London Forex Report: Soft consumer related data and inflation prints in the US continued to bolster expectations that the Fed rate normalization path will remain measured this year. Personal income grew at a slower pace of 0.2% MoM in February wile personal spending growth was flattish at 0.1% MoM as consumers remain cautious amid looming growth uncertainties. Core PCE also held steady at 1.7% YoY, confirming the lack of upside inflationary pressure. Lingering concerns over weaknesses in consumer spending that accounts for two thirds of the US economy overshadowed the rebound in pending home sales and the smaller contraction in Dallas Fed manufacturing. USD weakened amid concerns that spending remains weak in the US. The USD Index tumbled in early US trade, closing 0.34% lower at 95.94 as doubts over the Fed’s policy direction rose following lagging spending compared to income. All eyes turn to FED Chair Yellen’s speech later today.

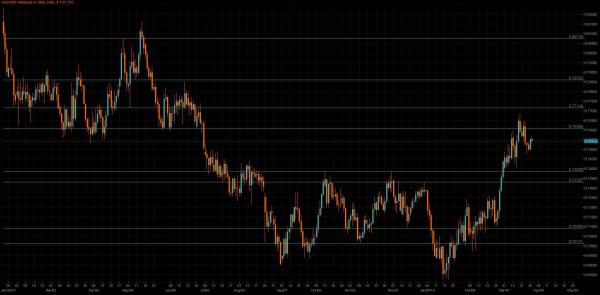

EUR/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/USD strengthened in response to a wave of selling pressure in the USD after worse than expected US PCE figures, sending the pair to break above 1.1200 barrier. Consumer prices in the single currency zone probably fell for a second month in March and the unemployment rate remained in double digits in February,according to economists forecast ahead of surveys released this week.

Technical: 1.1220 intraday resistance, while this level contains upside reactions anticipate a move back to 1.1050 in broader range trade. A close over 1.1220 opens a move back to retest range highs at 1.1350

Interbank Flows: Bids 1.1150 stops below. Offers 1.13 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

GBP/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP/USD jumped above 1.4200 handle yesterday there was no clear catalyst driving the price with reduced participation as London remained offline for the Bank Holiday. Concern the UK will leave the world’s biggest single market has weighed on the pound this year, sending it down about 3.3% to 1.4250s against the USD.

Technical: 1.4050 pivotal support provides a platform for technical rebound on the broader 1.45/1.40 range. A failure to hold 1.4050 opens a retest of year to date lows at 1.38 ahead of 1.37 weekly swing objective

Interbank Flows: Bids 1.4050 stops below. Offers 1.4200 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY recorded broad losses recently and even underperformed a defensive USD, which dropped on the back of disappointing US economic figures. Japan’s figures came in downbeat on the whole, the rebound in February household spending overshadowed by the unexpected uptick in the February jobless rate.

Technical: The close over 113 neutralises the immediate downside threat, in the broader range of 110/114, a breach of either level is required to help define the next directional play.

Interbank Flows: Bids 110.50 offers below. Offers 114 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: Japanese data remained patchy. Overall household spending unexpectedly rebounded to increase 1.2% YoY in February. In line with this, retail trade also saw a rebound although retail sales recorded bigger than expected decline of 2.3% MoM during the month. Amid a gloomier growth backdrop, unemployment rate staged a surprising uptick to 3.3% in February.

Technical: Bids sub 125 supported the current advance to target a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggests false upside break and opens retest of 123.

Interbank Flows: Bids 125 stops below. Offers 127.50 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD/USD slid to low of 0.7490 in early Asian trade before making its way higher over the remainder of the day despite the absence of the European market due to the Easter holidays. The Aussie was last at 0.7543 while the USD was weakened because of the disappointing US figures reducing expectations for an imminent hike in US interest rates.

Technical: Only a failure at.7400 support threatens near term bullish bias. Expect consolidation above this level with intraday resistance sited at .7600.

Interbank Flows: Bids .7450 stops below. Offers .7700 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: The Canadian dollar strengthened against the US dollar as economic figures weighed on the USD, while Canada’s finance minister expressed optimism that deficit spending will spur domestic economic growth. The USD hit its lowest level after a deep downward revision to US consumer spending for January released yesterday. The Canadian government said, the stimulus budget combined with a modest recovery in oil and non-commodity exports, make it likely the Bank of Canada’s next move will be an interest rate hike rather than a cut.

Technical: While 1.3110 contains downside reactions expect a retest of symmetry swing objective at 1.33 resistance, a close over 1.34 negates near term bearish bias

Interbank Flows: Bids 1.3100 stops below. Offers 1.3300 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral