For most equity strategies diversified across global markets, this year’s results will be painful. Short of a dramatic run higher between now and the end of 2022, red ink will prevail. But when losses dominate, it’s time to start looking for bargains.

The longer your investment horizon, the more confidence you can muster that the losses year to date imply relatively attractive return expectations. But the analysis is especially tricky at the moment as several risk factors dominate the outlook, including the war in Ukraine, elevated inflation, rising interest rates and signs that recession is near.

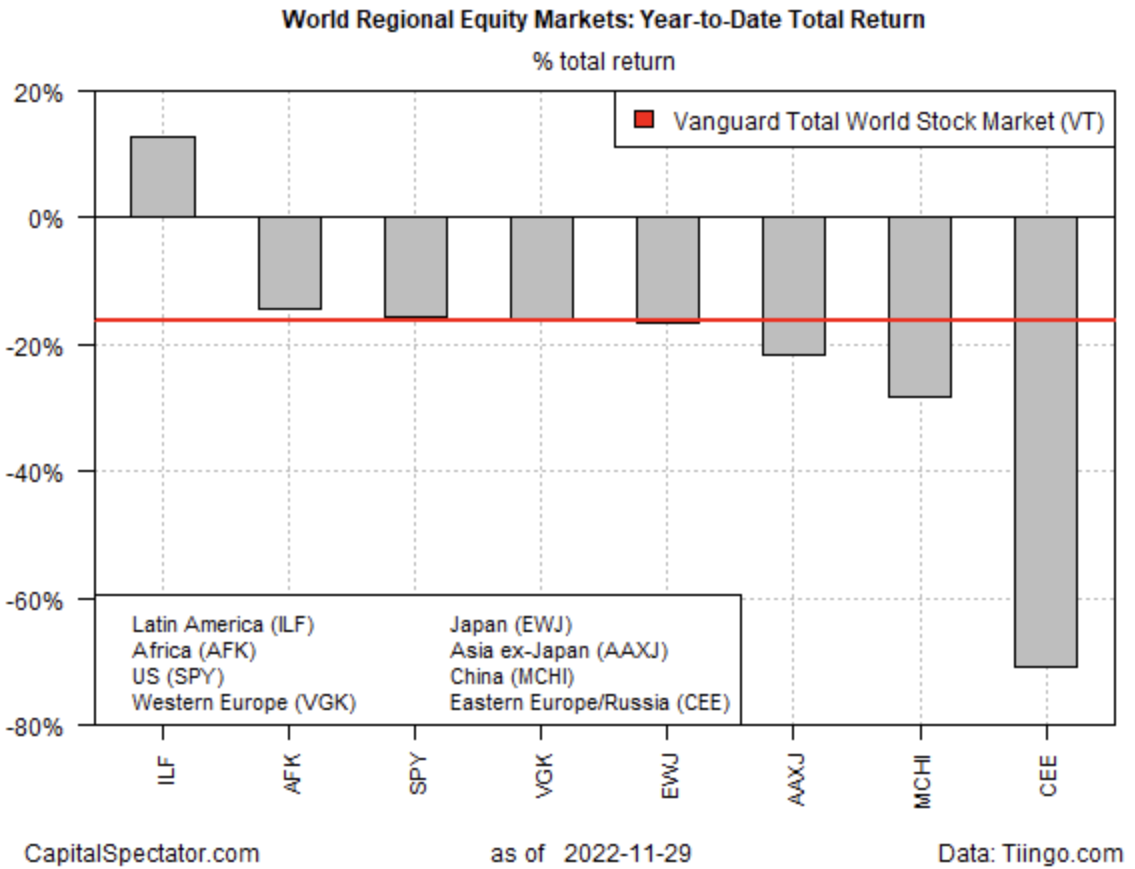

Baron Rothschild famously advised that “the time to buy is when there’s blood in the streets.” By that measure, markets arguably offer an opportunity to go risk-on at a point of maximum pessimism. Reviewing year-to-date results for the world’s equity regions, through a set of proxy ETFs, certainly paint a grim profile.

With the exception of shares in Latin America (ILF), the main slices of world stocks are deep in the red in 2022, ranging from a relatively mild 14.6% haircut for stocks in Africa (AFK) to a devastating 71.0% crash in eastern European markets CEE).

The world benchmark, based on Vanguard Total World Stock Index Fund (VT), is in the hole by 16.5% so far this year. The good news: VT has rallied in recent weeks, inspiring hope that the worst has passed.

No one can reliably call bottoms (or tops) in real time and so mere mortals are once again left to decide if we’re at an opportune point to start rebalancing in favor of higher equity risk. There’s a case for shifting to a risk-on posture, if only partially, on the assumption that that the losses so far in 2022 have materially boosted the long-run expected return for stocks.

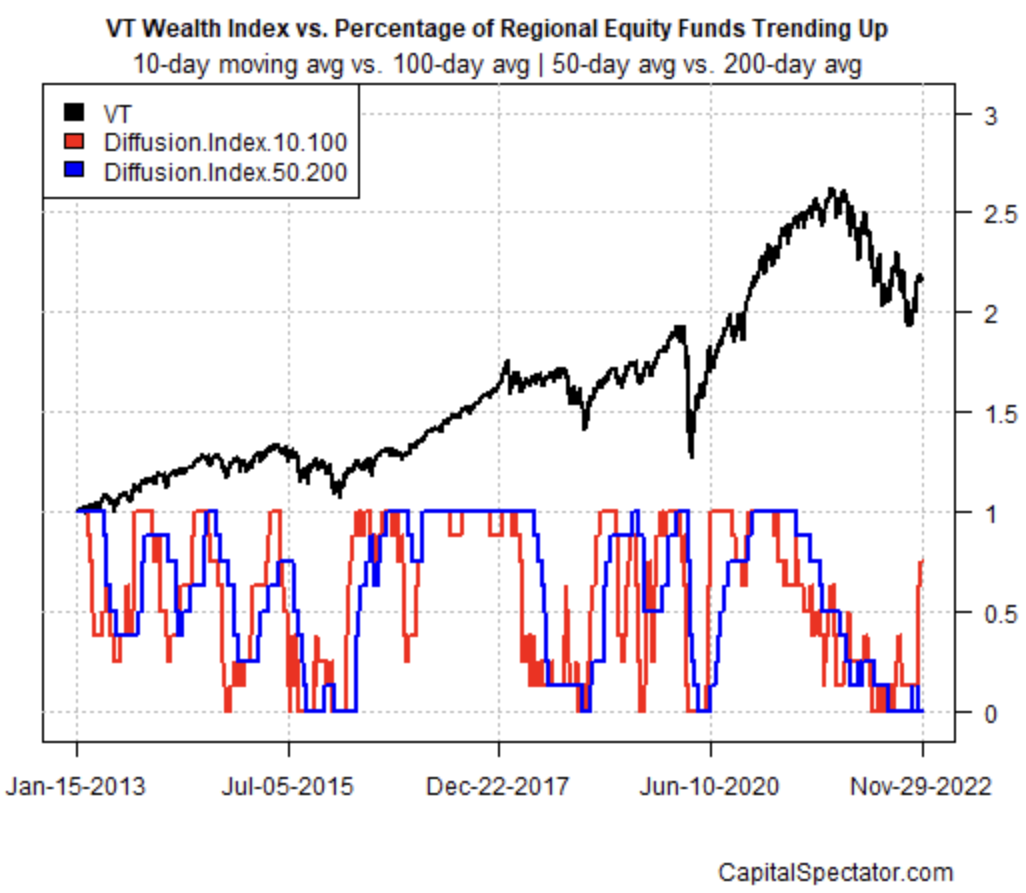

The caveat is that the trend still looks bearish. Using VT as a yardstick, the latest rally has lifted the fund to just below its 200-day moving average. Encouraging, but until VT moves decisively higher, and holds its position, the latest bounce looks like one more bear-market rally.

The big-picture question for investors is deciding if they’re more comfortable being early or late for the next bull market. Either way you’re going to suffer an opportunity cost. A third option is to diversify the risk-on trades through time, redeploying capital in stocks at regular intervals and thereby mitigating the losses from timing errors that surely lie in wait for most investors. On that basis, nibbling at markets now is appealing.

Using a set of moving averages to monitor trending conditions for all the funds listed above suggests the recent wave of selling was excessive. That’s no assurance that we’ll avoid even lower lows. But after a year of sharp losses, it’s reasonable to start throwing some money at equity markets.

Bearish news will likely continue to weigh on sentiment for the near term, and perhaps longer. But markets are always pricing in the future. That’s always a messy affair, and this time is no different. This may be one more false dawn, but at some point a genuine bottom will arrive. There’s nothing wrong with waiting for confirmation that the bear market has ended, but for investors with a relatively high tolerance for risk the current climate looks intriguing.

A key factor is deciding if the Federal Reserve’s close to pivoting on interest-rate hikes. On that point the crowd is looking for fresh clues in today’s speech by Fed Chairman Jerome Powell. Expectations are high that he’ll hint that policy tightening will begin to ease. Hope springs eternal, again.

“This is a Fed-made recession, so eventually when he does pivot, the market should move higher pretty quickly,” says Steve Grasso, CEO of Grasso Global.