London Forex Report: The dovish Fed signalling fewer rate increases this year has continued to reverberate through asset classes, while a rise in the US oil rig count somewhat set back recent rise in oil prices. Data flow was very light. Consumer confidence in the US skidded to a five month low of 90.0 in March, amid expectations of a dimmer growth outlook. UK’s house prices increased at a faster pace of 7.6% YoY in March, buoyed by demand ahead of the stamp duty surcharge effective next month. USD strengthened, rebounding from a sharp two-day loss even though risk appetite held firm. The USD Index rose steadily through Asian and European trades before making another leg higher in US session, closing 0.34% firmer at 95.08.

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: The pair has opened the week on a calmer footing following last week’s post Fed fallout, with 1.1340 area continuing to provide supply for now as we retrace to settle around 1.1250s for this morning’s trading as London walks in. Little in way of key data releases today and for the rest of the week as we approach the Easter break, so expect any signs of weight of positioning to provide the catalyst for directional sentiment.

Technical: Expect a further grind higher to test pivotal resistance at 1.1370 en route to the 1.1420 symmetry swing objective, while 1.1240 supports intraday. Only a close below 1.1050 eases immediate bullish pressure.

Interbank Flows: Bids 1.1250 stops below. Offers 1.14 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP’s rally failed to generate a weekly close above 1.4500, although the pair still trades relatively supported. Brexit concerns will likely stem further material upside heading into the holiday weekend. Brexit polls continues to generate a decent amount of headlines, recently more skewed in favor of leaving.

Technical: Close over 1.43 eases immediate downside pressure. Bulls now target a retest of offers and stops above 1.4668. Bulls have the ball while 1.43 supports downside corrections.

Interbank Flows: Bids 1.43 stops below. Offers 1.4550 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: It’s a quiet start to the week with the Japan market closed on holiday, and there is a risk that this low-volatility nature could continue given the shortened Easter week as well (not to mention the lack of significant risk events). On that note, domestic flows could play a bigger role, and with fiscal year and month-end looming, and amid a weak USD environment, market remains positioned for a move lower in the pair.

Technical: Retest of bids sub 111 attracts profit taking, and a sustained breach here will leave the psychological 110 exposed. Intraday resistance is cited at 112.20 with a close over 113 required to neutralize the immediate downside threat.

Interbank Flows: Bids 110 offers below. Offers 112.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

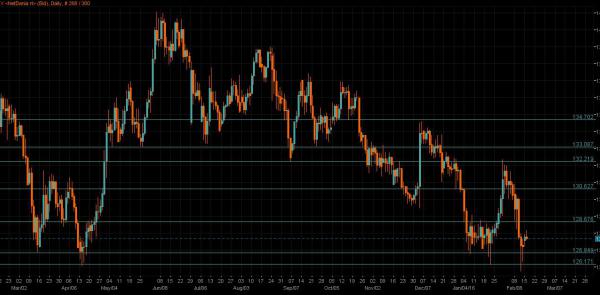

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Reflecting lackluster domestic demand, Japanese department store sales rebounded but rose a meager 0.2% YoY in Feb (Jan: -1.9% YoY). This underscored BoJ efforts in keeping monetary policy accommodative to spur household consumption.

Technical: While 125 acts as support for the current advance, expect a test of symmetry resistance at 128.15 as the immediate corrective objective. Failure at 124.50 suggest false upside break and opens retest of 123.

Interbank Flows: Bids 125 stops below. Offers 127.50 stops above

Retail Sentiment: Neutral

Trading Take-away: Neutral

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD extended its gains against the USD during the Asian session on last Friday as the PBoC set the strongest yuan fixing rate since November 2. The pair jumped to an intraday high of 0.7680 levels, which was an eight-month high. The Aussie was one of the strong performers last week, helped by the weak USD and a surge in commodity prices.

Technical: .7672 upside target achieved profit taking pull back should find fresh buyers at .7530/50 for the next upside leg to target .7729 next. Only a failure at.7400 support threatens near term bullish bias.

Interbank Flows: Bids .7590 stops below. Offers .7700 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: CAD edged up to a five-month high of 1.2919 against the USD amid a strong Canadian retail sales figures of January, beating the markets’ expectations by more than three times. Apart from better-than-expected data out of Canada, the oil prices also help Lonnie to stand firm. Markets believe the Bank of Canada (BoC) will hold the interest rate steady on the next policy meeting due to the strong manufacturing and retail sales figures released last week.

Technical: AB=CD ultimate downside objective at 1.2966 achieved, while 1.3160 contains profit taking bears target 1.2680 as the next downside objective. Only a close over 1.34 negates immediate bearish bias.

Interbank Flows: Bids 1.2950 stops below. Offers 1.3150 stops above

Retail Sentiment: Bullish

Trading Take-away: Short