2013 was a year of misery for the gold bugs. After 12 consecutive up years, a pause might have been expected but most failed to see the large drop that actually occurred. What happened was the worst down year for gold since 1997 and the highest loss since 1981. Gold fell 28% while silver was down 36%. The gold stocks fared worse as the Gold Bugs Index (HUI) came close to its 2008 low while the TSX Gold Index (TGD) actually fell slightly below the 2008 low. The gold bear that got underway in September 2011 is approaching three years in time. Thishas been the longest gold bear since the 1990’s.

Gold, like the stock market goes through cycles. The biggest problem with trying to determine gold’s cycles is the lack of history. Gold has only been free trading since the world came off the gold standard in August 1971. Prior to that gold was largely fixed. Futures have only been trading on the COMEX since 1974. The lack of history gives rise to the possibility that there are cycles that have not yet been seen. One cannot take stock market cycles and apply them to the gold market. Each has their own cycle rhythms.

In 1947, Edward Dewey and Edwin Dakin published their book on Cycles - The Science of Predictions. The Dewey/Dakin model outlined a possible 54 year cycle in wholesale prices going back to 1790. The Dewey/Dakin model fits well with the Kondratiev model, which was the study of capitalist societies going back to roughly 1775 at the time of the formation of the US republic. The Dewey/Dakin model theorized that commodities 54-year cycle goes through two phases – an up cycle of roughly 27 years and a down cycle of roughly 27 years. These long cycles are never precise and they can range from 20 to 30 years.

The Dewey/Dakin model predicted a commodity peak in 1979. The actually peak for numerous commodities was in 1980/1981. Gold prices peaked in January 1980. The Dewey/Dakin model predicted the trough for commodities would be in 2006. The actual bottom occurred from 1998-2002. Gold made its final bottom in April 2001. If the Dewey/Dakin model is correct then the current up cycle still has many years to run. The next peak is not expected until 2033 with the next major trough expected in 2060.

These cycles are quite long and it should be no surprise that the up cycle has bear markets and the down cycle has bull markets. Bull and bear markets within the context of long-term secular bull and bear markets are quite normal. Another model I have seen is Stiffel Nicholaus that suggested commodity price inflation followed a pattern similar to Kondratiev peaks and bottoms separated by roughly 55 years (peak to peak and trough to trough). One thing the Stiffel model noted was that historical trends had a pause period in the cycle that could subdivide the 55 years into either half or thirds.

Ray Merriman of MMA Cycles has noted a possible 25 year cycle in gold prices. The current 25-year cycle began with the double bottom of August 1999 and April 2001 near $250. The down cycle lasted 21 years from January 1980 to April 2001 or if one measures the cycle as being trough to trough the period would be 1976 to 2001. Assuming that a new 25-year cycle got underway in 2001, 2014 would mark the 13th year. Gold rose every year through the first 12 years of the cycle.

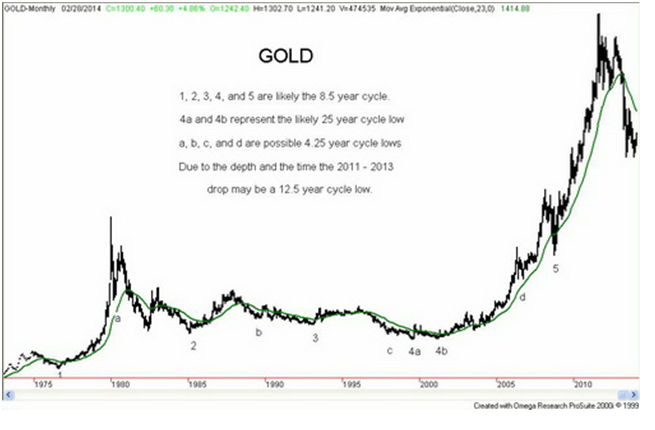

Cycles tend to subdivide into either halves or thirds. In theory, the 25-year cycle could be two cycles of 12.5 years or three cycles of 8.5 years. During the limited trading history of gold, the observation was that gold subdivided into three 8.5-year cycles. Counting from the major 1976 low significant lows were seen in 1985, 1993, 2001 and 2008 (labeled 1, 2, 3, 4 and 5 on the chart). The chart also labels the 25-year double bottom as 4a and 4b. The time frame between each successive low waslow #2 - 102 months (8.5 years), low #3 - 96 months (8 years), low #4 - 98 months (8.2 years) and low #5 - 90 months (7.5 years).

The 8.5-year cycle could subdivide in two halves of 4.25 years or three thirds of 34 months each. There is some evidence that both may occur although more likely one or the other would occur. I have labeled possible 4.25 year cycle lows as a, b, c and d. There is some evidence of a possible 4.25-year cycle following each 8.5 year cycle low as follows: low at a – 43 months (3.6 years), low at b – 52 months (4.3 years), low at c – 58 months (4.8 years), and, low at d – 74 months (6.2 years).

The low at d in June (or even October) 2006 came in far too late to be classified as a 4.25 year cycle low. The range should be no more than 9 months either side of the idealized 4.25-year cycle low. The others fit but the 2006 low did not. There were visible lows in 2003, 2004 and 2005 as well but they were generally shallow and of short duration. More likely, that period unfolded in two 34-month cycles. There was a low in April 2004 that came in 36 months after the April 2001 low. While that low was a higher one than the low in 2003, one can note that the market did not make new highs again until late 2004. Next there wasthe low in October 2006 that was 30 months after the April 2004 low. That would qualify as the 34 month low given that the range should be no more than + or – 6 months of 34 months.

The October 2008 low came in only 24 months later. This is where things appear to go off the “rails”. Yet numerous analysts including myself pegged it as an important and the probable 8.5-year cycle low although it came in at the early end of range. While the 2008 low was deep, (gold fell about 33%) it was all over quickly lasting only 7 months from peak to trough (March 2008 to October 2008). Following the low in October 2008 the market moved to new highs peaking in September 2011. There were corrections along the way, but most were shallow and short lived.

Following the peak in August/September 2011 the gold market gyrated wildly before making a low in December 2011. This came 38 months after the low of October and fit into the model of a potential 34-month cycle low. The market made numerous attempts to rally in 2012 but each time it fell back. The zone down to $1,525 appeared to hold all drops. In October 2012, the market broke out to new highs although still below the highs of September 2011. That high turned out to be the final high.

To date the low at $1,182 in December 2013 stands as the low for this cycle. It came in 62 months after the October 2008 low or 5.2 years. The late June 2013 low fit well with the 4.25-year cycle as it came in at 56 months (4.7 years). The collapse this time has also been deep (gold has fallen to date 38% from the September 2011 high) and the collapse has been lengthy (lasting 28 months so far). While the collapse fits well with the 4.25 year cycle using the June 2013 low as our key low the collapse is far too early for the 8.5 year cycle which is not due until 2017.

Given the depth of the collapse coupled with the long time the collapse has been in play it does appear to suggest that an even larger cycle might have been in play. With little or no long term trading history for gold this period has proven to be exceptionally difficult in trying to analyze it in terms of cycles. It is too easy to say that cycles or anything else doesn’t work when there is the appearance of possible market manipulation. The collapse, however, has come roughly half way through what may be the 25-year cycle. The recent low in late December 2013 came 152 months or 12.7 years after the April 2001 low.Merriman has suggested that a 12.5-year cycle is quite possible. That cycles break down into halves and thirds is not unusual.

Naturally, one cannot say unequivocally that this is the final low. There are numerous analysts predicting that gold will collapse to $1000 and even lower in 2014. They could also be wrong. The August 2013 rebound rally high was at $1,428/$1,434. If gold fails to take out that high then returns to the downside taking out the December 2013 low at $1,179/$1,182 then the bears may have the upper hand and a collapse to $1000 may be in order. However, if gold were to take out $1,434 it would go a long way to potentially confirming that a major low is in and that the next up cycle was under way. Finally, a close back over the $1,525 level, would confirm that the long-term cycle low is in and that low may be in for the 12.5-year cycle low.

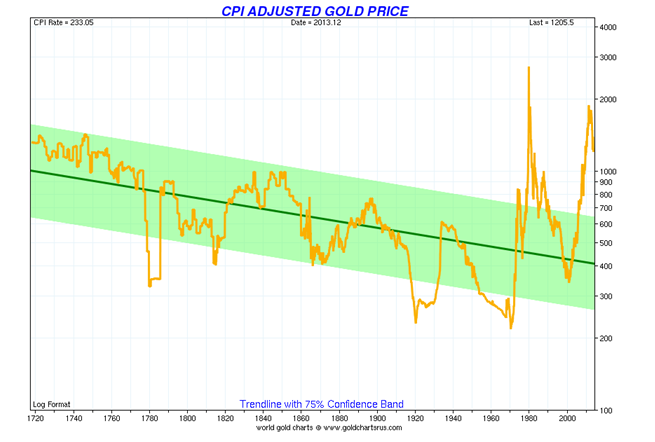

I want to leave you with one more chart. It is a very long (300 years) chart of CPI adjusted gold. The CPI adjusted gold is interesting because it shows highs and lows that are not visible on a nominal chart. Gold was largely fixed until the world came off the gold standard in August 1971. On the chart major lows appear to be have been made in 1780, 1815 (35 years), 1865 (50 years), 1920 (55 years), 1970 (50 years) and 2000 (30 years). Not that there is a consistent pattern here but what it does suggest is that the next major low shouldn’t come until at least 2030 but could go out as long as 2050. The Dewey/Dakin model’s next major trough is predicted for 2060.

One other observation. At roughly $1,200/$1,300, gold today is about where it was in 1720 on an inflation-adjusted basis. Seems that the more things change the more things remain the same.

General disclosures

The information and opinions contained in this report were prepared by MGI Securities. MGI Securities is owned by Jovian Capital Corporation (‘Jovian’) and its employees. Jovian is a TSX Exchange listed company and as such, MGI Securities is an affiliate of Jovian. The opinions, estimates and projections contained in this report are those of MGI Securities as of the date of this report and are subject to change without notice. MGI Securities endeavours to ensure that the contents have been compiled or derived from sources that we believe to be reliable and contain information and opinions that are accurate and complete. However, MGI Securities makes no representations or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to MGI Securities that is not reflected in this report. This report is not to be construed as an offer or solicitation to buy or sell any security. The reader should not rely solely on this report in evaluating whether or not to buy or sell securities of the subject company.

Definitions

“Technical Strategist” means any partner, director, officer, employee or agent of MGI Securities who is held out to the public as a strategist or whose responsibilities to MGI Securities include the preparation of any written technical market report for distribution to clients or prospective clients of MGI Securities which does not include a recommendation with respect to a security.

“Technical Market Report” means any written or electronic communication that MGI Securities has distributed or will distribute to its clients or the general public, which contains a strategist’s comments concerning current market technical indicators.

Conflicts of Interest

The technical strategist and or associates who prepared this report are compensated based upon (among other factors) the overall profitability of MGI Securities, which may include the profitability of investment banking and related services. In the normal course of its business, MGI Securities may provide financial advisory services for issuers. MGI Securities will include any further issuer related disclosures as needed.

Technical Strategists Certification

Each MGI Securities technical strategist whose name appears on the front page of this technical market report hereby certifies that (i) the opinions expressed in the technical market report accurately reflect the technical strategist’s personal views about the marketplace and are the subject of this report and all strategies mentioned in this report that are covered by such technical strategist and (ii) no part of the technical strategist’s compensation was, is, or will be directly or indirectly, related to the specific views expressed by such technical strategies in this report.

Technical Strategists Trading

MGI Securities permits technical strategists to own and trade in the securities and or the derivatives of the sectors discussed herein.

Dissemination of Reports

MGI Securities uses its best efforts to disseminate its technical market reports to all clients who are entitled to receive the firm’s technical market reports, contemporaneously on a timely and effective basis in electronic form, via fax or mail. Selected technical market reports may also be posted on the MGI Securities website and davidchapman.com.

For Canadian Residents: This report has been approved by MGI Securities which accepts responsibility for this report and its dissemination in Canada. Canadian clients wishing to effect transactions should do so through a qualified salesperson of MGI Securities in their particular jurisdiction where their IA is licensed.

For US Residents: This report is not intended for distribution in the United States.

Intellectual Property Notice

The materials contained herein are protected by copyright, trademark and other forms of proprietary rights and are owned or controlled by MGI Securities or the party credited as the provider of the information.

Regulatory

MGI SECURIITES is a member of the Canadian Investor Protection Fund (‘CIPF’) and the Investment Industry Regulatory Organization of Canada (‘IIROC’).

Copyright

All rights reserved. All material presented in this document may not be reproduced in whole or in part, or further published or distributed or referred to in any manner whatsoever, nor may the information, opinions or conclusions contained in it be referred to without in each case the prior express written consent of MGI Securities Inc.