Chart 1: Russian equities might be ready for a breakout soon enough

This is a market I have been watching closely since the panic sell off in March of this year. Regular readers also know that I initiated my first long position (via the MarketVectors Russia Index (NYSE:RSX)) in early March lows, as selling pressure climaxed and most investors capitulated on high volume. Since I have discussed Russian equities a few times over the last several months, I won’t be repeating myself here. However, this is a quick post with a view that there is above-average probability that Russian equities have now already bottomed.

This past week's price action saw a huge weekly bullish engulfing candle as the Russia-Ukraine geopolitical situation calmed a little bit with a cease fire treaty. I find it even more interesting that despite deterioration in “bad news” over the last several weeks, Russian equities have actually failed to make new lows below those of March 2014. In other words, it seems that the market has already discounted the worst and could now be posting a higher low instead – a first sign the downtrend might be ending.

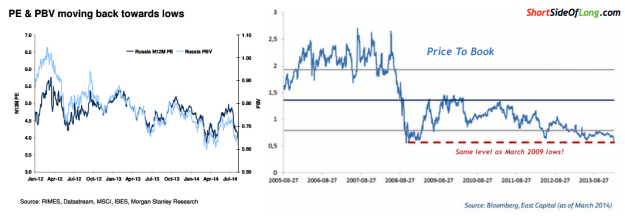

Price to book valuations are at March 2009 lows, dividend yield is 3% on large caps and 3.6% on small caps, which is much more attractive then the U.S. 10-Year Treasury Note, and definitely a lot more attractive then the German 10-Year Bund. All in all, a technical breakout above the 7 year downtrend line could see Russian equities follow through together with China and the rest of GEMs. A rally above $27 on the RSX ETF, would be a very good sign. This one could be a real buy-and-hold for a few years, so if the price confirms my view I will act with a very large position!

Chart 2: Russian stocks are the cheapest and most hated in the world!