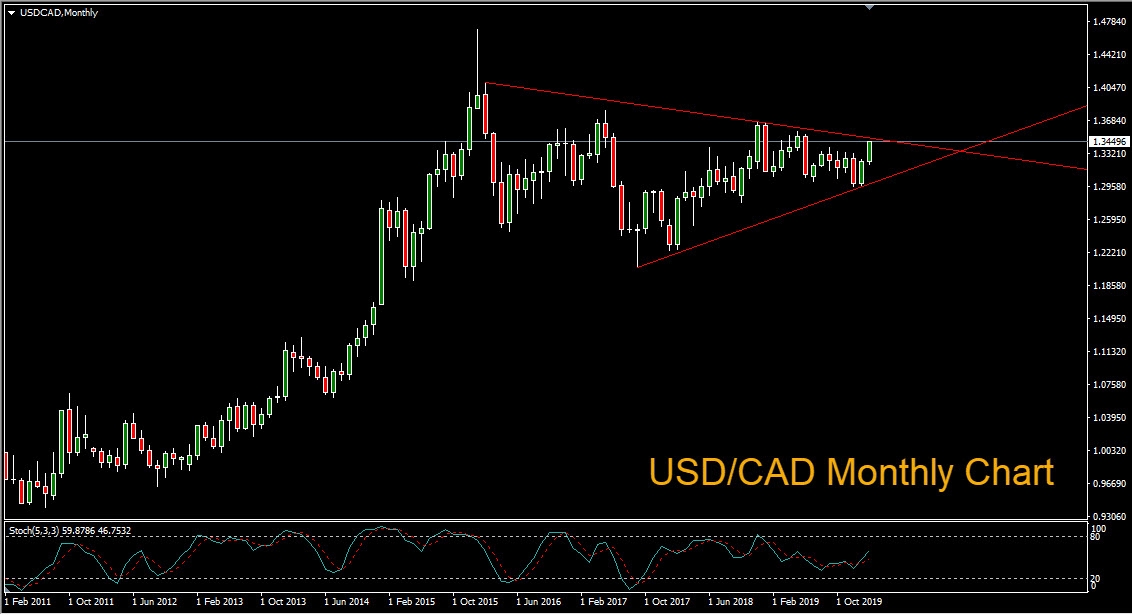

Looking at the USD/CAD monthly chart we can see that a pennant pattern has formed and that price is currently pressed against the upper trendline. A break above will bring the prior high of 1.3664 into view for the bulls.