Heading into the last hour of trading Wednesday the broad market is looking to make new lows for the day. The bullish scan I run has only three names on it. Keurig Green Mountain (O:GMCR) which is wrapped up in a deal, Solar City which I bought Monday and is holding up well, and Qihoo 360 Technology (N:QIHU). What is so special about this stock. Lets take a look.

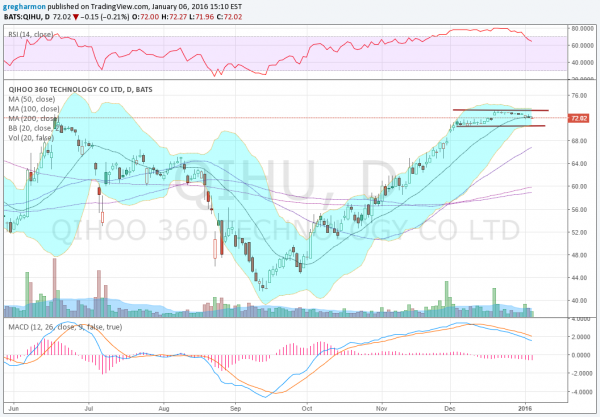

The chart below shows a straight trend higher from mid September. Too bad you did not ride that one higher, huh. But since the beginning of December it has stalled out. Moving sideways. This is not really a bad thing. Looking at the RSI, it had become over bought on the run higher and is working off that condition.

A consolidation like this can be two things. Either a pause before the next leg higher. Or the top and a roll lower. Which will it be? The short answer is, “Who cares!” There is a trade either way. On a move under the consolidation channel, under 70.50 a trade to the short side looks good. There may be some support at 65.50 from the July to August top, but that is a 7% gain on the short. With only 5% short interest fuel for a short squeeze is low to moderate.

But a move over 73.40 confirms continuation on the upside with a Measured Move to 89. That is a very nice ride to the upside. Which will it be? I do not know. What I do know is that the Bollinger Bands® are squeezing in. This is often a precursor to a move in price. So it is time to start watching very closely and setting an alert for which ever way it breaks.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.