Today, the Federal Reserve, the ECB, the Bank of Canada, the Bank of England, the Bank of Japan and the Swiss National Bank announced a co-ordinated action to lower the pricing on the existing temporary US dollar liquidity swap arrangements by 50bp so that the new rate will be the US dollar Overnight Index Swap rate plus 50bp. Hence, the maximum price for dollar funding has now been lowered.

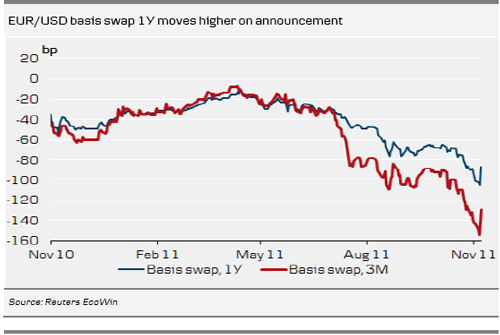

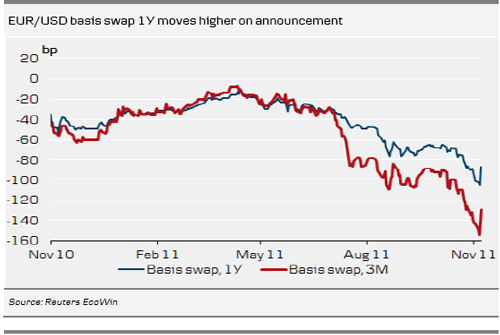

This is especially important for the European financial sector, which remains underfunded in US dollars and, as such, the move by the central banks should ease strains in the European financial markets. Further, it makes backstop access to dollar funding cheaper; hence, it should also lower the market price of USD funding. This brought relief to the EUR/USD basis swap. Remember, a lack of dollar funding was one of the main issues in 2008 following the Lehman Brothers collapse.

Market participants will clearly be waiting to see whether more will be announced or whether this is a one-off from global central banks. However, note the strong positive reaction in global equity markets, emerging markets and commodities. Expectations are clearly building that more monetary easing is coming. In the coming days and weeks, we could potentially see even more globally co-ordinated action. In particular, we would keep an eye on action by other central banks such as the Scandinavian central banks and the Central and Eastern European central banks.

Next focal point for financial markets will be the ECB meeting 8 December and the EU summit 9 December

In respect of the ECB meeting, this should boost expectations that the ECB could react more aggressively than currently expected, i.e. lowering rates by 50bp and supplying 24M funding to the market.

This is obviously positive for risk appetite but it is probably not enough and we do not expect the European crisis to “go way” on the back of this. Furthermore, it should be noted that while the problem back in 2008-09 was primarily a USD funding problem outside the US, the European debt the crisis is much more complex in terms of serious sovereign debt problems. In this regard, it is notable that this basically seems to have been initiated more by the Federal Reserve than by the ECB.

Consider selling EUR/USD on this

We recommend being careful in respect of EUR/USD. One reason why EUR/USD has been lifted so dramatically is that the market was caught on the wrong foot. Remember, the weekly IMM positions data clearly shows that speculative accounts are extremely short EUR. Again, today's move does not solve the debt crisis itself. Hence, some investors might be tempted to sell into the EUR rebound, not least if this fuels speculation that the ECB might lower rates more aggressively on 8 December. Hence, clients with USD expenses should consider using this spike in EUR/USD as an opportunity to increase hedges. Further short covering could potentially push the cross higher. However, fundamentally, the trend is still pointing lower for EUR/USD. We continue to see EUR/USD at 1.30 in 3 months time.

EUR/USD initially jumped to 1.35 from 1.33 ahead of the announcement; however, following the initial relatively marked reaction the impact is fading.

This is especially important for the European financial sector, which remains underfunded in US dollars and, as such, the move by the central banks should ease strains in the European financial markets. Further, it makes backstop access to dollar funding cheaper; hence, it should also lower the market price of USD funding. This brought relief to the EUR/USD basis swap. Remember, a lack of dollar funding was one of the main issues in 2008 following the Lehman Brothers collapse.

Market participants will clearly be waiting to see whether more will be announced or whether this is a one-off from global central banks. However, note the strong positive reaction in global equity markets, emerging markets and commodities. Expectations are clearly building that more monetary easing is coming. In the coming days and weeks, we could potentially see even more globally co-ordinated action. In particular, we would keep an eye on action by other central banks such as the Scandinavian central banks and the Central and Eastern European central banks.

Next focal point for financial markets will be the ECB meeting 8 December and the EU summit 9 December

In respect of the ECB meeting, this should boost expectations that the ECB could react more aggressively than currently expected, i.e. lowering rates by 50bp and supplying 24M funding to the market.

This is obviously positive for risk appetite but it is probably not enough and we do not expect the European crisis to “go way” on the back of this. Furthermore, it should be noted that while the problem back in 2008-09 was primarily a USD funding problem outside the US, the European debt the crisis is much more complex in terms of serious sovereign debt problems. In this regard, it is notable that this basically seems to have been initiated more by the Federal Reserve than by the ECB.

Consider selling EUR/USD on this

We recommend being careful in respect of EUR/USD. One reason why EUR/USD has been lifted so dramatically is that the market was caught on the wrong foot. Remember, the weekly IMM positions data clearly shows that speculative accounts are extremely short EUR. Again, today's move does not solve the debt crisis itself. Hence, some investors might be tempted to sell into the EUR rebound, not least if this fuels speculation that the ECB might lower rates more aggressively on 8 December. Hence, clients with USD expenses should consider using this spike in EUR/USD as an opportunity to increase hedges. Further short covering could potentially push the cross higher. However, fundamentally, the trend is still pointing lower for EUR/USD. We continue to see EUR/USD at 1.30 in 3 months time.

EUR/USD initially jumped to 1.35 from 1.33 ahead of the announcement; however, following the initial relatively marked reaction the impact is fading.