Markets witnessed a return of risk appetite, on optimism of a December Fed rate hike as Friday’s Kansas City Fed manufacturing data surprisingly returned to positive territory for the first time since February this year. San Francisco Fed President John Williams said that there is a “strong case” for a December hike if data continues to show improvement in economic conditions, affirming expectation that the central bank is going to tighten policy in the upcoming December meeting. On similar note, Fed Bullard said the pace of monetary policy tightening should be data-dependent and that real consumption growth is fairly strong in 4Q. USD rallied on renewed weakness in European majors the USD Index climbed strongly in European and US sessions to close 0.59% higher at 99.56.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: ECB chief Draghi expressed willingness to add more stimulus to raise inflation as fast as possible, while the head of New York Fed Reserve Bank Dudley reaffirmed expectations of a rate hike next month. As markets again continue to weigh on monetary policy divergence between Fed and ECB, the euro fell back below 1.07 levels against the USD after two days of advance. With a raft of PMI data from Eurozone due today, poor results likely adds further pressure to the EUR.

Technical: While 1.07 caps intraday upside corrections, bears target a test of 1.0560 next ahead of an assault on year to date lows. Only a close above 1.08 eases immediate downside pressure.

Interbank Flows: Bids 1.06 stops below. Offers 1.0750 Stops above.

Retail Sentiment: Bullish

Trading Take-away: Short 1.0830 targeting 1.0560

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: UK public borrowing rose to 8.2 billion pounds in October, much higher than market expected. Effect on the cable was muted in the aftermath of the data release. Against a strong USD overnight boosted by the weakness in EUR, GBP dropped significantly to close the day at 1.5189. Attention this week will be on UK Q3 GDP figures due this Friday to provide further hints as to what BoE’s next step could be.

Technical: While 1.5230 contains upside reactions expect a test of of bids at 1.50 as the next bearish objective. Only a close above 1.54 eases immediate bearish bias

Interbank Flows: Bids 1.51 stops below. Offers 1.53 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines for now

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: BoJ’s Sayuri Shirai saw Japanese inflation rising in the near future, but highlighted that higher wage growth remains key to reaching the central bank’s inflation target. She also stated the importance of BoJ to support the health of the economy by maintaining an accommodative monetary environment. USD/JPY was little changed below 123 levels last Friday ahead of important data due this week, which includes BoJ’s meeting minutes, Flash Manufacturing PMI and CPI figures.

Technical: While 122.50/30 supports downside reactions, market structure remains bullish to test 2015 highs next

Interbank Flows: Bids 122 stops below. Offers 124 stops above

Retail Sentiment: Bearish

Trading Take-away: Long 122.50 stops to entry target 125.50

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Japan is on holiday Monday due to the Labour Thanksgiving holiday.

Technical: Only a close above 133.50 eases immediate bearish pressure, while 132.50 caps upside reactions expect retest of 130.50 lows

Interbank Flows: Bids 130.50 stops below. Offers 132.50 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines for now

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD had broken higher last Friday, reaching as far as 0.7249 level. Recent upbeat jobs and confidence data from Australia reduces the risk of further RBA easing this year, whilst the RBNZ looks increasingly at risk of cutting rates next month. The widening yield differentials might continue to support AU/DNZD. This week’s focus will turn to RBA Governor Stevens’ speech on Tuesday and CAPEX figures due Thursday.

Technical: While .7170/50 supports downside reactions expect grind higher to retest Friday’s highs, a failure at .7150 suggests a retest of current base towards .7070

Interbank Flows: Bids .7100 stops below. Offers .7250 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines for now

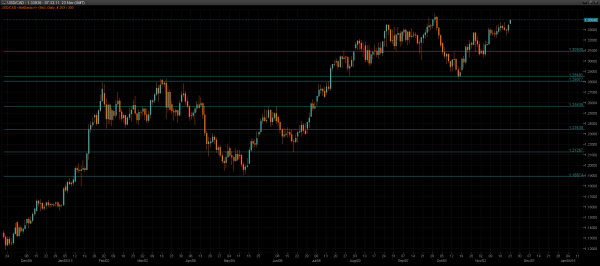

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Fundamental: CAD CPI figures YoY unexpectedly slowed to 1% from 1.3% the month prior, while the core CPI slightly missed expectations. The slowdown in prices growth may put increased pressure on BoC to further loosen its monetary policy, thus boosting USD/CAD. Coupled with disappointing retail sales data, the loonie climbed above 1.3300 handle to end the day at 1.3341. Under the absence of domestic data this week, the USD and oil prices will be the key drivers for USD/CAD

Technical: Offers just above 1.3350 eroded year to date highs are the primary upside objective now, bulls have the ball while 1.33/1.3280 supports intraday downside. A close below 1.3220 would ease the near term bullish bias.

Interbank Flows: Bids 1.33 stops below. Offers 1.34 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines for now