The markets appear to be in turmoil. Historically markets have proven to be forward looking, and it is hard to imagine this is true when looking at seemingly illogical movements (at times good is bad and bad is good).

Follow up:

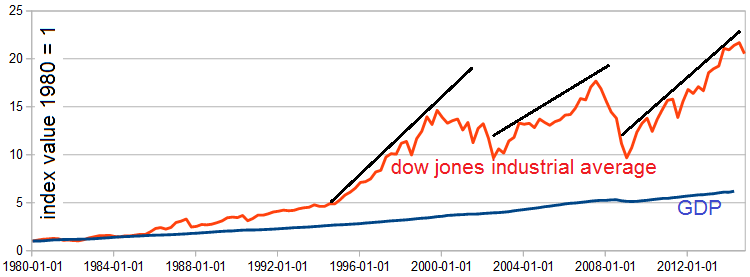

I do look at the markets to predict the economy. For whatever reason, the market players understand economic dynamics better than economists - albeit in an exaggerated and emotional pattern peaking before each recent recession.

I look at it this way - if every time I saw a hawk outside my window - Apple stock (NASDAQ:AAPL) rose - would I buy Apple when I see the hawk? The reasons for market movement do not have to be logically based on an economic perspective. The market is making noise, but we must decide if the noise is foretelling economic downturn - or just a simple correction, a repricing adjustment.

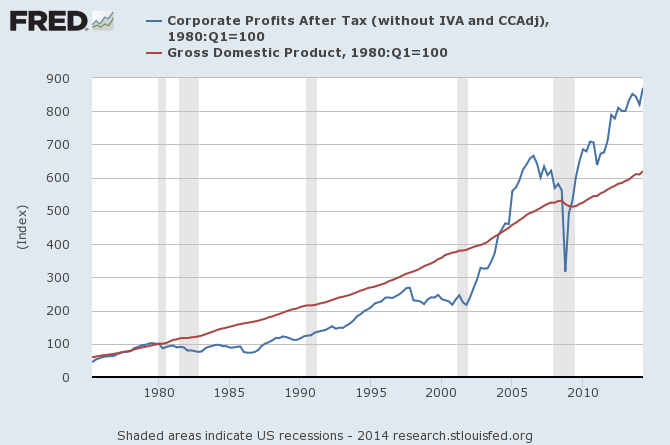

From my perspective, the market was overvalued prior to the Great Recession of 2007 - and has since regained this overvalued position. However, this is based on taxable earnings INSIDE the USA. Pundits have stated 40% to 50% of the earnings of major corporations come from outside the USA today. So it is possible (even likely) the perceived slowdown of the major advanced economies and BRICS could have spooked the market.

The consolidated economic report from the 12 Federal Reserve Districts (Beige Book) released this past week described economic growth continuing "at a pace similar to that noted in the previous Beige Book". The previous report said "economic activity has expanded since the previous Beige Book report; however, none of the Districts pointed to a distinct shift in the overall pace of growth". The key thought was that the rate of growth is unchanged.

Fed's Words When Economy is entering a Recession:

For the December 2007 recession, here is the lead up summary words from the Beige Books:

- 28Nov2007 - "expanding"

- 16Jan2008 - "increasing moderately"

- 05Mar2008 - "growth slowed"

- 16Apr2008 - "weakened"

For the March 2001 recession which ended in November 2001, here are the Beige Book summary words:

- 17Jan2001 - "economic growth slowed"

- 07Mar2001 - "sluggish to modest economic growth"

- 02May2001 - "slow pace of economic activity"

- 13Jun2001 - "little changed or decelerating"

- 08Aug2001 - "slow growth or lateral movement"

- 19Sep2001 - "sluggish"

- 24Oct2001 - "weak economic activity"

- 28Nov2001 - "remained soft"

- 16Jan2002 - "remained weak"

Personally, I would not look to the Federal Reserve for guidance on economic direction.

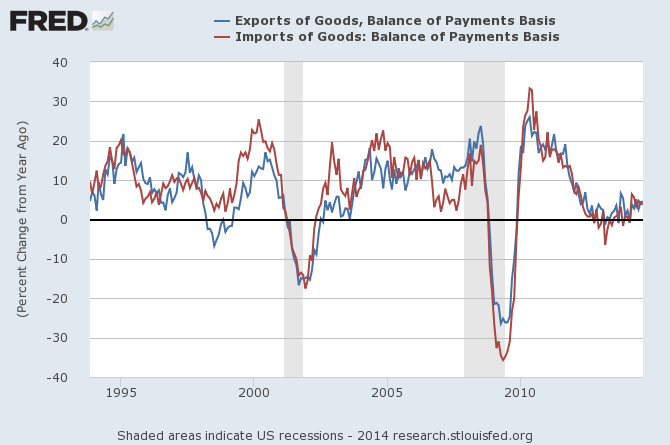

If corporate revenue and earnings were limited to the USA, and since there are no warning signs in the leading indicators, the current downturn in the markets would be considered a correction. But in this ever increasingly globalized world, the effects of a global slowdown seemingly migrate into the USA economy in ever increasing strength as time passes. However, to date, no slowdown is evident in the trade data trends. Growing exports signal strengthening export markets (or at least a more competitive USA position in the markets), whilst growing imports signal a strengthening USA consumer (or a stronger dollar).

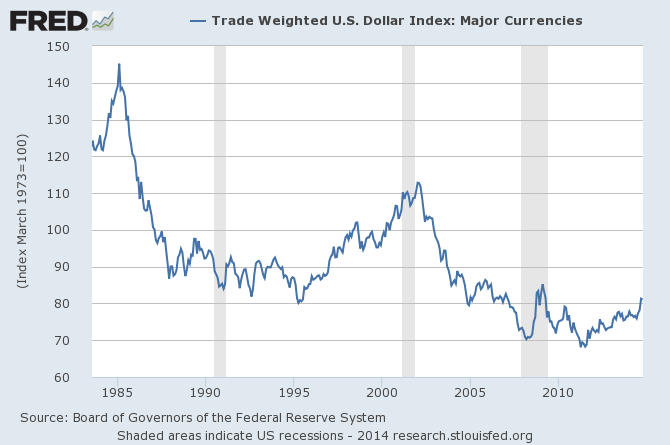

Still, there are enough signs the global economies are slowing in the manufacturing surveys. Further consider that the dollar has strengthened to a post Great Recession high point (which diminishes non-dollar earnings) - although the dollar's strength has been easing at the end of this past week.

One final thought provided by Ambrose Evans-Pritchard in a Telegraph post:

Combined tightening by the United States and China has done its worst. Global liquidity is evaporating.

What looked liked a gentle tap on the brakes by the two monetary superpowers has proved too much for a fragile world economy, still locked in "secular stagnation". The latest investor survey by Bank of America shows that fund managers no longer believe the European Central Bank will step into the breach with quantitative easing of its own, at least on a worthwhile scale.

Markets are suddenly prey to the disturbing thought that the five-and-a-half year expansion since the Lehman crisis may already be over, before Europe has regained its prior level of output. That is the chief reason why the price of Brent crude has crashed by 25pc since June. It is why yields on 10-year US Treasuries have fallen to 1.96pc, and why German Bunds are pricing in perma-slump at historic lows of 0.81pc this week.

We will find out soon whether or not this a replay of 1937 when the authorities drained stimulus too early, and set off the second leg of the Great Depression.

The USA equity markets may be signalling an economic slowdown - or not. This is part of the haze of looking at information in real time.

Other Economic News this Week:

The Econintersect Economic Index for October 2014 is showing our index remaining in a tight growth range for over a half a year. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption although data is now showing consumer income is now growing faster than expenditures growth - but with the rate of savings historically on the low side. There are no warning signs in other leading indices that the economy is stalling - although ECRI's Weekly Leading Index is showing very little growth is coming.

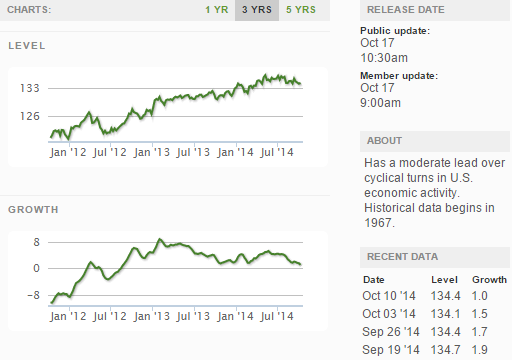

The ECRI WLI growth index value has been weakly in positive territory for almost two years. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

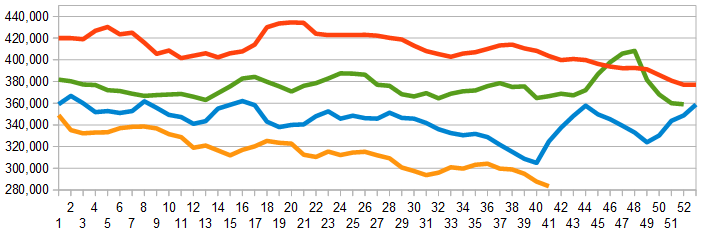

The market was expecting the weekly initial unemployment claims at 280,000 to 295,000 (consensus 290,000) vs the 264,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 287,750 (reported last week as 287,750) to 283,500.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Endeavour International, Inversiones Alsacia

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: