London Forex Report: US retail sales pointed to a slowdown in household consumption last quarter. Industrial production in the euro area headed for its worst decline in 18 months while house price in the UK is expected to rise at the slowest pace in nine months. On a brighter note, China’s exports made a comeback in March, mirroring the pick- up in regional manufacturing activities of late. Fed’s beige book survey indicated that economic growth in most US districts were in the modest to moderate range, tightening the labour market and delivering some upward pressure on wages and prices. The report also affirmed a pick-up in momentum in the manufacturing sector. USD index climbed higher on the back of weakness in European majors that triggered demand for safety, closing 0.84% higher at 94.74 and erased losses from the last nine days.

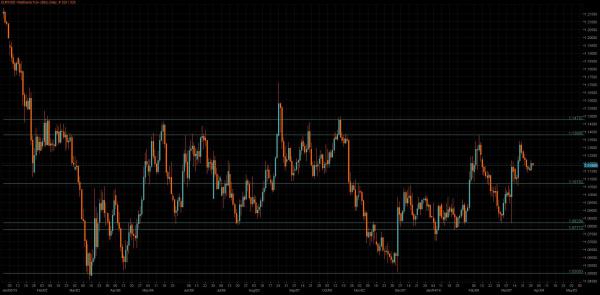

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR dropped 0.9% to 1.1264 against the USD on Wednesday. It fell as low as 1.1234 which was a two-week low. Eurozone Industrial Production YoY was 0.8%, far below the previous 2.9%. The disappointing data was the main culprit to cause euro to tumble. Risk sentiment has turned as global stock markets rally causing traders to borrow euro for carry trades again

Technical: Failure at 1.1330 opens 1.1220 support next as 1.1330 now become intraday resistance. A breach of 1.1220 opens 1.1140 as the next downside objective.

Interbank Flows: Bids 1.12 stops below. Offers 1.1350 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP fell for the first time in four consecutive days against the USD on Wednesday, reverting to a trend that has seen the pound dropped almost 7% in the past four months, amid worries of the Brexit issue. The ICM survey on Tuesday showed 45% of British supported leaving the EU, three points ahead of the campaign to keep Britain in. Markets await the BoE rate decision meeting today.

Technical: Price continues to finds bids at 1.4050 pivotal support within the broader 1.45/1.40 range, while 1.4140 supports 1.44 symmetry swing objective is the upside target.. A failure to hold 1.40 opens a retest of year to date lows at 1.38 ahead of 1.37 weekly swing objective.

Interbank Flows: Bids 1.41 stops below. Offers 1.44 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: The USD bounced back against the JPY overnight amid an improvement in global risk sentiment. The pair hit an intraday high of 109.39, after hitting its lowest level of this year at 107.66 on Monday.

Technical: The downside ratchet now targets 105.50 as the next major downside objective.The breach of 1.09 intraday resistance now sets sites on a symmetry and structure targets at 110.70 which should attract fresh selling for renewed weakness.

Interbank Flows: Bids 107.50 offers below. Offers 110.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Bank of Japan Governor Haruhiko Kuroda said that there are “many ways” to expand monetary policy further if risks threaten the achievement of the central bank’s 2% inflation target and he also reiterated that the monetary easing steps of BoJ were not directly targeted at weakening the JPY.

Technical: Bears target a retest of 122.05 year to date lows, resistance is sited at 124.50. Only a close over 126.80 eases immediate downside pressure.

Interbank Flows: Bids 122 stops below. Offers 124.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

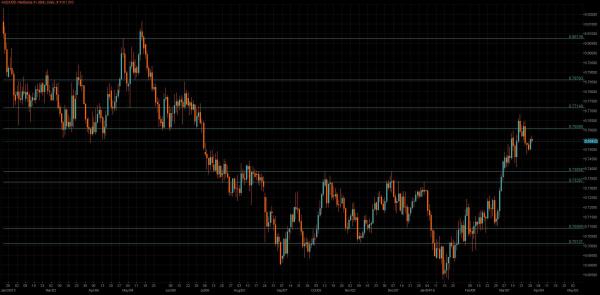

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD hovered at a 10-month peak, after upbeat Chinese export statistics and a rally in commodity prices underpinned appetite for risk assets. The Aussie had been buoyed by a near 5% rise in price of iron ore, Australia’s top export earner, the second straight session of gains.

Technical: Only a close below .7500 threatens the near term bullish bias, while this level supports intraday expect a grind higher to test .7770. A failure at .7500 opens pivotal .7450 support.

Interbank Flows: Bids .7500 stops below. Offers .7700 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: CAD weakened against the USD as oil prices retreated and after the Bank of Canada advised caution on the country’s growth outlook. The central bank kept interest rates steady, saying weaker global growth, a less favourable US outlook and shrinking business investment would drive the economic outlook lower if not for the boost from the government’s fiscal stimulus.

Technical: Bids just below below 1.2780 encourage a bounce intraday resistance now sited at 1.29 ahead of pivotal 1.30 resistance. As 1.29 rejects the rebound expect a move to 1.2550 as the next downside objective.

Interbank Flows: Bids 1.2750 stops below. Offers 1.29 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short