A month has gone by since the last earnings report for Logitech International S.A. (NASDAQ:LOGI) . Shares have lost about 10.6% in that time, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Logitech Q1 Earnings Beat, Up Y/Y, Guidance Raised

Logitech continues its impressive streak of earnings beats for the seventh consecutive quarter. The company reported its first-quarter fiscal 2018 adjusted earnings (including stock-based compensation expense adjustments) of $0.22 per share, beating the Zacks Consensus Estimate of $0.17 by 29.1%.

On a non-GAAP basis, the company’s earnings per share came in at $0.24, up 20.0% year over year. Remarkable year-over-year rise in the bottom line was driven by strong top-line performance. Also, Logitech's concerted efforts to drive cost efficiency proved conducive to overall earnings and profitability growth.

Net sales for the quarter rose an impressive 10.0% year over year to $529.9 million, surpassing the Zacks Consensus Estimate of $521 million. Double-digit rise in sales across most of the product lines in all the three geographies, namely, Americas, EMEA, and Asia, drove year-over-year top-line growth.

Segment-Wise Performance

Creativity and Productivity business comprises four sub-business lines – Keyboards and Combos, Pointing Devices, PC Webcams, and Tablet and Other Accessories. Of these, Keyboards and Combos remained flat as high sales in the Americas and the EMEA region was offset by decline in sales in the Asia-Pacific region. Pointing Devices sales were up 5% to $122.1 million, driven by solid demand for mouse and the recently introduced Spotlight presentation device.

Greater proliferation of personal broadcasting mediums, including video blogging, proved conducive to sales growth of PC webcams. Encouragingly, the Tablet and Other Accessories segment witnessed a rebound as sales grew 67% to $23.2 million. Rapid market traction of the newly introduced products including, Slim Combo Case for the iPad Pro and Rugged Combo family of products, drove sales of the tablet segment.

Gaming surged 38% year over year to $77.7 million, driven by double-digit growth from all three regions. On the other hand, Video Collaboration grew 49% to $35.6 million on the back of double-digit increase from all three regions. Rising demand from companies, both large and small, for video-enabling huddle rooms and conference rooms drove sales growth of this segment.

The Music business, which comprises Mobile Speakers units and Audio-PC & Wearables, witnessed mixed performance. Mobile Speaker sales rose 10% to $62.9 million, led by impressive market traction of Ultimate Ears and Wonderboom product lines. However, this was largely offset by the drab performance of the Audio PC & Wearables segment, which fell 11% during the first quarter of fiscal 2018, driven by the Jaybird buyout.

In addition, sales under the Home Control category increased 47% to $16.5 million, driven by continued demand for smart home products. Integration of voice assistants (such as Alexa and Google (NASDAQ:GOOGL) Assistant) into Harmony Hub proved conducive to the sales performance of this segment.

During the first quarter of fiscal 2018, Logitech generated record non-GAAP gross margin growth, up 140 basis points (bps) to 37.0% year over year. Cost savings across all product lines drove the gross margin improvement. Non-GAAP operating margin for the company expanded a remarkable 20 bps year over year to 8.1%, as non-GAAP operating income jumped 13.8% year over year to $43.0 million on top-line strength. Though higher gross margins boosted operating income, higher investments offset some of this improvement.

Liquidity

As on Jun 30, 2017, Logitech’s cash and cash equivalents were $527.6 million compared with $547.5 million as of Mar 31, 2017.

Guidance Raised

Concurrent with the first-quarter fiscal 2018 results, Logitech raised its full-year 2018 guidance. Currently, it expects non-GAAP operating income in the range of $260–$270 million compared with the earlier guided range of $250–$260 million. Also, it now anticipates constant currency fiscal 2018 sales in the range of 10–12%, compared with the earlier projection of high single-digit growth.

The upward revision is mainly attributable to the recent Astro Gaming buyout. This acquisition will enable Logitech to explore the console gaming market and help accelerate long-term growth of its gaming business.

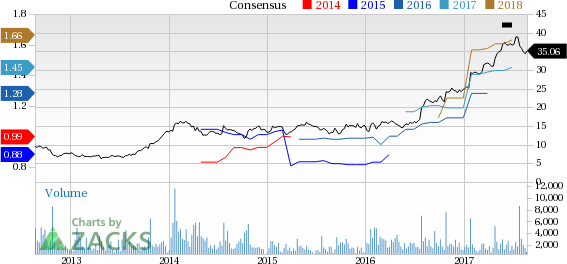

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter. While looking back an additional 30 days, we can see even more downward momentum. There have been two moves down in the last two months. In the past month, the consensus estimate has shifted lower by 7.6% due to these changes.

VGM Scores

At this time, Logitech's stock has a nice Growth Score of B, though it is lagging a lot on the momentum front with a D. Following the exact same course, the stock was allocated also a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for growth based on our styles scores.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Interestingly, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Logitech International S.A. (LOGI): Free Stock Analysis Report

Original post

Zacks Investment Research