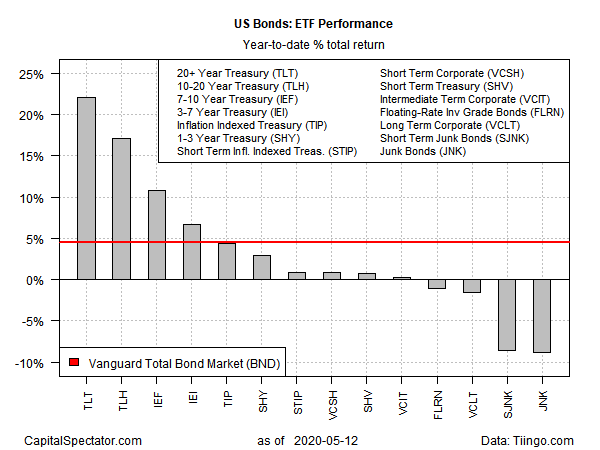

The rallies have faded, but by holding on to monster gains posted earlier this year the long Treasuries segment remains far ahead of the rest of US bond market so far this year, based on a set of exchange traded funds through Tuesday’s close (May 12).

The iShares 20+ Year Treasury Bond (NASDAQ:TLT) is up an impressive 22.0% year to date. That’s a dramatic gain, but the sharp rally in TLT in 2020 unfolded in February and March. Since early April, by contrast, the fund has been treading water, but that’s enough to keep the ETF well ahead of the rest of the field.

The second-best performer this year is also a Treasury fund—with an intermediate maturity focus. The iShares 10-20 Year Treasury Bond (NYSE:TLH) is up 17.2% year to date. That’s a solid gain, but no match for TLT’s increase.

The big gains may be over, at least for now, but sentiment still favors Treasuries, some analysts advise. “There’s nowhere else to put your money,” says Tom di Galoma, managing director of Seaport Global Holdings. Noting the lingering uncertainty on the outlook for other asset classes as coronvirus risk hangs over the global economy, he adds: “At least with Treasuries you know what you have.”

For the rest of the field, the gap between TLT’s leadership widens sharply, all the way down to the worst performer: US junk bonds. Although SPDR Bloomberg Barclays High Yield Bond (NYSE:JNK) has bounced back from its deepest losses in March, the fund remains in the red by nearly 9% so far in 2020.

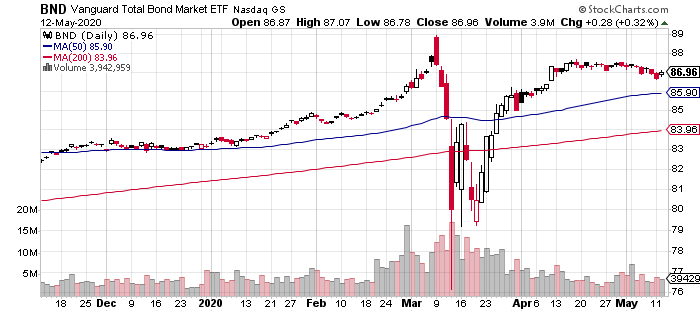

For US investment-grade bonds overall, the market is up a moderate 4.6%, based on Vanguard Total Bond Market (NASDAQ:BND), which has been holding steady in a tight range in recent weeks after rallying earlier in the year.