London Forex Report: In line with other regional readings, Chicago PMI continued to signal that US manufacturing is on the mend, and we will have a better picture when the nationwide prints from PMI and ISM are released tonight. Nonfarm payroll gains will also be closely watched tonight, although, as we have highlighted before, the Fed's policy decision has increasingly shifted away from job data (which we expect to affirm steady job prospects in the US) to external risks and inflation prospects.

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR climbed about 4.7 percent last quarter to 1.1378 versus the dollar, the biggest rise since March 2011, while the pair peaked at 1.1411 overnight, the highest since October 15. The euro strengthened in the first quarter by the most in five years, defying convention as the European Central Bank (ECB) bolstered its monetary stimulus, a step that tends to debase a currency. The ECB expanded monthly bond purchases to 80 billion euros from 60 billion euros.

Technical: The close over 1.1220 opens a move to test the symmetry swing objective at 1.1420. Expect intraday support to come in at the aforementioned 1.1220.

Interbank Flows: Bids 1.1250 stops below. Offers 1.14 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: GBP weakened for a second day against the euro as data showed Britain’s current-account deficit widened in the fourth quarter more than forecasts. The current-account deficit widened to a record, and recent surveys suggest domestic resilience may be fading amid concern that the UK might vote to quit the European Union in the June 23 referendum. The British economy ended 2015 with more momentum than previously estimated. GDP rose 0.6 percent in the fourth quarter.

Technical: 1.4050 pivotal support provides a platform for technical rebound to retest the topside of the broader 1.45/1.40 range. Intraday support sited at 1.4280. A failure to hold 1.4050 opens a retest of year-to-date lows at 1.38 ahead of 1.37 weekly swing objective.

Interbank Flows: Bids 1.4050 stops below. Offers 1.45 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY strengthened against the dollar this morning as Japanese stocks dropped after the release of a worse-than-expected Tankan index of confidence among large manufacturers. Sentiment among Japan’s large manufacturers fell to the lowest level since mid-2013, with a stronger yen posing risks to company profits, undermining efforts to spur recovery in the world’s third-largest economy.

Technical: Continue to play the broader range of 110/114 with 112 as the pivot to lean against intraday. A breach of the range is required to help define the next directional play.

Interbank Flows: Bids 110.50 offers below. Offers 114 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Tankan index of confidence among large manufacturers printed at 6 in March, declining from 12 three months ago.

Technical: While 126.40 bids support intraday, expect a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggests false upside break and opens retest of 123.

Interbank Flows: Bids 126.50 stops below. Offers 128 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

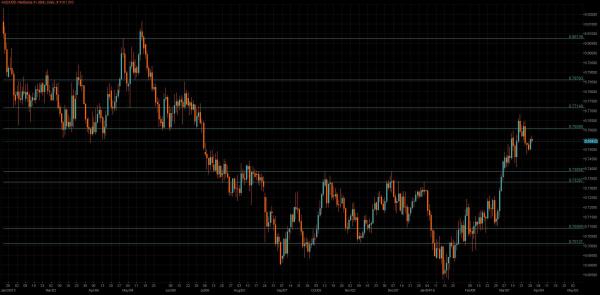

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD stood near 9-month peaks yesterday, though explosive monthly gains were unlikely to be greeted by the central bank. The AUD/USD sat at 0.7654, popped above 77 cents on Wednesday for the first time since June. If the boost sustained, it would be the largest increase since late 2011. Investors believe the lift of the Australian dollar could test the patience of the RBA, which will hold its policy review on April 5.

Technical: Only a close below .7550 threatens the near-term bullish bias. While this level supports intraday, expect a grind higher to test .7770.

Interbank Flows: Bids .7550 stops below. Offers .7750 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: CAD weakened slightly against the USD and closed low, even though strong domestic figures helped drive the currency to a 5-month high in short moment. Month-end buying of US dollars was accompanied by position adjustments ahead of tonight's US employment report. Canada’s economy grew by a much larger-than-expected 0.6 percent in January. It was the fourth straight monthly gain and the biggest since July 2013.

Technical: Bears have the ball. While 1.3160 contains upside reactions, expect a retest of recent lows in the 1.2920s to set a potential double-bottom base. A failure of buyer participation here opens a run down to test structural support at 1.2830.

Interbank Flows: Bids 1.2900 stops below. Offers 1.3150 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short