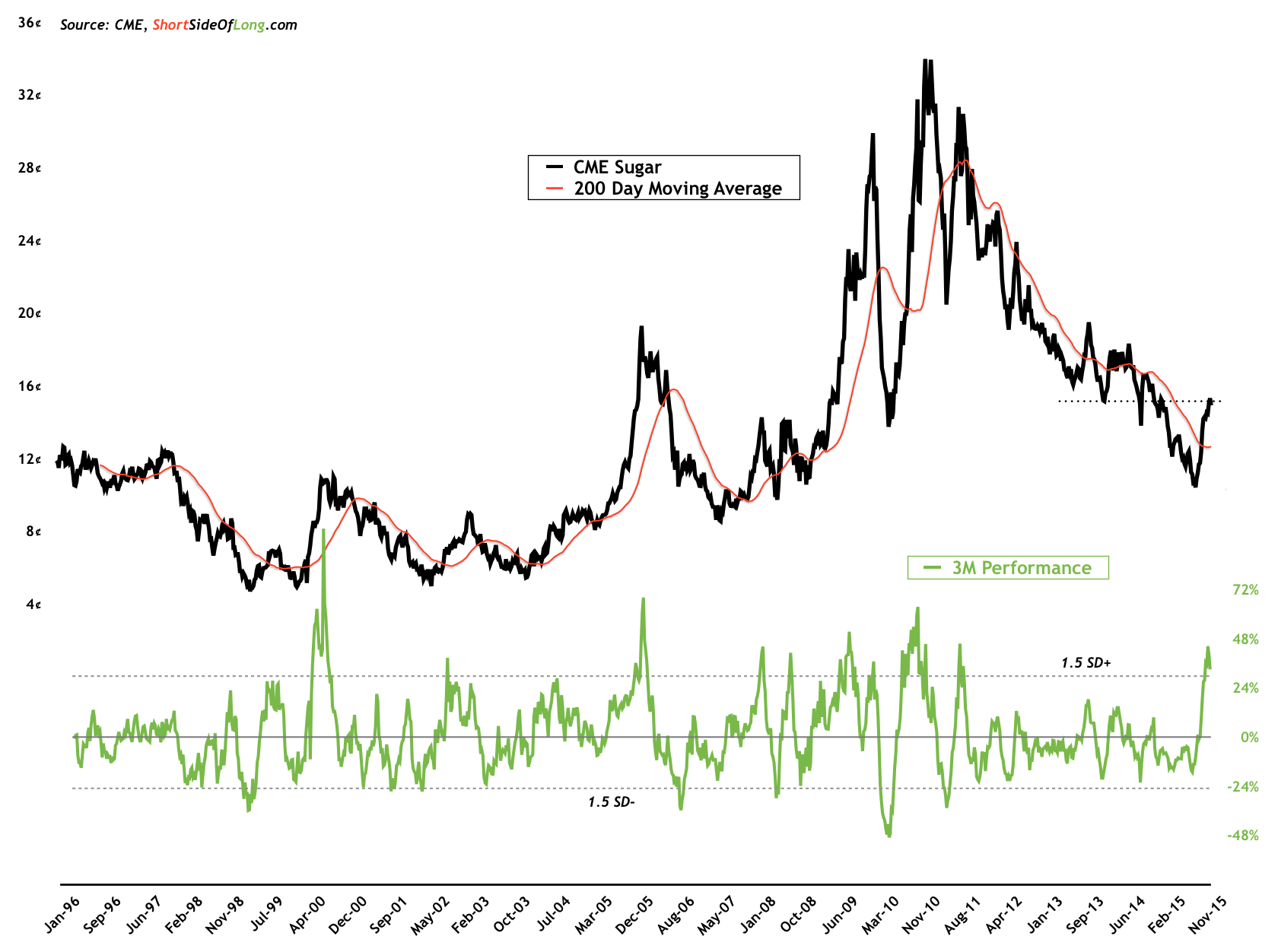

The price of Sugar has rallied over 45% in the last 3 months

As discussed previously, the CRB Index has been in a powerful downtrend for majority of the last 18 months. However, not all individual commodities have suffered the same fate. Take for example the prices of Cocoa, which have been in an uptrend since bottoming out in July of 2013. That commodity has done extremely well, bucking the deflationary trend. Furthermore, in recent times, Sugar prices (iPath Bloomberg Sugar Subindex Total Return Exp 24 June 2038 (N:SGG)) have rallied over 45% in the space of 3 or so months.

The majority of the gains are attributed to the current El Nino weather pattern we are experiencing, throwing supply into question from Brazil to India. Moreover, as Sugar already experienced a devastating bear market in recent years, demand has recovered. Not surprisingly, even ethanol demand is growing.

The question for speculators now is whether the recent rally is start of something more meaningful or if it was yet another relief rally in a longer term downtrend?

From the short term perspective, Sugar prices are very much overbought, This usually signals that we are due for either a consolidation of recent gains or a more significant correction. It all really depends on what the primary trend is.

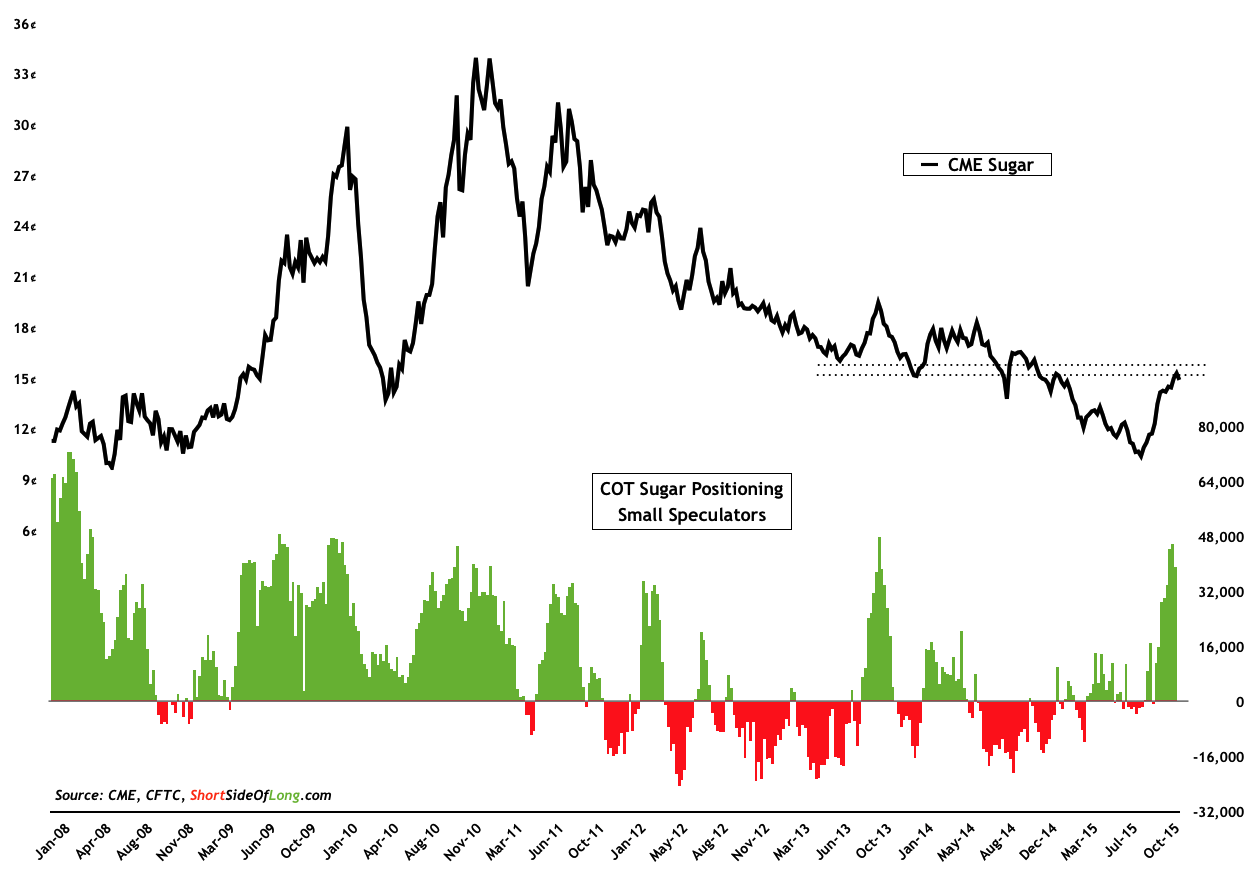

If we were to ask professionals the same question, according to the recent Commitment of Traders report, smart money (commercials) is betting heavily against the price of Sugar. These guys are farmers, producers and savvy about this agricultural commodity. As they take big shorts, it also means that dumb money (non reportable small speculators) are now heavily long the market.

As the chart below clearly shows, previous instances when small specs were heavily long Sugar, prices usually ultimately pulled back. However, when considering the question of whether this is the start of a more significant uptrend for Sugar, my advice would be to closely track the current El Nino progress and how it impacts the global supply.

Speculators have now gone heavily long the agricultural commodity