London Forex Report: Resumption of risk sentiments dominated yesterdays trading as recent decent data bag from the US renewed expectations the Fed could still be able to squeeze out one rate hike this year, contrary to renewed global easing trend in other parts of the world.

USD extended its rebound amid risk-off in commodity majors and some European currencies. USD Index consolidated through European and US sessions but inched higher just before closing to register a 0.14% gain at 97.20.

FX Majors: EUR ECB current account surplus fell to € 30.8 billion in May (April: € 36.4 billion) amid declines in both trade surplus and investment income since April. In a separate release, consumer confidence index slipped to -7.9 in July (June: -7.2). GBP In May, UK unemployment rate fell below 5.0% for the first time since 2005.

Jobless rate dropped to 4.9% before Brexit as 176k jobs were added to the labor market in the three months through May. On the other hand, claimant count rate remained unchanged at 2.2%. JPY Japan’s department store sales dropped 3.5% YOY to ¥ 470 billion in June (May: -5.1% YOY), marking its fourth straight declines.

Domestic consumption remained sluggish despite BOJ’s enormous stimulus package and prompted the government to pump in fiscal stimulus to spur spending. Details on the much anticipated stimulus however is still undisclosed.

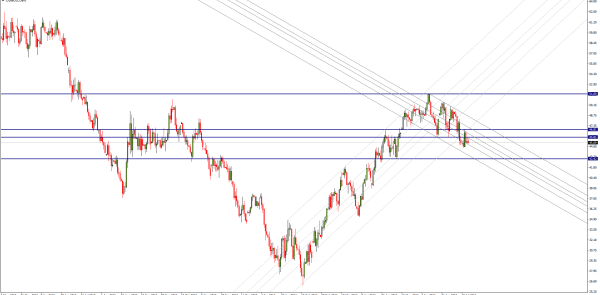

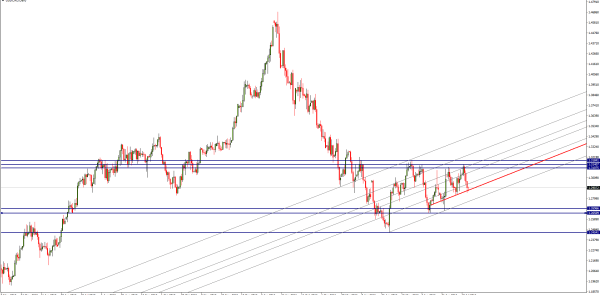

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: Bids below 1.10 arrest range support test and delay a challenge of 1.09 post Brexit reaction lows. Intraday resistance is sited at 1.1070, while this area caps expect further downside

Retail Sentiment: Neutral

Trading Take-away: Neutral

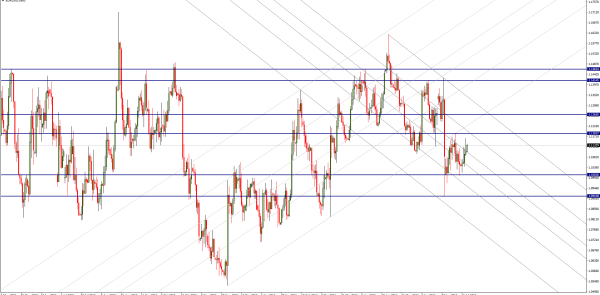

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: 1.3260 represents symmetry resistance while this area caps expect a retest of 1.30 base. Over 1.3330 shifts attention back to 1.3550 symmetry swing objective.

Retail Sentiment: Neutral

Trading Take-away: Neutral

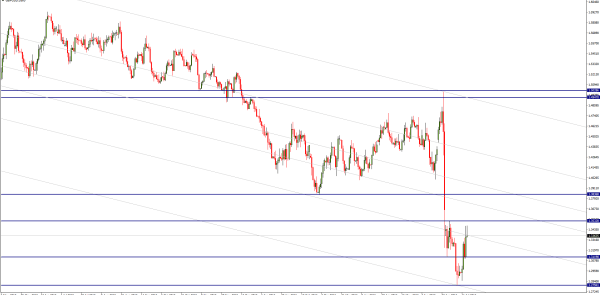

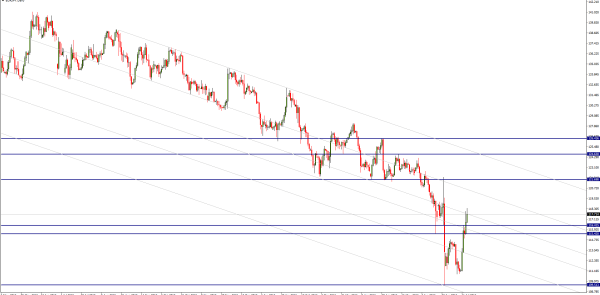

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: While 106.70 former resistance now acts as supports expect grind higher to test 107.60 next. Only a close below pivotal 105.50 threatens near term bullish bias.

Retail Sentiment: Bearish

Trading Take-away: Sidelines

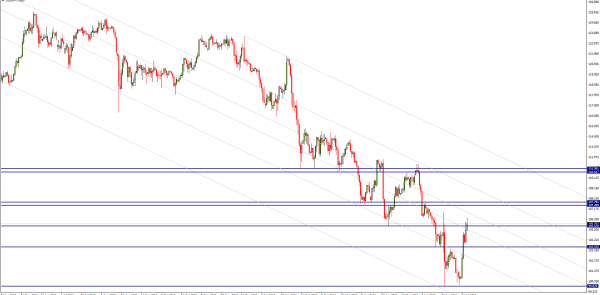

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: As 116.40 supports bulls target 119.30 as the next upside objective.Only below 115 threatens near term bullish bias

Retail Sentiment: Bearish

Trading Take-away: Sidelines

Commodities FX: GOLD fell to its lowest in three weeks on the back of advancing European and US equities, and as the dollar strengthened following strong US economic data, which raised expectations that the Fed may raise rates before the end of the year Oil prices turned positive after hitting a two-month low earlier in the session. Prices rose as much as 1 percent after the US government reported a ninth straight week of crude inventory draws, easing some concerns in a market worried about a glut. US gasoline prices, however, hit four month lows after the data from the US Energy Information Administration (EIA) also showed a surprise build in supplies of the motor fuel despite forecasts of American drivers hitting the road in record numbers this summer. The EIA said crude inventories fell 2.3mn barrels in the week to 15 July, close to expectations for a decrease of 2.1mn barrels. AUD stays heavy in choppy trading in wake of dovish RBNZ meeting. Speculation is high that Reserve Bank of Australia (RBA) will cut its 1.75% cash rate in August. Much will depend on inflation figures for the second quarter due on 27 July while a weak inflation outcome would likely convince the RBA to lower rates again. CAD weakened to a one-week low against USD, though some losses were pared as oil prices turned higher.

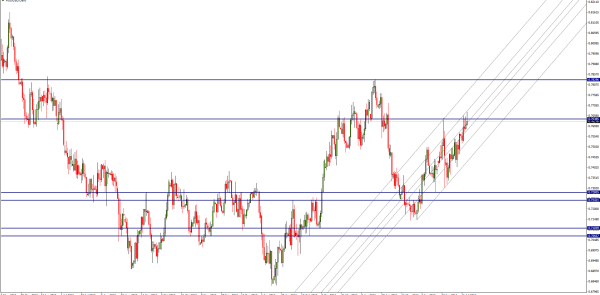

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Technical: Attention shifts back to .7430 as we continue to rotate in a broader .7660/.7340 range, with .7330 representing symmetry swing support. Intraday resistance is sited at .7550

Retail Sentiment: Bullish

Trading Take-away: Sidelines

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Technical: 1.2850 pivotal for carving out a potentially bullish base, with higher lows targeting a push higher to 1.32. Below 1.28 opens move back to range lows 1.2650.

Retail Sentiment: Neutral

Trading Take-away: Neutral

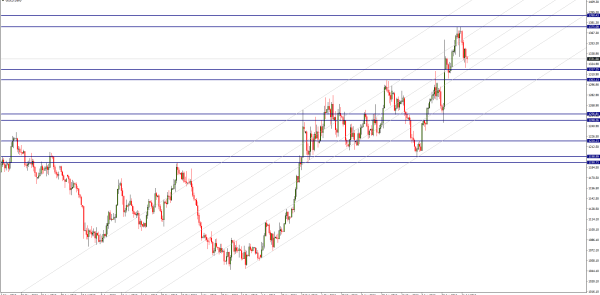

XAU/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Technical: Testing symmetry swing support sited at 1305, while this area attracts buyers will set a potential platform to challenge and breach 1360 highs en-route to 1391. Below 1300 opens 1270 as next downside objective

Retail Sentiment: Neutral

Trading Take-away: Neutral

US Oil

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Technical: 44.50 continues to act as pivotal support while this level survives 48.30 become the upside objective. Below 44 opens 41.87 as the downside objective

Retail Sentiment: Neutral

Trading Take-away: Neutral