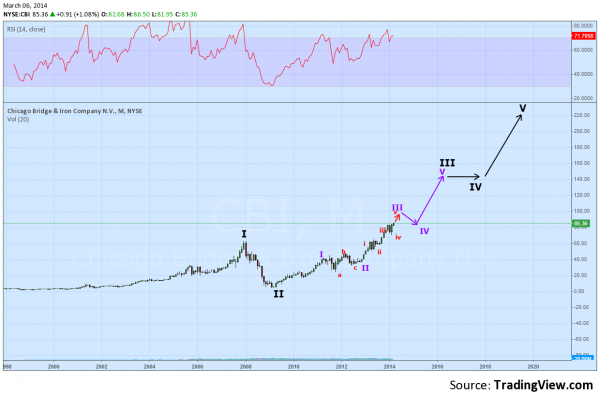

Today’s long term pick goes to Chicago Bridge & Iron Company, (CBI). This company has had a a long run higher from the 2009 low, but looking on a longer scale and applying the voodoo magic of Elliott Wave Principles suggests it may still have a long way to go.

The monthly chart above gives a loose road map from the Elliot Wave (EW). As a reminder EW sees 5 Wave Patterns, alternating between up (motive) and down (corrective) Waves. It also is fractal in nature, which just means you can see the same 5 Waves on smaller and larger scales too. Looking at the chart, the Black labels show the longer scale, with the purple labels the intermediate scale and red short term. This shows that the price is in Wave v on the short term basis within Wave III on the intermediate timeframe within Wave III on the long term perspective.

The translation is that it still has a little way to go higher (Wave v) before a correction (purple IV) before a long way to go higher. So what do you do about it? A long term investor could get into the stock right now with a stop at the bottom of Wave iv at about 72.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.