Defining whether a benchmark or stock price is in a bull market or a bear market is not as straightforward as it might sound. There are a lot of nuances and "if's" and "but's". That said, one rule of thumb is that a bull market is when the price is up more than 20% and a bear market is when the price is down more than 20%.

So, armed with the knowledge of what constitutes a bull market, here's a question: how many countries in the world are currently in a bull market?

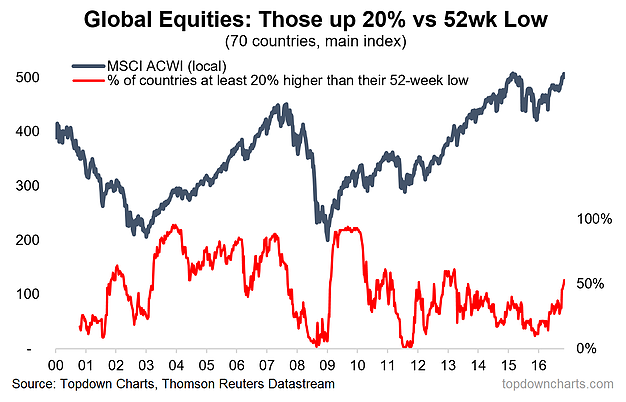

The chart above shows the proportion of countries that have seen their main benchmark index rise more than 20% off the low (in this study there are 70 countries, and I used a 52 week window for simplicity). And as you can see in the graph, and as you might guess from the title, just over half of those 70 countries are now in a bull market as defined here.

Looking at the chart, you may notice a few things:

- First, the indicator really fires up at the start of a bull market e.g. 2003, 2009, and again around the start of the QE rally.

- Second, it goes low, almost to zero, at a major market bottom (e.g. at the end of 2015).

- Third and final - the MSCI All Countries World Index (ACWI) in local currency terms just made a new all-time high last week.

What does that add up to? In my opinion a new bull market for global equities.