Gold looked very good last Tuesday. It posted the biggest gain of the year, up 1.3 percent, on Bernanke's reassurance of continued monetary accommodation combined with Italy's uncertain political and economic future. Gold broke above $1,600 an ounce, extending its rally to a fourth straight day. Italy’s problems raise uncertainty about the viability of Europe’s single currency. The unemployment rates for youths in Spain, Portugal and Greece are approaching 50% and that may spell trouble this summer. Italian elections failed to show a clear winner indicating that voters reproached the present government’s austerity measures. Flight-to-safety buying of U.S. Treasuries, German bunds, gold and the U.S. dollar became the thing to do. Bernanke delivered the central bank’s semi annual testimony to the Senate Banking Committee, sending a strong signal that he backed the continuation of the $85 billion bond-buying program.

The market largely ignored a cut of more than $200 in the gold price outlook by Goldman Sachs, one of the top global bullion banks. The bank reduced its 2013 gold price forecast to $1,600 an ounce from $1,810, citing bullion's recent price drop and an increase in U.S. real interest rates.

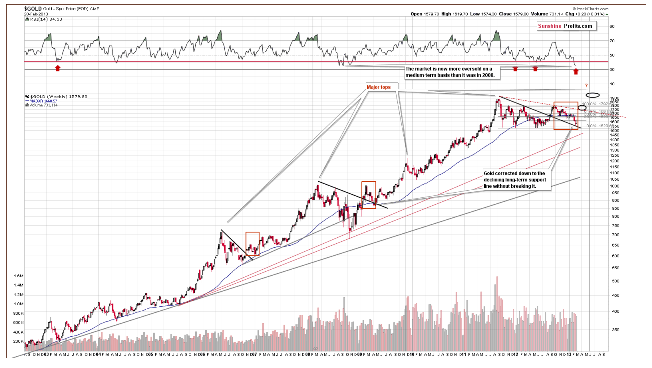

For those who have recently bailed out of gold it may have the allure of a rusty tin can, but for us, it still has its timeless allure, that special something that has made it a store of value for centuries and millennia. Let's see what is in store for the yellow metal in the near future with the analysis of its long-term chart:

The RSI level is extremely oversold and at levels very similar to 2008. At no other time in this bull market has the situation been as oversold. This is a good reason for considering long positions in gold as opposed to short.

We are still seeing a continuation of two weeks ago, when gold bounced off the declining medium-term support line and no breakdown was seen. Last week, back and forth price movement was seen but no breakdown yet, so the situation remains bullish for the medium term.

Let us see how the situation looks like from the non-USD perspective.

Recall that in our essay from a week and a half ago, we stated that the breakdown had been invalidated. Prices did pull back and rally last week, but on average, the price in non-USD currencies is now clearly above the medium-term declining support line. The breakdown has been invalidated and the picture remains bullish.

Finally, let us have a look at gold from the British Pound perspective.

In this chart we have a situation even more bullish than in the previous one. The consolidation has continued, and prices are clearly above the declining resistance line. The consolidation began last October, and the situation remains bullish; prices are expected to move to the upside. It’s good to remember the saying that, “the longer the base, the stronger the move”. The consolidation lasted for a long time so the coming rally will likely be significant. The consolidation is exceptionally visible.

The reason a lengthy consolidation often leads to a significant rally, is that many investors stay on the sidelines or continue to leave the market while the consolidation plays out. This keeps the consolidation in place to some extent until something finally triggers a move to the upside -to signal that the consolidation is about to end. Then an influx of capital from the sidelines quickly drives the price even higher. With longer consolidations, more investors, hence capital, is waiting on the sidelines and can fuel following move.

This is what we have on the precious metals market now, with some discouragement. Since the fundamentals are on our side, this creates a significant potential, just waiting to be triggered.

To recap, the long- and medium-term outlook remains bullish for the yellow metal and it seems that the long-awaited rally will probably begin soon. Most of this week’s charts remain bullish and indicate that the overall situation for gold is improving.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Long Awaited Bull Rally May Begin Soon For Gold

Published 03/06/2013, 05:18 AM

Updated 05/14/2017, 06:45 AM

Long Awaited Bull Rally May Begin Soon For Gold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.