London Forex Report: ECB ‘Will Be Ready To Act’

London Forex Report: Mario Draghi said that the ECB “will be ready to act” in response to concerns on health of European banks, hinting that further monetary stimulus may be on the cards when the central bank meets next week. Comments from Draghi overshadowed positive surprise in trade balance on the macro front.

PBOC was also in the limelight yesterday as the yuan was fixed at a much stronger rate, turning investors’ attention away from weak trade numbers. Exports tumbled much more than expected in Jan, reinforcing the case for additional stimulus from PBOC. USD recovered, spurred by declines in safe haven majors JPY and CHF, as well as on the broad-based weakness in European majors. The USD Index eased after US mid-day but still registered 0.82% gain to 96.73.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The EUR fell yesterday strengthened in line with improving risk sentiment. EUR falls were aided by Draghi reiterating March is live for the ECB. ECB President Draghi’s comments spurred speculation of further monetary policy easing, EUR is likely to extend is decline against USD amid signs that the ECB is ready to unleash more stimulus.

Technical: While 1.1220/40 rejects intra-day upside reactions expect a test of pivotal support at 1.1050/30 as the next downside objective. A breach of 1.1260 opens 1.1350 offers.

Interbank Flows: Bids 1.1150 stops below. Offers 1.1250 stops above

Retail Sentiment: Bearish

Trading Take-away: Short

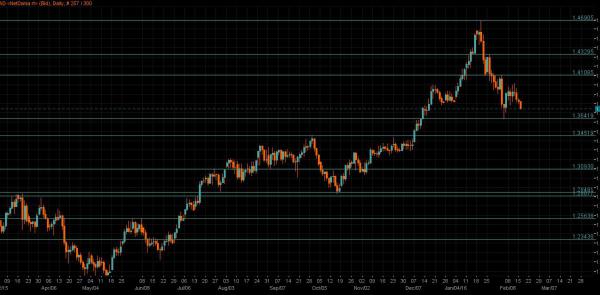

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: BoE MPC member McCafferty stated that the case for a rate rise is less compelling as upside risks to wages had been pushed out. However, we do note that between August 2015 and January 2016, McCafferty had been the only MPC member to vote for a rise in the bank rate before calling for no change in rates in February.. However, GBP fell as Brexit concerns continue to escalate ahead of this week’s EU Leaders’ summit on the matter.

Technical: While 1.4510/30 caps the upside expect a retest of bids towards 1.4350/30. A breach of 1.4550 opens a retest of February highs a 1.4660’s

Interbank Flows: Bids 1.4350 stops below. Offers 1.45 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/JPY is rotating around the 114.60-levels this morning, lifted by the improvement in risk sentiments, the stable yuan and oil prices sparking a sell-off in the JPY against the other majors. BOJ’s negative interest rate policy (-0.1% on certain excess cash holdings of cash at the BOJ), comes into play from today.

Technical: While 113.40/20 supports downside rotations expect a grind higher to retest the broken neckline resistance at 115.80/116 where fresh selling interest should emerge

Interbank Flows: Bids 113.40 offers below. Offers 116 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Japan data continued to disappoint. Industrial production fell at a faster than initially estimated pace of 1.7% MOM while tertiary industry index fell more than expected by 0.6% MOM in December, pointing to weaknesses from both the manufacturing and services sectors that will continue to undermine growth in the Japanese economy. .

Technical: While 129 caps upside reactions expect a retest of year to date lows 125.77 a breach of this support opens a move down to 124 as the next downside objective. A close over 129.74 would ease immediate downside pressure and open a rotation higher yo test 132.30

Interbank Flows: Bids 126 stops below. Offers 128.50 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Tone of RBA minutes this morning was somewhat neutral. While the central bank reiterated that “continued low inflation may provide scope for easier monetary policy”, “there continued to be evidence that low rates were supporting household consumption and dwelling investment”, suggesting that they are in no hurry to cut rate anytime soon

Technical: While AUD continues to trade above the pivotal .7100 expect a retest of offers above .7200 en-route to .7310. Another failure at .7100 would suggest further weakness to retest year to date lows at .6820’s

Interbank Flows: Bids .6950 stops below. Offers .7250 stops above

Retail Sentiment: Bearish

Trading Take-away: Neutral

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: With Canadian markets offline yesterday Loonie took its lead from Crude. Oil prices were stronger. Another week, another OPEC supply cut rumour. Saudi Arabia’s oil minister plans to meet with his Russian counterpart in Doha on Tuesday to discuss the oil market. Saudi Arabia is not keen to cut production to restore the supply/demand balance, but could consider output cuts if other producers join

Technical: While USDCAD trades sub 1.3830 downside pressure remains the driver with bears fully focused on a retest of 1.3630 bids ahead of 1.3530. A close over 1.3850 suggests a retest of 1.40 offers in broader range trade.

Interbank Flows: Bids 1.3650 stops below. Offers 1.40 stops above

Retail Sentiment: Bullish

Trading Take-away: Short