London Forex Report: Global equities and commodities extended their slides, as FOMC and Brexit jitters continue to unnerve investor sentiments, further driving gains in safety assets. The fall in UST yields were more muted but German bund yields slipped below zero for the first time and 10-year UK gilts and JGB reached record low. Data flow was heavy and largely positive. US retail sales rose more than expected by 0.5% MOM in May, a strong indicator that consumption will boost GDP growth in 2Q. Despite the monthly surge in fuel prices, car sales remained solid. Excluding automobiles, fuels, building materials and food services, core retail sales rose 0.4% MOM in May (April: revised to 1.0% MOM), which correspond most closely with the consumer spending component of GDP. All eyes on FOMC meeting decision due tonight. USD strengthened amid firmer support from refuge demand as commodities and equities resumed their declines. The USD Index climbed strongly going into European trade before gaining further ground on better than expected US data, closing 0.6% higher at 94.92

FX Majors: EUR In the euro area, industrial production and employment change had both surpassed the estimates whereas markets had largely bypassed the results as markets continue to be driven by Brexit concerns. GBP Headline and core CPI in the UK missed expectation in May, increasing BOE’s concerns of achieving the desired inflation target on top of intensifying risks on economic growth due to the upcoming EU referendum. CPI was unchanged at 0.3% YOY, less than the expected 0.4% YOY growth. Core CPI on the other hand, rose 1.2% YOY for the month of April and May. Other price gauges were also lackluster. Retail prices climbed 1.4% YOY in May (April: +1.3% YOY) while producers prices dropped 0.7% YOY last month. JPY Affirming uneven recovery in global manufacturing, a final report on Japan’s IPI indicated that output fell 3.3% YOY in April (March: +0.2% YOY).

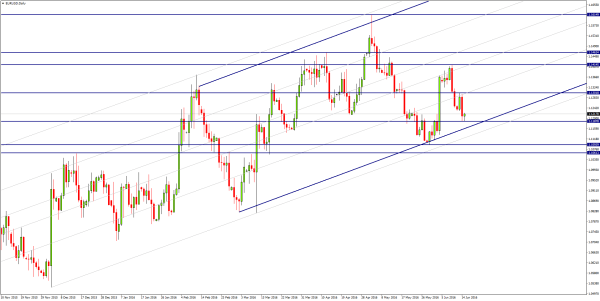

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Technical: Sharp Rejection by symmetry swing resistance sited at 1.140 Below 1.12 suggests false upside break and resets attention on 1.1065, interim resistance sited at 1.1310

Retail Sentiment: Neutral

Trading Take-away: Neutral

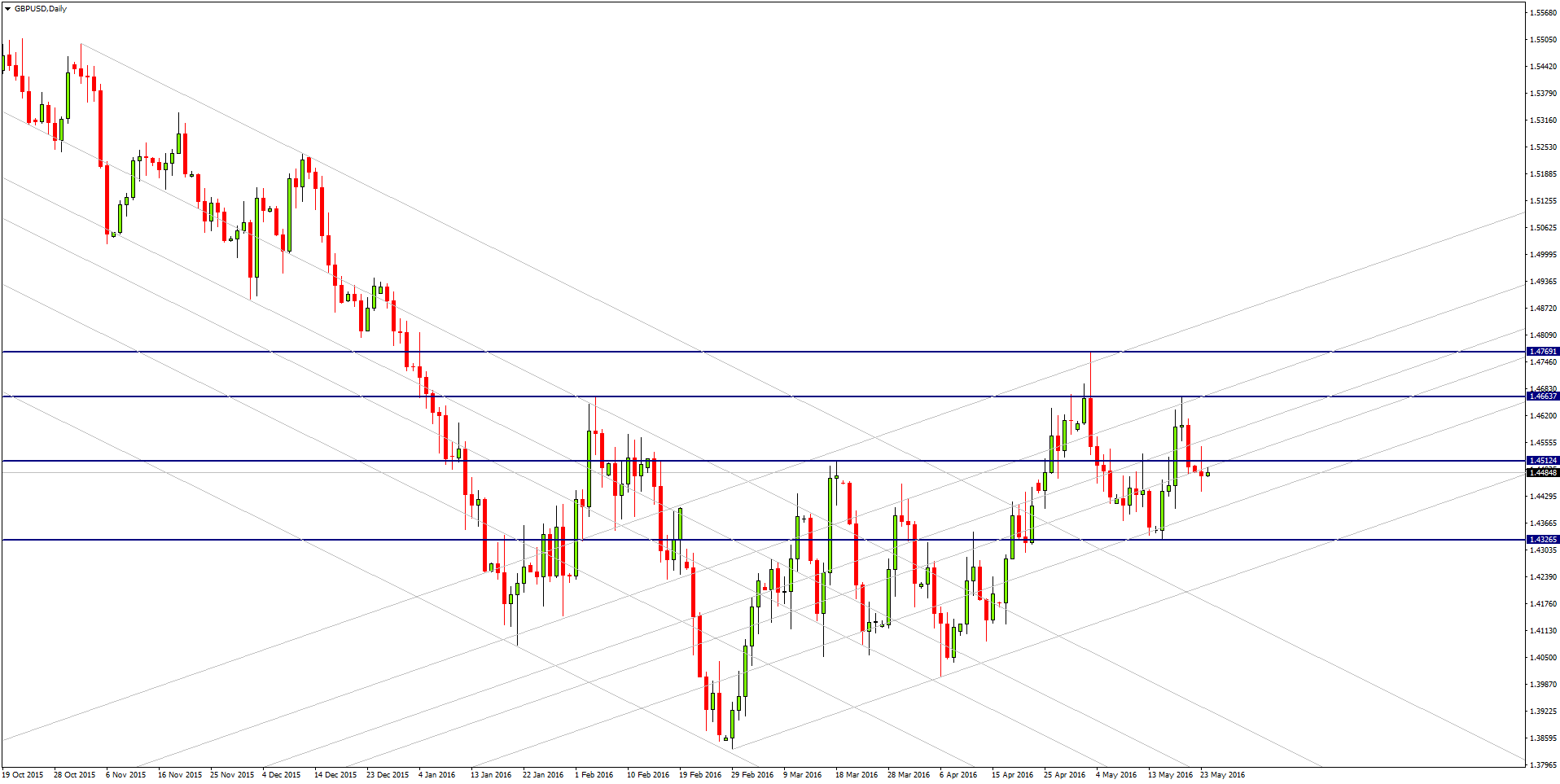

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: Pre Brexit referendum range of 1.4770/1.4330 expands to the downside, only a daily close above 1.4350 suggest false downside break. As 1.4330 contains upside reactions expect test of 1.40 next, over 1.4350 suggest return to range

Retail Sentiment: Neutral

Trading Take-away: Neutral

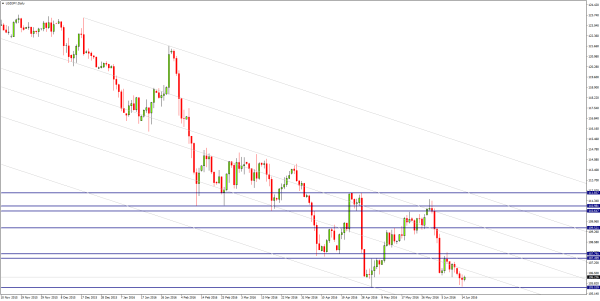

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: Downside ratchet now targeting a retest of 105.55 lows with the potential for a daily double bottom pattern to develop. Failure at 105 opens 103 as the next downside objective. 106.90 is the near term pivotal resistance

Retail Sentiment: Bullish

Trading Take-away: Sidelines

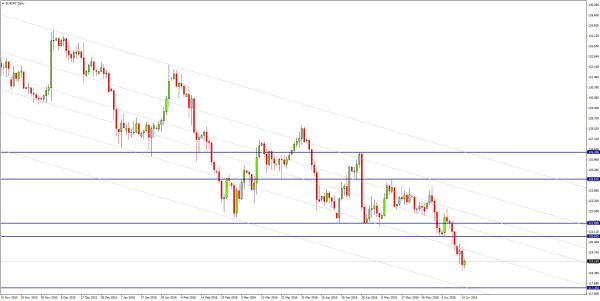

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: While 120.60 contains upside reactions expect a grind lower to breach last weeks lows enroute to a weekly equality objective at 117.36. A close over 123 suggests a broader recovery targeting 124.30 as the next upside objective

Retail Sentiment: Neutral

Trading Take-away: Neutral

Commodities FX: GOLD Bloomberg data showed holdings in gold ETFs rose by 2.85 tonnes to 1,877 on Monday, the highest since October 2013. Oil fell despite a bullish report from the EIA. It stated that the oil surplus is 40% smaller than estimated last month due to supply disruptions and strong demand. AUD slipped from 0.7360 to 0.7340 following the MSCI announcement. The MSCI announcement didn’t come as a surprise. They will delay till 2017 market classification review. But should there be positive developments, MSCI said it does not rule a potential off-cycle announcement. CAD/USD surged on Tuesday due to the weakening oil prices and subdued market risk appetites amid the ongoing concerns about Brexit issue.

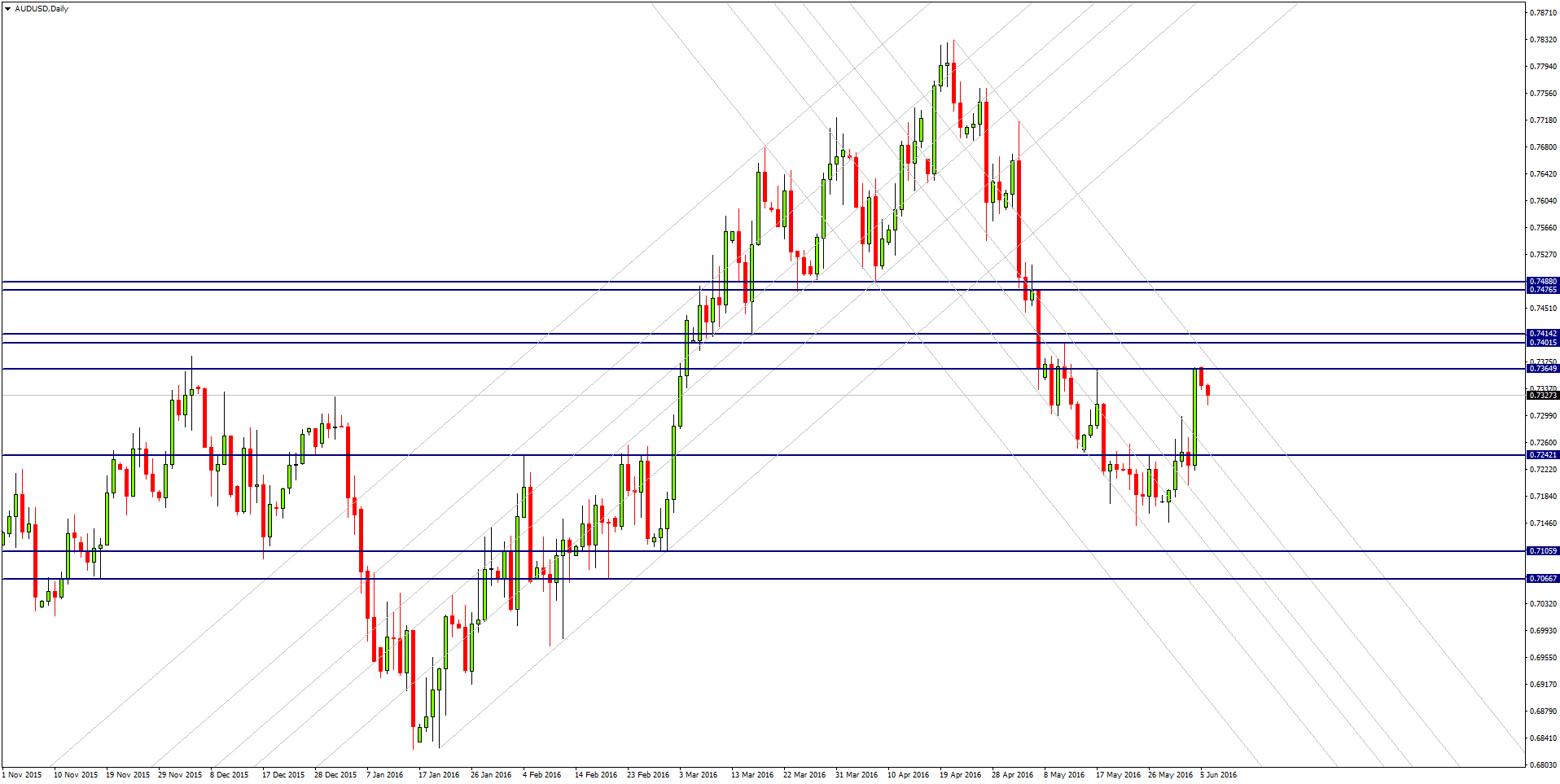

AUD/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Technical: Rejected by resistance sited at .7480/.7500 where fresh selling emerged as expected. As .7450 rejects upside reactions expect rotation to test .7230 support next.

Retail Sentiment: Neutral

Trading Take-away: Neutral

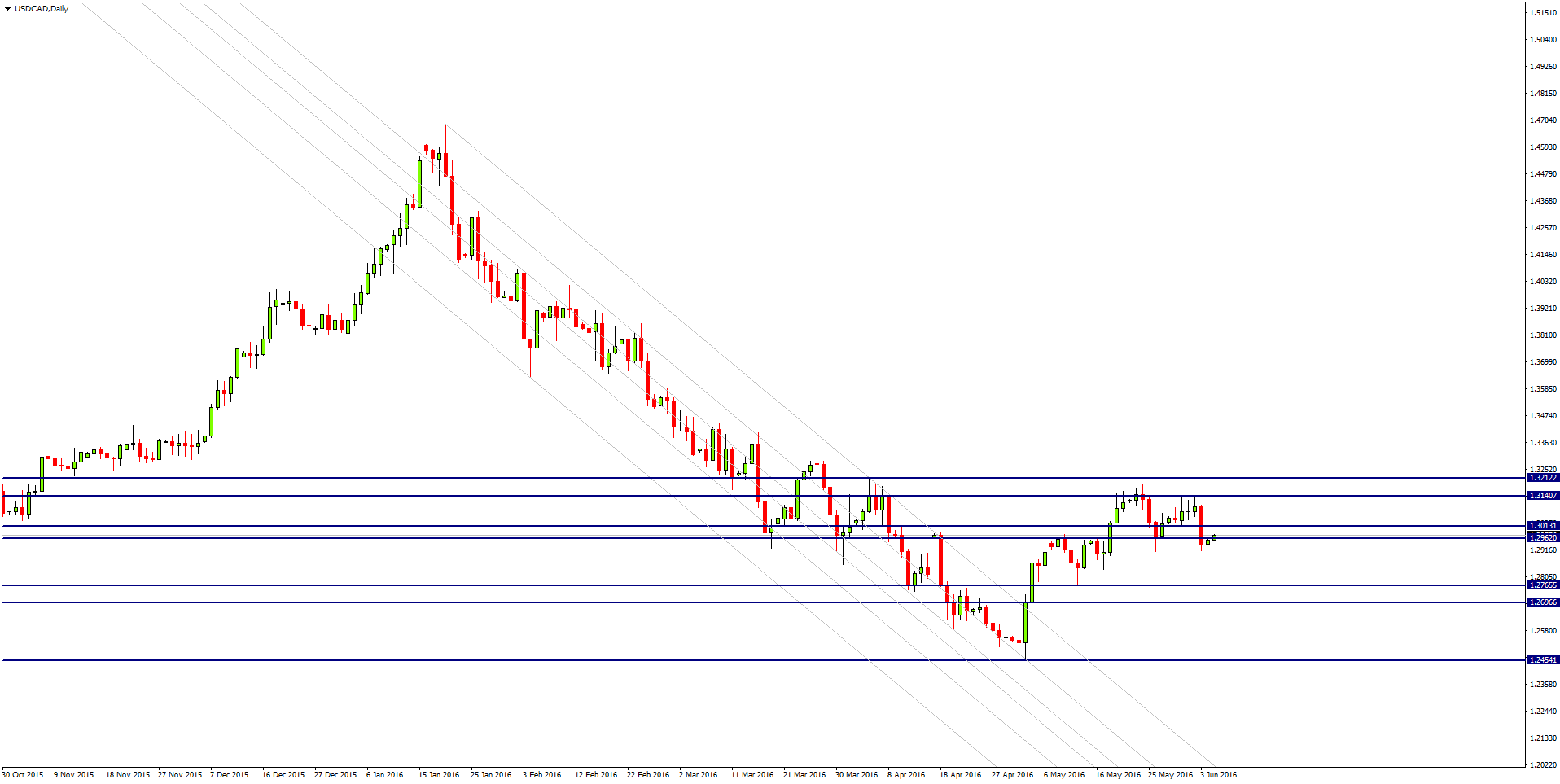

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: Fridays close 1 pip below 1.2760 suggested a potential false break of support, which was confirmed as anticipated by yesterdays close. While 1.2655 supports 1.2910 is the next upside objective.

Retail Sentiment: Neutral

Trading Take-away: Neutral

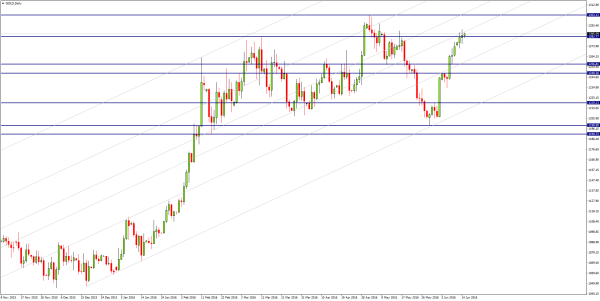

XAU/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Technical: Pivotal 1280 resistance proves sticky while 1295 contains the current upside advance expect rotation back to 1260.. Failure at 1230 opens 1190 again

Retail Sentiment: Bearish

Trading Take-away: Sidelines

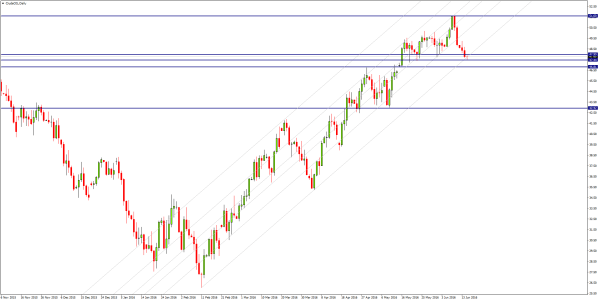

US OIL

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Technical: Anticipated AB=CD swing objective at 51.07 achieved and prompts sharp reversal, only a close below 46 threatens medium term bullish bias, as 47.40 supports expect deep retest of prior 51.60 highs, potential double top

Retail Sentiment: Bearish

Trading Take-away: Long