London Forex Report: Markets turned risk-off amid renewed growth concerns triggered by weak manufacturing data and commodity prices as well as RBA’s surprised rate cut. This overshadowed Fed speeches by Fed Williams and Fed Lockhart who are open to a June rate hike. Fed Williams signaled yesterday that strength in the US economy could warrant a hike next month. Lockhart said that “I would put more probability on it being a real option” although he wasn’t leaning for or against a June increase until he sees more data”. USD rebounded strongly following revival in refuge demand amid declines in equities and commodities. The USD Index bounced off its intraday low in European morning to climb higher thereafter, closing 0.35% higher at 92.94.

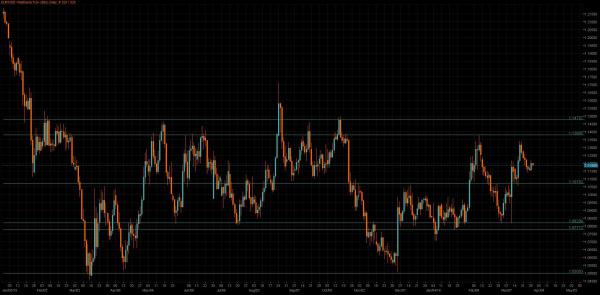

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: During early European session, the release of better than expected data in Europe fueled demand for the common currency, as industrial producer prices in March rose by 0.3% in the euro area, following a 0.7% in the previous month. The pair began to ease after the release of poor UK data, which gave the USD a breath that turned into a strong intraday advance following Wall Street’s opening. The euro pullback accelerated to the downside on American hours amid a stronger USD across the board.

Technical: EUR bulls now target a weekly AB=CD target of of 1.1766, intraday support is now sited back at prior resistance which should now act as support 1.1460/80 area, while this holds expects a grind higher to test previous reaction highs at the 1.1710 level. A failure at 1.1450 suggest a a return to retest 1.1240 support.

Retail Sentiment: Bearish

Trading Take-away: Long

GBP/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Fundamental: GBP/USD turned negative for the day as it dropped to a low of 1.4527 after being rejected from four month highs at the 1.4770 level, losing more than 200 pips from the highs. The pound initially hit by the final revision of the UK April Markit manufacturing PMI that fell below 50.00 for the first time since March 2013, coming in at 49.2. The decline in the pair was then fueled by a sharp comeback of the USD during the US session.

Technical: 1.4670 achieved bulls now set their sites on the psychological 1.50 levels. Near term support is sited at 1.45. While this area contains downside reactions expect continued upside pressure. A failure at 1.44470 opens a deeper correction to 1.4280 next.

Retail Sentiment: Bullish

Trading Take-away: Sidelines

USD/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY jumped to an 18-month high against the USD on Tuesday. USD/JPY dropped to an intraday low of 105.52, extending gains on doubts that Bank of Japan will intervene to stem the dramatic rise which has potentially undermined the Japan’s export. Japan Prime Minister Shinzo Abe is visiting Italy and Germany in a tour while some traders believe that he will grab this chance to set the stage for possible intervention in currency markets as Japan in going to host G7 meeting this month.

Technical: 105.50 weekly swing objective achieved, intraday 107.50 now become resistance a move through here opens a retest of 110 from below.

Retail Sentiment: Bullish

Trading Take-away: Sidelines

EUR/JPY

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: The Euro Zone growth will be slower than previous forecasts with subdued poor inflation this year, revealed by the European Commission’s economic forecasts on Tuesday.

Technical: Bears now target weekly symmetry objective at 120.60. Only a close over 126.80 eases immediate downside pressure. Intraday resistance now sited at 123.30

Retail Sentiment: Neutral

Trading Take-away: Neutral

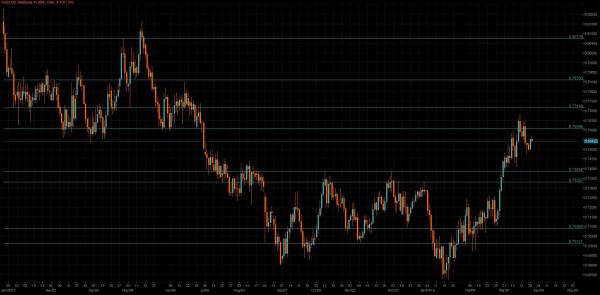

AUD/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bullish

Fundamental: AUD took a tumble yesterday after the Reserve Bank of Australia (RBA) surprised markets by cutting its cash rate to a record low. The RBA cut its cash rate by a quarter-point to a record low of 1.75% at its monthly policy meeting, the first easing in a year. The AUD skidded to 0.7479 against the USD, also dropped to its lowest in two months against the yen, euro and pound, while it touched a six-month low versus its Canadian peer.

Technical: Price is probing pivotal .7470/50 support. While this level holds expect a recovery and grind higher to retest .7830 resistance. Failure at .7450 opens .7380 as the next downside objective.

Retail Sentiment: Bullish

Trading Take-away: Short

USD/CAD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: CAD recorded its biggest daily decline in more than nine months yesterday, sliding against the USD as weak Chinese economic figures raised worries about the global economy. Oil fell for a second day as rising output from the Middle East and North Sea renewed concerns about global oversupply. US crude ended down $1.13 at $43.65 a barrel

Technical: The challenge of 1.2750 eases immediate downside pressure but bulls require a close above this level to negate near term bearish pressure and open a move to 1.30 as the next upside objective.

Retail Sentiment: Bearish

Trading Take-away: Long