Long-term and short-term Elliott wave patterns for natural gas suggest a durable low is nearby. We have been following the decline in the United States Natural Gas Fund (NYSEARCA: UNG) especially closely since it spiked in November 2018, treating it as a downward five-wave (impulsive) move that is also a terminal pattern. An upward reversal should follow.

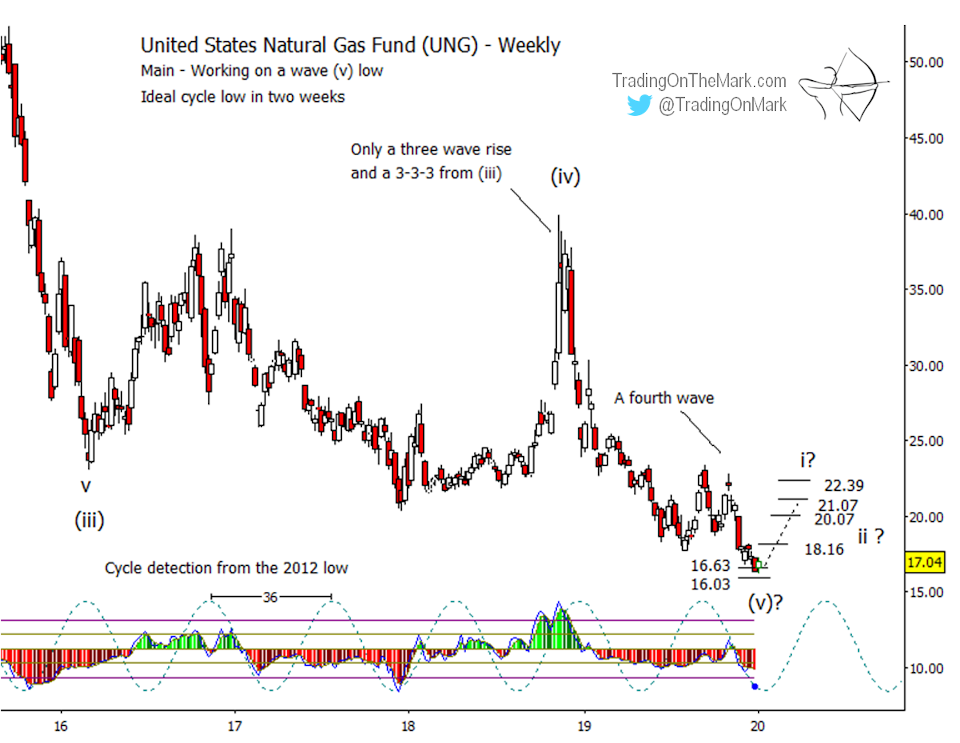

To put context around the idea of a reversal, the entire price decline from 2008 counts well as a five-wave (i)-(ii)-(iii)-(iv)-(v) pattern, with the 2018 price spike marking the completion of corrective wave (iv) in the sequence. The more recent decline from 2018 represents the final wave (v) of the move.

Inside wave (v), there should also be five smaller waves forming a downward impulse. Right now the question is whether the smaller impulse is complete.

Structurally, the sub-waves inside (v) meet the formal requirements for completion. On the weekly chart below, you can see five distinct moves although they are not labeled. Price currently appears to be working through the final stages of the fifth sub-wave of (v).

The support zone near 16.63 and 16.03 is based on a Fibonacci-related technique, and it will probably be felt by the market. Note also that the empirical 36-week price cycle will have an inflection during the week of January 20-24.

On a more detailed daily chart of natural gas futures (available to subscribers), it is possible to count an even smaller set of five waves starting in September 2018 and moving down into an important support area for futures. On the same daily chart there also timing in a faster cycle nearby. This suggests that in addition to big wave (v) being nearly complete, the internal structure of the final fifth sub-wave might also be nearly complete.

Last year we prematurely identified the steep rise in August and September as the beginning of the expected reversal. The rally started at support almost exactly where we said it would, and it touched the first resistance area we were watching. However it failed to produce a weekly close above that area. In hindsight the rally appears to have been the fourth sub-wave inside (v).

Our experience with forecasting the bounce last year emphasizes how important it is to use good trade management practices. The support we mentioned in September worked well for an entry, and the first resistance targets were tested. That could have made for a decent trade, but UNG's failure to produce a confirmation signal should have alerted bullish traders to raise stops or take profits.

Similar considerations might apply in the current situation. If a bounce starts from near the supports marked at 16.63 and 16.03, then the first upward target should be modestly higher at 18.16. A weekly close above that level opens the door to 20.07, 21.07 and possibly 22.39. A close above 21.07 would serve as initial confirmation that a new upward pattern is starting to form.