London Forex Report: In her speech to the Economic Club of New York, Yellen diverged from recent hawkish comments from other Fed officials, saying the Fed should proceed “cautiously” with raising rates, highlighting her concerns over prevailing headwinds from weaker global growth, low oil prices and China. The Fed Chair was also not confident that the recent spike in inflation is sustainable. This reinforced the view that the Fed rate normalization path will be very gradual, and odds are rising that we may only see just one hike this year. The gain in house prices in 20 major US cities were flat at 5.7% YoY while consumer confidence edged higher on improving job market outlook and rebound in stock prices. USD tumbled as the Fed Chair indicated a slower rate hike direction amid a sliding global economic outlook. The USD Index slumped after Janet Yellen’s speech, closing 0.81% lower at 95.16.

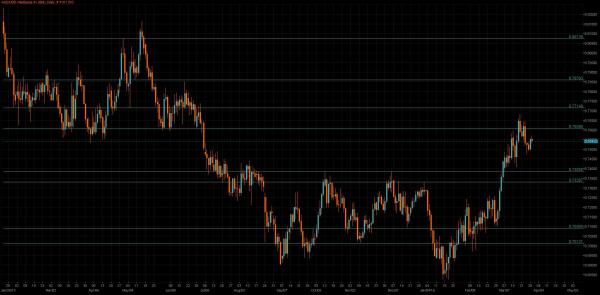

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR rallied sharply against the USD overnight above the 1.1300 barrier on another wave of selling of the USD in the market after the release of Janet Yellen’s speech. Euro-area debt has outperformed US Treasuries this month before the ECB increases monthly bond purchases to 80 billion euros from 60 billion euros on April 1.

Technical: The close over 1.1220 opens a move back to retest range highs at 1.1350 en-route to symmetry swing objective at 1.1420, expect intraday support to come in at the aforementioned 1.1220.

Interbank Flows: Bids 1.1250 stops below. Offers 1.1350 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP jumped from 1.4280 to test 1.4400 barrier overnight after Yellen’s dovish tone speaking in New York. The BoE said that banks should start to build capital reserves earmarked for supporting lending when the economy turns lower, noting that the referendum on June 23 heightened financial stability risks

Technical: 1.4050 pivotal support provides a platform for technical rebound to retest the topside of the broader 1.45/1.40 range. A failure to hold 1.4050 opens a retest of year to date lows at 1.38 ahead of 1.37 weekly swing objective.

Interbank Flows: Bids 1.4050 stops below. Offers 1.45 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The USD dipped to around 112.30 levels against the JPY in the Asian trading session, recoiling from a two-week high of 113.80, after Yellen highlighted external risks and stressed needs to be cautious in raising interest rates. The exchange rate of JPY is less of a concern for the Japanese government than sharp swings in its value, according to top Japanese financial diplomat Asakawa.

Technical: Continue to play the broader range of 110/114 with 112 the pivot to lean against intraday, a breach of the range is required to help define the next directional play.

Interbank Flows: Bids 110.50 offers below. Offers 114 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Japan’s industrial production tumbled more than expected in Feb. IPI fell 6.2% MoM last month, overturning the 3.7% MoM increase in Jan. Output of capital goods dropped 9.0% MoM as businesses continue to cut capex amid bleak economic outlook. IPI print offset the uptick in small business confidence index, which rose 0.9 points to 48.8 in March

Technical: While 126.40 bids support intraday expect a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggests false upside break and opens retest of 123.

Interbank Flows: Bids 126.50 stops below. Offers 128 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD/USD rose yesterday after the speech from Federal Reserve Chair Janet Yellen. The Aussie edged up to 0.7645 but remained within reach of an eight month summit of 0.7680 touched earlier this month. If the lift of AUD/USD sustained, it would be the largest monthly rise since 2011 while much of the gains are due to a weaker US currency on fading expectations the Fed will resume raising rates soon.

Technical: Only a close below .7550 threatens the near term bullish bia, while this level supports intraday expect a grind higher to test symmetry swing objective at .7670.

Interbank Flows: Bids .7550 stops below. Offers .7700 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: CAD strengthened to a near one-week high against the USD after Federal Reserve Chair Janet Yellen said the US central bank should proceed “cautiously” with rate hikes. The comments offset factors that would weigh on the Canadian currency, including a drop in oil prices and soft domestic figures. Traders’ focus will now turn to January gross domestic product figures due on Thursday.

Technical: Bears have the ball while 1.3160 contains upside reactions expect a retest of recent lows in the 1.2920’s to set a potential double bottom base, a failure of buyer participation here opens a run down to test structural support at 1.2830.

Interbank Flows: Bids 1.3000 stops below. Offers 1.3150 stops above

Retail Sentiment: Bullish

Trading Take-away: Short