Finally we have had a respite from Greece and now get to concentrate on fundamentals as the UK, Germany and the Eurozone have released a torrent of economic data this morning.

UK inflation data was the key release, just ahead of tomorrow’s Inflation Report. Prices fell as expected to a 3.6% annualised rate as the effects of VAT fell out of the index. Prices were also lower as a result of petrol, tobacco and restaurant prices.

The retail price index fell sharply to 3.9% from 4.8% in December, which the Office for National Statistics said was down to the falling costs of cars, alcohol and food. Gilt yields were little changed and the pound remained off its lows in the aftermath of the data, the next resistance level of note in GBPUSD is 1.5775.

There wasn’t much love lost this Valentine’s Day between the credit rating agency Moody’s and Europe. It followed Standard & Poor’s and cut the ratings of six European nations. This caused risk to falter at the end of the NY session yesterday, however, it has clawed back some of its earlier losses after Spain, who was downgraded two notches by Moody’s, had a very successful bond auction earlier.

But perhaps the biggest shock was that Moody’s went out on a limb and put the UK on negative watch, S&P left the UK untouched when it downgraded Eurozone countries last month.

The UK still has its top rating, but it could be downgraded in the next year if a dip in growth causes the UK to slip on its fiscal consolidation measures. This has caused the usual partisan reactions from UK politicians. Chancellor Osborne used it as an opportunity to reinforce his commitment to reigning in the public finances, while the opposition said that fiscal austerity was weakening growth and making the UK’s finances worse.

The trouble is that fiscal consolidation of the scale that the UK needs is always going to be painful so it’s better for Osborne to stay the course. If the UK is downgraded in the meantime then that would be a major blow and would certainly damage Osborne’s credibility, but ratings can go up and down, and if the government was to reach its target of eliminating the deficit by the next parliament then the UK’s triple A status could be reinstated.

The interesting thing is that Gilts have barely reacted and yields are actually lower on the day and the spread between German and UK debt is stable even though Germany is the last major European economy to keep its triple A rating and not be put on negative watch. The impact of the change in outlook on UK creditworthiness may have a muted impact on the pound for two reasons. Firstly, ratings agencies have threatened to act for months so downgrades and even the UK’s negative outlook aren’t real surprises; secondly, the pound is actually more sensitive to what happens in the overall risk environment; GBPUSD, for example, has a much stronger correlation to the SPX 500 than it does to yield spreads.

But the action by Moody’s does make a continuation in the Bank of England’s QE programme more likely in our view. If the Coalition government is not willing to ditch its fiscal consolidation plans then the Bank will need to step in to support growth. QE in the UK has been a little topsy-turvy. Usually central banks do it to ward off deflation. While the BOE has said this is its aim, it also needs to see inflation fall off this year before it can embark on more asset purchases without stoking fears of hyper-inflation. So while QE and falling inflation are usually bad news for a currency, that isn’t necessarily the case for the pound as it could help support growth, which is currency positive.

The other thing that dominated news flow this morning was the Bank of Japan’s “surprise” stimulus. It adopted an inflation target of 1%, and it also increased its asset purchases and the BOJ announced a further Y 10 trillion to be spent on JGB purchases before year-end. This may only be the beginning of the Bank’s easing policy since Japan is currently in deflationary territory and prices are falling at a 0.2% annual rate. Thus, to ensure it reaches its inflation target more monetary easing may be necessary. The “surprise” announcement is also another way to deal with a strong yen, although perhaps if the Bank wanted to really weaken the yen then it could have used some of its new stimulus to buy European peripheral debt and try to strengthen EURJPY that way. (After all the euro is boosted by asset purchases as it helps to reduce credit risk).

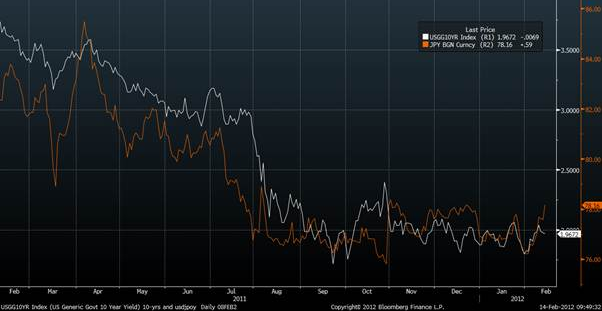

In the aftermath of the announcement, USDJPY had a storming session and surged above 78.00. It is currently running into a wall of stops at 78.15, so this could be a sticky level for the pair. It is worth pointing out that this pair usually follows the 10-year Treasury yield. It will be interesting to see if this relationship holds. There are a lot of risk events out there that could limit Treasury yield upside, so could this cap USDJPY gains?

Will 10-year Treasury yields follow USD/JPY higher – or will yields cap USD/JPY gains?

USD/JPY" title="USD/JPY" width="602" height="311">

USD/JPY" title="USD/JPY" width="602" height="311">

Watch out for European industrial production, German ZEW and an Italian debt auction later this morning.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

London Update: Love is Not in the Air Between Moody’s and the UK

Published 02/14/2012, 08:54 AM

Updated 05/18/2020, 08:00 AM

London Update: Love is Not in the Air Between Moody’s and the UK

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.