Ever since last week, the market has been slicing the heads off bears left and right, with the Dow up thousandsof points and the S&P 500 Futures up about 300. It’s been unrelenting.

My view is that all this is going to accomplish is that the surviving 12 bears on the entire planet will just have another opportunity to short at good prices. There may be more upside in some sectors, but there are definitely some ETFs where I can point to logical, and major, resistance levels, like the SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA):

And he worldwide equities iShares MSCI EAFE ETF (NYSE:EFA):

(Which, on a much longer timescale, illustrates how beautifully we are mashed up against that incredibly important broken trendline):

And the iShares Russell 2000 ETF (NYSE:IWM) small caps:

And the consumer discretionary Consumer Discretionary Select Sector SPDR® Fund (NYSE:XLY):

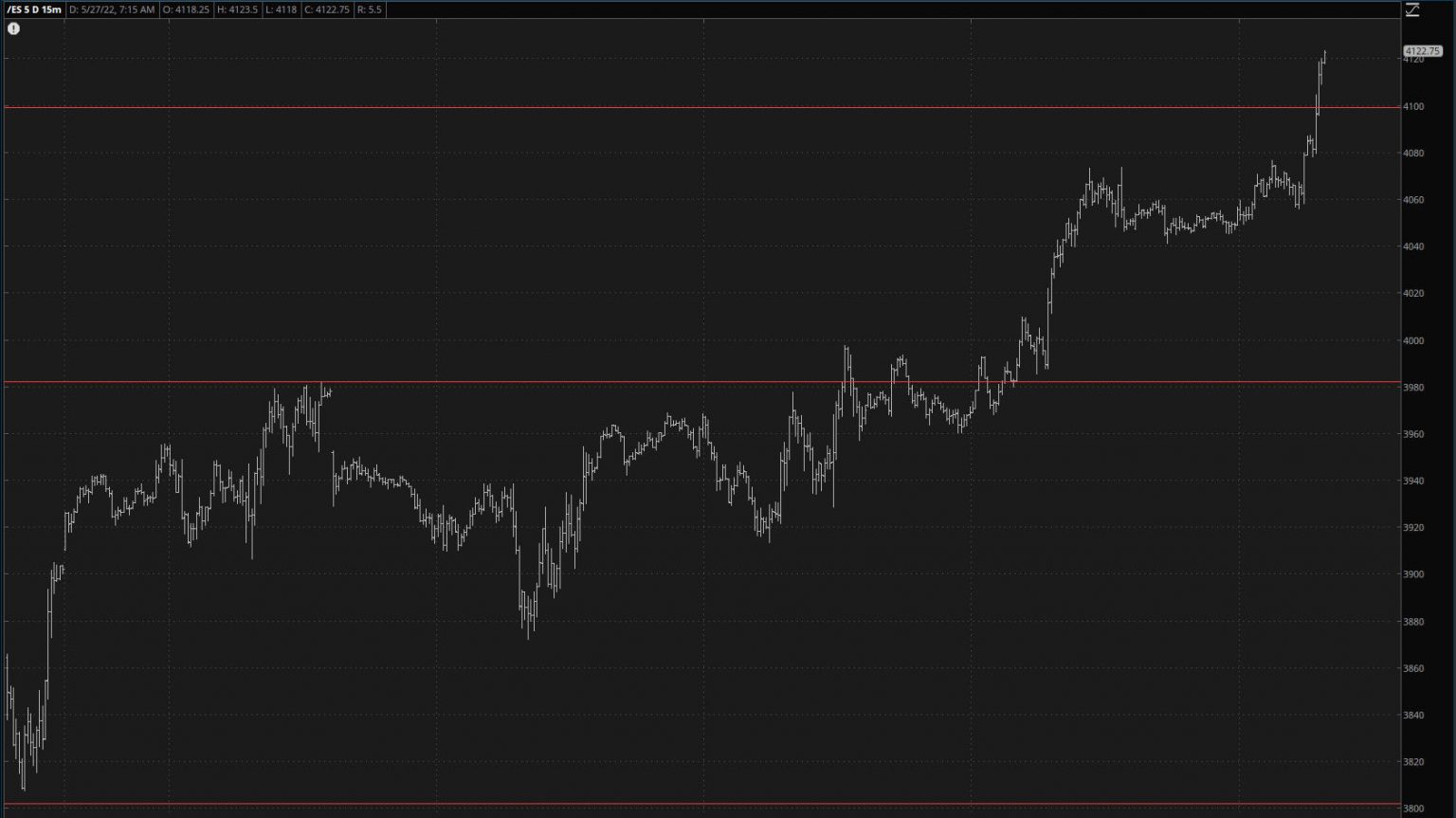

I’ve mentioned 4100 (approximately) as a key level on the /ES futures, and we’ve pushed past that (strictly speaking, the retracement is at 4165.02, so we have not exceeded the line, as today’s peak has been 4126 as of the composition of this post):

The Nasdaq 100 Futures also look enticing:

In spite of the fact this is probably a sensational time to go “all-in” with shorts, I am simply too bloodied and dazed and cautious to do so. Thus, I remain merely two-thirds committed to positions. Emotions are terrible for good trading, and I regret that mine are still in fully-functioning operation.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.