London Forex Report: GBP Hammered By London Mayor Support For ‘Brexit’

London Forex Report: GBP is hammered by London Mayor Boris Johnson telling reporters that he is to throw his weight behind the yes vote for Brexit.

The quickest rise in US core CPI in four years bolstered expectations the Fed could continue to nudge interest rates higher in a gradual manner this year. CPI was flat MoM in January but its pace of increase was doubled to 1.4% YoY. Core CPI jumped to 2.2% YoY as a result of the low base effect of oil prices last year. Rising price pressure, though it may just be transitory given renewed fall in global oil prices, suggests that the Fed may not have to resort to negative interest rates like their counterparts in Eurozone and Japan. A gradual hike path remains on the table this year. USD Index tumbled from its intraday high to notch a 0.36% loss at 96.60, as a rally in European majors led by GBP offset signs of pick up in US inflationary pressures.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR fell to two-week lows following the US CPI report but then rebounded, climbing back above 1.1100 handle. Attention is turning to the ECB monetary policy meeting in March, which is regarded as having a high probability that the ECB will further loosen monetary policy. CPI is the key data point this week, as a disappointment here could see traders reload on the short side heading into the ECB.

Technical: Initial test toward pivotal support at 1.1050/30 attract profit taking bounce. While 1.1220 caps upside sellers have the ball targeting stops sub 1.10. A breach of 1.1250 suggests consolidation and potential return to test offers over 1.13 ahead of 1.1376 highs.

Interbank Flows: Bids 1.1050 stops below. Offers 1.1250 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

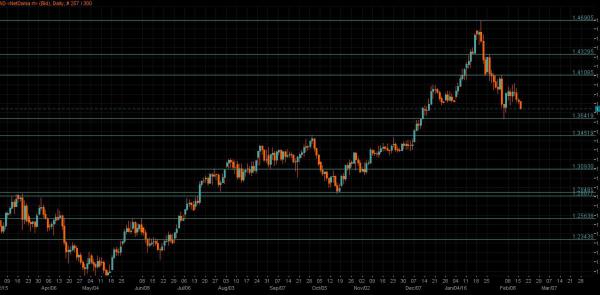

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP rose above 1.4400 as European Union leaders reached a deal aimed at keeping the UK in the EU. UK Prime Minister David Cameron said that he had negotiated a deal that gives his nation special status within the EU, while referendum on the UK’s membership of the EU will be held on June 23. The pound fell considerably against the dollar this morning after London Mayor Boris Johnson said he’ll campaign for Britain to leave the European Union.

Technical: Continued failure above 1.4380 give bears the upper hand while the failure at 1.42 support opens a retest of 1.4040 lows. A close over 1.4450 eases bearish bias.

Interbank Flows: Bids 1.4150 stops below. Offers 1.44 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY gained for three consecutive weeks against the USD, the longest run of weekly gains since September 2015. Traders channelled their cash into safe haven assets, with turmoil stemming from concern that global economic growth is slowing. The move has come even after Bank of Japan Governor Kuroda adopted negative interest rates at the end of last month.

Technical: While 112.40 supports downside rotations expect a grind higher to retest the broken neckline resistance at 115.80/116 where fresh selling interest should emerge. Failure at 112 opens retest of 111 bids.

Interbank Flows: Bids 112 offers below. Offers 113.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Reflecting a decline in the Japanese economy in Q4, all industry activity index slumped 0.9% MoM in Dec (Nov: -1.1% MoM) due to sluggish industrial output, slowdown in construction activities and the services sector. Household consumption was equally downbeat in January. A report from the Department Store Association showed that sales fell 1.9% YOY in Jan after a 0.1% YOY increase in December.

Technical: While 126.20/40 caps upside reactions expect further fresh two and a half year lows for a move down to 124 as the next downside objective. A close over 128.20 would ease immediate downside pressure

Interbank Flows:

Bids 125 stops below. Offers 126.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD weakened against its major peers after the Wall Street Journal reported that the central bank board member John Edwards said the currency is too strong, stating that he would be more comfortable with a level around 65 US cents, though he was not confident a drop to that level would occur.

Technical: While AUD continues to trade above the pivotal .7100/.7070 expect a retest of offers above .7240 en-route to .7310. Another failure at .7050 would suggest further weakness to retest year to date lows at .6820’s

Interbank Flows: Bids .6950 stops below. Offers .7250 stops above.

Retail Sentiment: Bearish

Trading Take-away: Long

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD advanced against the CAD after US inflation figures gauged by the CPI report showed headline consumer prices advancing more than expected. Canada CPI surprised the markets, advancing 0.3% MoM and 2.0% YoY, but the negative surprise has come from December’s Retail Sales, contracting 2.2% MoM.

Technical: While USD/CAD trades sub 1.3850 downside pressure remains the driver with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3630 stops below. Offers 1.3850 stops above

Retail Sentiment: Bullish

Trading Take-away: Neutral