London Forex Report: Another Crude Collapse, Risk Reverses.

London Forex Report: Another crude collapse, as oversupply concerns continued to dominate despite the slight recovery to the $30/barrel levels. Yesterday’s data flow was all negative, casting further shadows over global growth outlook. There will be a lot to keep markets on edge this week, most noticeably FOMC meeting that will begin to convene today. Most likely a non-event but the Fed rhetoric on the pace of its normalization path will be closely watched given the abrupt turn of events. 4Q GDP from the US and the UK will shed more lights on the extent of the slowdown. USD Index dipped 0.21% lower to 99.36 on the back of ebbing confidence that the FOMC could further tighten policy amid prevailing conditions.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD edged lower as renewed selling in oil markets drove traders into currencies often deemed as less risky investments, such as the EUR, JPY and the CHF, so called safe haven currencies. The EUR/USD rebounded sharply from 1.0780 level but traders still worry about the growing expectations that the European Central Bank is gearing up to take more easing steps.

Technical: Trading mid range, a sustained breach of 1.08 bids opens 1.07 range lows. A breach of 1.0990 trend resistance opens a broader 1.1240 symmetry corrective objective.

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 Stops above.

Retail Sentiment: Bullish

Trading Take-away: Play the range, buy dips to 1.07 sell rallies to 1.10

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Having enjoyed a protracted rally after bouncing off 7-year lows at 1.41 levels touched last Friday, GBP remained under pressure overnight as expected delays in monetary policy are continually extended. With very little on the domestic calendar, attentions will turn to BoE Governor Carney as he will speak on the Financial Stability Report in London. His speech will be closely monitored, especially after his recent dovish rhetoric.

Technical: A breach of 1.42 opens a retest of last week's 7-year lows. Over 1.44 eases immediate downside pressure and sets up a broader correction.

Interbank Flows: Bids 1.42 below. Offers 1.44 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY strengthened yesterday from around 118.80 to an intraday low of 118.16. It continued to go stronger overnight and reached as low as 118.06 at early Asian session. Risk sentiment deteriorated again as oil price fell furiously on Monday, market tended to enter long position of risk-off currency hence USD/JPY dropped. Today we will have US Consumer Confidence while markets will also be poised for the FOMC meeting due Thursday.

Technical: While 117.90 caps downside attempts expect a retest of 119 offers. Only above 119.30 eases immediate downside pressure. A breach of 117.40 resets the bearish tone.

Interbank Flows: Bids 117.50 stops below. Offers 119 stops above

Retail Sentiment: Bearish

Trading Take-away: Buy pullbacks to 117.90/70 for 119

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Japanese exports tumbled 8.0% YOY in Dec (Nov: -3.3% YOY), the sharpest decline in more than 3 years while imports plunged a deeper 18.0% YOY in Dec (Nov: -10.2% YOY). Trade balance however, turned around to register a 140.2 billion yen surplus in Dec (Nov: -381.3 billion yen deficit) due to higher monthly exports growth coupled with decline in imports.

Technical: While 128.50 caps upside reactions, expect a retest of bids at 127.50. Only over 129.50 eases immediate downside pressure.

Interbank Flows: Bids 127 stops below. Offers 128.50 stops above

Retail Sentiment: Bearish

Trading Take-away: Buy pullbacks to 127.60/40 for 129

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: AUD was slightly higher in early trade yesterday, but went south after riskier assets were hit tough overnight on repeated selling in oil markets and recorded a day-low of 0.6944. With Australian holiday today, traders may focus on the risk appetite and the Australian CPI figures tomorrow.

Technical: While .6930/50 caps intraday downside expect a test .7050. Only a breach of .7150 eases immediate downside pressure.

Interbank Flows: Bids .6900 stops below. Offers .7050 stops above

Retail Sentiment: Neutral

Trading Take-away: Sidelines

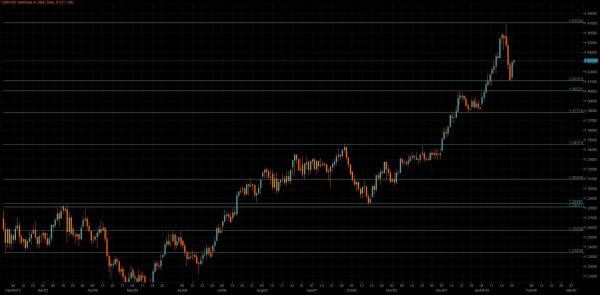

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: Crude oil prices fell after Iraq announced record-high oil production and OPEC signaled an unlikely change in level of crude production. The loonie was soft overnight, with weakness driven by oil as WTI retreated from its recent two-week highs. The key focus this week for the currency pair will be Thursday’s FOMC rate decision and Friday’s Canadian GDP figures.

Technical: While 1.4310/30 caps upside reactions expect a broader corrective phase to test 1.40 support. Only above 1.44 eases immediate downside pressure and opens a retest of 2016 highs.

Interbank Flows: Bids 1.4050 stops below. Offers 1.4350 stops above

Retail Sentiment: Bullish

Trading Take-away: Sell pullbacks to 1.43 for 1.40