Lockheed Martin Corp.’s (NYSE:LMT) business unit, Aeronautics Co., has won a modification contract from the U.S. Navy to procure electronic components for the F-35 Lightning II multi-role fighter aircraft.

The contract is valued at $93.9 million. Contracting activity is the Naval Air Systems Command, Patuxent River, MA.

Per the contract, Lockheed Martin will provide support services for F-35 Lightning II aircraft production through Lot 14 for the U.S. government, and Lot 15 for international customers.

The latest modification contract includes service purchases for the Air Force of about 45.04%; 13.61% for Navy; 6.12% for Marine Corps; 16.47% for foreign military sales or FMS customers; and 31.79% for international partners under the FMS program.

Work is scheduled to be complete by Jun 2017. The majority of the work will be performed in Richardson, TX, while the rest will be carried out in Fort Worth, TX. The contract will use fiscal 2014 aircraft procurement (Air Force, Navy); fiscal 2015 aircraft procurement (Marine Corps); foreign military sales; and international partner funds.

The F-35 Lightning II is the 5th generation stealth fighter combining radar evading stealth, supersonic speed and agility with the most powerful and wide-ranging integrated sensor package of any fighter aircraft in history. Apart from the U.S., the company has also received orders for the plane from Australia, Britain, Israel, Turkey, Italy, Japan, the Netherlands and Norway.

Lockheed Martin is the largest U.S. defense contractor with a platform-centric focus that guarantees a steady inflow of follow-on orders from a leveraged presence in the Army, Air Force, Navy and IT programs. The company expects organic growth of 3%-5% to be led primarily by the Aeronautics segment and specifically by the F-35 program. As of Mar 27, 2016, the company delivered 160 production aircraft to the U.S. and allies. For 2016, it expects to deliver 53 more F-35s.

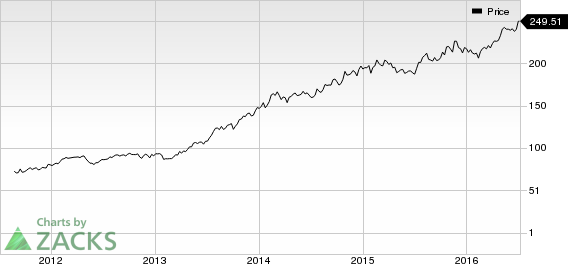

Lockheed Martin currently has a Zacks Rank #2 (Buy).

Other Stocks to Consider

A few other favorably placed stocks in the aerospace and defense space include Engility Holdings, Inc. (NYSE:EGL) , Northrop Grumman Corporation (NYSE:NOC) and Rockwell Collins Inc. (NYSE:COL) , each carrying a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

ROCKWELL COLLIN (COL): Free Stock Analysis Report

ENGILITY HLDGS (EGL): Free Stock Analysis Report

Original post

Zacks Investment Research