By Carly Forster

Wall Street has an exciting week ahead as three big companies are set to announce financial earnings. What should investors watch for?

Urban Outfitters (NASDAQ: URBN):

Urban Outfitters' (NASDAQ:URBN) fourth quarter 2015 earnings conference call is scheduled for Monday, March 9th after the market close. The company is expected to post earnings of $0.57 a share, down from $0.59 a share and marking a 3% decrease from the same quarter a year prior.

Urban Outfitters posted its revenue and same-store sales for the fourth quarter on February 9th. Highlights from the report include $1.01 billion in revenue, marking a 12% increase on a year-over-year basis. For the full year ending January 31, 2015, sales rose 8% to $3.32 billion. The company’s wholesale segment net sales also increased by 27%.

The company’s strong revenue was a direct result of strong holiday sales. However, the sales were mostly driven from Anthropologie and Free People which consistently performed well over the past year, while Urban Outfitters has not seen the same positive results.

In addition, Urban Outfitters has seen an average 2% drop in revenue year-over-year for each of the last four quarters, with the biggest fall of 10% in its most recent quarter from the same quarter a year earlier.

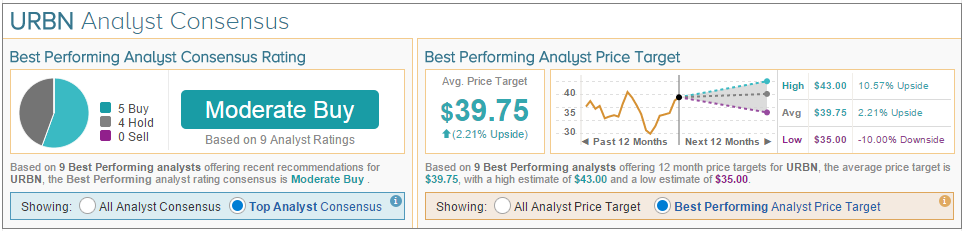

On average, the top analyst consensus for Urban Outfitters on TipRanks is Moderate Buy.

Shake Shack (NYSE: SHAK):

Shake Shack (NYSE:SHAK) is scheduled to announce its fourth quarter 2014 financial results on Wednesday, March 11th after market close. The hamburger restaurant chain is expected to post a loss of -$0.03 a share. This will be the first earnings report Shake Shack is posting since its IPO this past January.

The company currently operates just 63 restaurants in nine different countries, with 16 of them located in the metropolitan New York City area. The company said it plans to expand slowly with a goal to open 10 new locations in the United States every year, as well as adding more international locations.

The Shake Shack excitement has started to wear off as the stock dropped roughly 9% in mid-February. Since this dip, Shake Shack’s stock has slightly rebounded, closing at $43.87 on March 6th. Investors have begun to question the stock’s valuation with the measured growth strategy presented by CEO Randy Garutti and Chairman Danny Meyer.

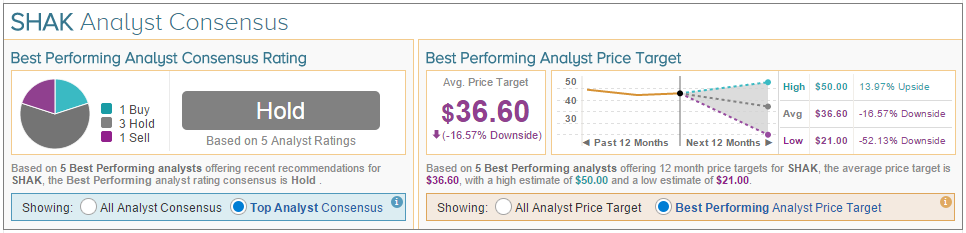

On average, the top analyst consensus for Shake Shack on TipRanks is Hold.

El Pollo Loco (NASDAQ: LOCO):

El Pollo Loco (NASDAQ:LOCO) is set to announce its fourth quarter 2014 earnings results on Thursday, March 12th after market close. The company is expected to post earnings of $0.12 a share and $87.48 million in revenue.

El Pollo Loco has had its ups and downs since going public in July 2014. After going public, shares initially soared above the IPO price of $15, hitting a high of $41 roughly one week later. However, shares have been bouncing between $20 and $27.50 for the past several months

Investors are concerned that El Pollo Loco is only planning to open 5 new locations in 2015 in addition to its issues of moving to the east coast.

Moreover, El Pollo Loco has been trying to transition into health conscious meals very similar to Chipotle’s, the clear leader in the industry. Investors will be looking to see if El Pollo Loco can compete with Chipotle in the healthy fast-food industry.

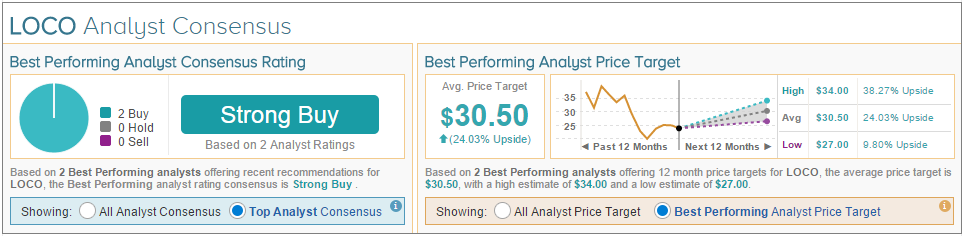

On average, the top analyst consensus for El Pollo Loco on TipRanks is Strong Buy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Ahead of Wall Street: Urban Outfitters, Shake Shack, El Pollo Lo

Published 03/09/2015, 09:48 AM

Updated 05/14/2017, 06:45 AM

Ahead of Wall Street: Urban Outfitters, Shake Shack, El Pollo Lo

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.