Loews Corporation (NYSE:L) reported fourth-quarter 2017 operating earnings of 83 cents per share, beating the Zacks Consensus Estimate of 72 cents. The bottom line however, declined 3.5% year over year.

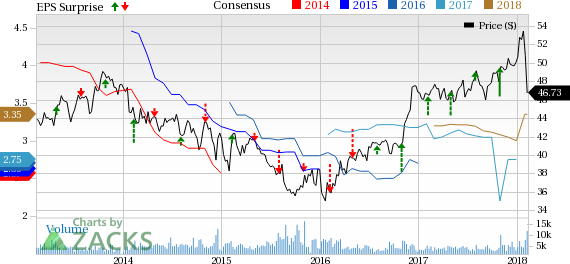

Loews Corporation Price, Consensus and EPS Surprise

Although earnings benefited from high performance at CNA Financial (NYSE:CNA) and Loews Hotels, lower results at Diamond Offshore Drilling (NYSE:DO) weighed on the upside.

Including net gain of 59 cents per share from the enactment of the Tax Cuts and Jobs Act of 2017, net income came in at $1.43.

Behind the Headlines

Operating revenues of $3.6 billion increased 6.7% year over year. Rise in insurance premiums and other revenues aided this improvement.

Total expenses rose 7.5% year over year to $3.1 billion, mainly due to higher contract drilling expenses and other operating costs.

Book value as of Dec 31, 2017 was $57.83 per share, up about 7.2% from $53.96 as of Dec 31, 2016.

Full-Year Highlights

Operating earnings of $2.86 per share surpassed the Zacks Consensus Estimate of $2.80. The bottom line improved 48% year over year.

Operating revenues of $13.7 billion grew 4.8% year over year. Moreover, the top line outpaced the consensus mark of $13.2 billion

Segment Details

CNA Financial’s revenues increased nearly 2% from the prior-year quarter to $2.4 billion. Its reported net income attributable to Loews Corp. is $193 million, reflecting a decline of 11.1% from the year-ago quarter due to the impact of the Tax Act. The quarter witnessed higher favorable net prior-year development and improved current accident year underwriting results from its property and casualty operations, partially offset by lower net investment income.

Boardwalk Pipeline’s (NYSE:BWP) revenues decreased 4.8% year over year to $338 million. Net income attributable to Loews Corp., increased nearly 12 times to $320 million, driven by net benefit related to the Tax Act. The quarter witnessed higher revenues from growth projects, offset by a decrease in storage and parking and lending revenues plus a decline in revenues associated with the sale of the Flag City processing plant and the restructuring of a firm transportation customer contract.

Loews Hotels’ revenues improved 11.7 % year over year to $172 million. Income attributable to Loews Corp. increased eight fold to $40 million. The quarter witnessed an improved performance at several large properties including the Loews Miami Beach Hotel, which had been under renovation in the year-ago quarter, and higher equity income from the Universal Orlando joint venture properties.

Diamond Offshore’s revenues fell 8.7% year over year to $356 million. Net loss attributable to Loews Corp. was $52 million compared with the earnings of $58 million in the year-earlier quarter. The period witnessed lower contract drilling revenues, higher contract drilling expense, an impairment charge related to the carrying value of a drilling rig plus restructuring and separation costs.

Share Repurchase Update

The company bought back 4.8 million shares for $237 million in 2017. Subsequently through Feb 9, 2018, the company repurchased another 4.3 million shares for $218 million.

Zacks Rank

Loews Corp. has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Boardwalk Pipeline Partners L.P. (BWP): Free Stock Analysis Report

Loews Corporation (L): Free Stock Analysis Report

CNA Financial Corporation (CNA): Free Stock Analysis Report

Diamond Offshore Drilling, Inc. (DO): Free Stock Analysis Report

Original post

Zacks Investment Research